What is the deadline for submitting the quarterly report on the use of invoices in Vietnam?

What is the deadline for submitting the quarterly report on the use of invoices in Vietnam?

Pursuant to Clause 1, Article 29 of Decree 123/2020/ND-CP, which regulates the reporting on the use of printed invoices purchased from the tax authority, as follows:

Report on the use of printed invoices purchased from the tax authority and the invoice listing used during the period

- Quarterly, enterprises, economic organizations, households, and individuals engaging in business activities that purchase invoices from the tax authority are responsible for submitting the report on the use of invoices and the invoice listing used during the period to the directly managing tax authority.

The report on the use of invoices must be submitted quarterly no later than the last day of the first month of the following quarter in which the use of invoices occurs, according to Form No. BC26/HDG Appendix IA issued with this Decree.

In case no invoice is used during the period, enterprises, economic organizations, households, and individuals engaging in business activities shall submit the report on the use of invoices stating that the number of invoices used is zero (0), without having to send the invoice listing used during the period. If all invoices were used up in the previous period and the report on invoice usage showed a zero (0) balance, and no invoices were purchased or used in the current period, enterprises, economic organizations, households, and individuals engaging in business activities do not need to report on invoice usage.

...

Hence, the deadline for submitting the quarterly report on the use of invoices is no later than the last day of the first month of the quarter following the quarter in which invoice usage occurs.

If no invoice is used during the period, enterprises, economic organizations, households, and individuals engaging in business activities shall submit the report stating that the number of invoices used is zero (0), without having to send the invoice listing used during the period.

If all invoices were used up in the previous period and the report on invoice usage showed a zero (0) balance, and no invoices were purchased or used in the current period, enterprises, economic organizations, households, and individuals engaging in business activities do not need to report on invoice usage.

What is the deadline for submitting the quarterly report on the use of invoices in Vietnam? (Image from the Internet)

What is the latest quarterly report form for the use of invoices in Vietnam?

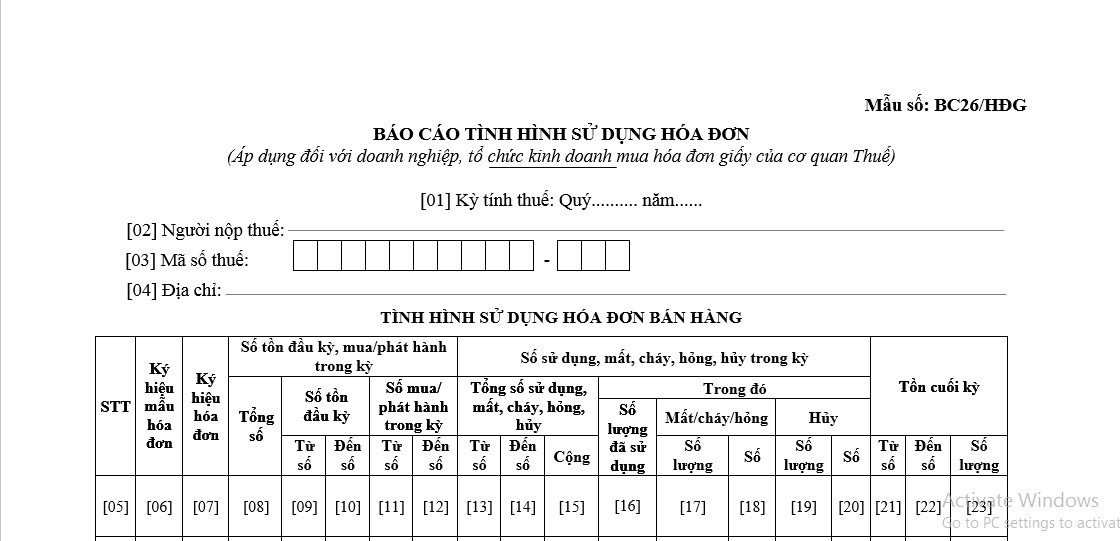

The latest quarterly report form for the use of invoices is Form No. BC26/HDG according to Appendix 1A issued with Decree 123/2020/ND-CP and is shown as follows:

The latest quarterly report form for the use of invoices is shown as follows:

The latest quarterly report form for the use of invoices...Download

What are the regulations on the sale of invoices printed by the tax authority in Vietnam?

According to Article 24 of Decree 123/2020/ND-CP, the regulations on the sale of invoices printed by the tax authority are as follows:

(1) Enterprises, economic organizations, households, and individuals engaged in business activities eligible to purchase invoices from the tax authority must submit a request form to purchase invoices (according to Form No. 02/DN-HDG Appendix 1A issued with Decree 123/2020/ND-CP) to the tax authority when purchasing invoices, accompanied by the following documents:

- The invoice purchaser (the person named in the request form or the person authorized by the enterprise, business organization, business owner, or the person authorized by a power of attorney as per legal regulations) must present an identity card or citizen identity card valid according to legal regulations.

- Enterprises, economic organizations, households, and individuals engaging in business activities purchasing invoices for the first time must have a declaration of commitment (according to Form No. 02/CK-HDG Appendix 1A issued with Decree 123/2020/ND-CP) regarding the production and business address consistent with the business registration certificate, business registration certificate, certificate of branch operation registration, business household registration certificate, taxpayer registration certificate, tax code notification, investment registration certificate, cooperative registration certificate, or establishment decision by a competent authority.

- When purchasing invoices, enterprises, economic organizations, households, and individuals purchasing invoices issued by the tax authority must be responsible for recording or stamping: name, address, tax code on the second sheet of each invoice before taking them out of the tax authority.

(2) The tax authority sells invoices to enterprises, economic organizations, households, and individuals engaging in business activities monthly.

- The number of invoices sold to enterprises, economic organizations, households, and individuals purchasing for the first time shall not exceed one book of 50 numbers for each invoice type. If the first purchase invoices are used up before the month ends, the tax authority decides the number of invoices sold for the next purchase based on the time and number of used invoices.

- For subsequent purchases, after checking the invoice usage, tax declaration situation and invoice purchase request in the purchase request form, the tax authority will sell invoices to enterprises, economic organizations, households, and individuals engaging in business activities on the same day. The number of invoices sold will not exceed the number of used invoices from the previous month's purchase.

- Enterprises, economic organizations, households, and individuals eligible to purchase invoices issued by the tax authority switching to electronic invoices must stop using the purchased invoices from the tax authority from the date they start using electronic invoices as provided in Article 15 Decree 123/2020/ND-CP.

In the case where households or individuals do not wish to use paper invoices but require invoices, the tax authority provides electronic invoices on an occurrence basis as regulated in Clause 2, Article 13 Decree 123/2020/ND-CP.

(3) Invoices printed by the Tax Department for sale are publicly announced on the portal of the General Department of Taxation, and before the first sale, the Tax Department must issue an invoice issuance notice according to Form No. 02/PH-HDG Appendix 1B Decree 123/2020/ND-CP attached to the sample invoice on the portal of the General Department of Taxation.

The content of the Invoice Issuance Notice includes: Name of the Tax Department issuing invoices, tax code, address, phone number, types of invoices issued (invoice type name, invoice code, invoice form code, start date of use, number of invoices issued (from number... to number...)), name and tax code of the printing enterprise (for printed invoices); date of issuance notice, name, signature of the legal representative, and seal of the unit.

The sample invoice is a printed form accurately reflecting all criteria on the sheet of the invoice given to the purchaser type issued, with an invoice number consisting of a series of zeros and the word "Sample" printed or stamped on the invoice.

The invoice issuance notice, along with the sample invoice, must be clearly posted at all units affiliated with the Tax Department throughout the duration that invoices are in use.

In the event of any changes to the content of the issuance notice or the invoice sample, the Tax Department must carry out the procedures for a new issuance notice as stipulated in Article 24 Decree 123/2020/ND-CP.