What is the deadline for submitting the personal income tax declaration for February 2025? What is the form for the February 2025 personal income tax declaration in Vietnam?

What is the deadline for submitting the personal income tax declaration for February 2025 in Vietnam?

Based on Article 44 of the Law on Tax Administration 2019, which stipulates the deadline for submitting tax declaration dossiers as follows:

Deadline for submitting tax declaration dossiers

- The deadline for submitting tax declaration dossiers for taxes declared monthly or quarterly is stipulated as follows:

a) No later than the 20th day of the following month in cases of monthly declaration and payment;

b) No later than the last day of the first month of the following quarter in cases of quarterly declaration and payment.

…

Additionally, Clause 1, Article 43 of the Law on Tax Administration 2019 specifies the tax declaration dossier as follows:

Tax declaration dossier

- The tax declaration dossier for types of taxes declared and paid monthly is a monthly tax declaration form.

- The tax declaration dossier for types of taxes declared and paid quarterly is a quarterly tax declaration form.

- The tax declaration dossier for types of taxes calculated annually includes:

a) The annual tax declaration dossier includes the annual tax declaration form and other documents related to determining the payable tax amount;

b) The tax finalization declaration dossier when the year ends includes the annual tax finalization declaration form, annual financial report, transfer pricing declaration; other documents related to tax finalization.

…

From the above regulations, it can be seen that the deadline for submitting the February 2025 personal income tax declaration form is no later than the 20th day of the month following the month the tax obligation arises, which is March 20, 2025.

What is the deadline for submitting the personal income tax declaration for February 2025? What is the form for the February 2025 personal income tax declaration in Vietnam? (Image from the Internet)

What is the form for the February 2025 personal income tax declaration in Vietnam?

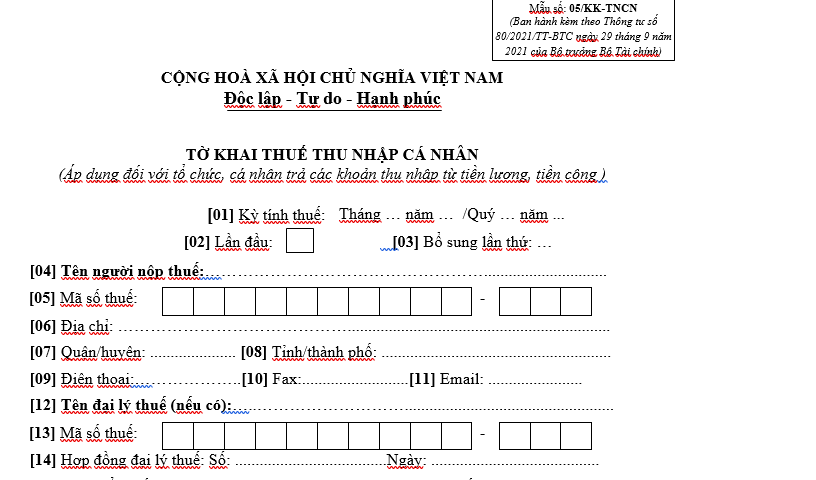

The form for the February 2025 personal income tax declaration is form number 05/KK-TNCN, issued together with Circular 80/2021/TT-BTC, applicable for organizations and individuals who make payments of income from wages and salaries.

The 05/KK-TNCN personal income tax declaration form is as follows:

Download the 05/KK-TNCN personal income tax declaration form

Note:

- This declaration is only applicable to organizations and individuals that arise income payment from wages and salaries for individuals during the month/quarter, regardless of whether tax withholding arises or does not arise.

- The monthly tax declaration period applies to organizations and individuals paying income with a total turnover from sales of goods and providing services from the previous year exceeding VND 50 billion or in cases where organizations and individuals paying income choose to declare tax monthly.

- The quarterly tax declaration period applies to organizations and individuals paying income with a total turnover from sales of goods and providing services from the previous year equal to or less than VND 50 billion, including organizations and individuals paying income where there is no turnover from sales of goods and providing services arising.

How much is the penalty for late submission of the February 2025 personal income tax declaration in Vietnam?

According to Article 13 of Decree 125/2020/ND-CP, the penalty levels for late submission of the February 2025 personal income tax declaration are as follows:

(1) A warning penalty for the act of submitting a late personal income tax declaration from 01 day to 05 days, with mitigating circumstances.

(2) A fine ranging from VND 2,000,000 to VND 5,000,000 for the act of submitting a late VAT declaration from 01 day to 30 days, except for the case stipulated in Clause 1, Article 13 of Decree 125/2020/ND-CP.

(3) A fine ranging from VND 5,000,000 to VND 8,000,000 for the act of submitting a VAT declaration late from 31 days to 60 days.

(4) A fine ranging from VND 8,000,000 to VND 15,000,000 for any of the following acts:

- Submitting a personal income tax declaration late from 61 days to 90 days;

- Submitting a personal income tax declaration late over the stipulated period from 91 days or more with no tax payable arising;

- Not submitting a personal income tax declaration but no tax payable arises;

(5) A fine ranging from VND 15,000,000 to VND 25,000,000 for the act of submitting a personal income tax declaration over 90 days past the deadline for filing tax returns, when tax is payable, and the taxpayer has paid the full tax amount and late payment interest to the state budget before the tax authority issues a decision on a tax inspection, audit or before the tax authority makes a record of the act of late submission of tax return documents as stipulated in Clause 11, Article 143 of the Law on Tax Administration 2019.

In cases where the penalty amount, if applied under this clause, exceeds the tax amount arising in the tax return dossier, the maximum penalty amount for this case will be the tax amount arising to be paid in the tax return dossier but not less than the average amount of the fine frame stipulated in Clause 4, Article 13 of Decree 125/2020/ND-CP.

Additionally, individuals who commit the aforementioned violations must implement remedial measures, including:

- Must pay the full amount of tax late payment interest to the state budget for violations stipulated in Clauses 1, 2, 3, 4, and 5 of Article 13 of Decree 125/2020/ND-CP if the taxpayer submits the VAT declaration late resulting in late tax payment;

- Must submit the tax declaration dossier, appendices attached to the tax declaration dossier for violations set forth in points c and d, Clause 4 of Article 13 of Decree 125/2020/ND-CP.

Note: The penalties for late submission of the personal income tax declaration outlined above apply to violations committed by organizations. For individuals committing similar violations, the penalty is half the amount imposed on organizations (as per Clause 5, Article 5 of Decree 125/2020/ND-CP).

Is it allowed to supplement the February 2025 personal income tax declaration form if there are errors?

Based on Clause 1, Article 47 of the Law on Tax Administration 2019 (amended and annulled in some parts by Clause 6, Article 6 of the Law Amending the Law on Securities, the Law on Accounting, the Law on Independent Audit, the Law on State Budget, the Law on Management, Use of Public Assets, the Law on Tax Administration, the Law on Personal Income Tax, the Law on National Reserves, the Law on Handling Administrative Violations 2024), which stipulates the additional tax declaration as follows:

Supplementary tax declaration

1. If a taxpayer discovers that the submitted tax declaration dossier has errors or omissions, they are allowed to submit an additional declaration within 10 years from the expiration date for submitting the tax declaration of the tax period with errors or omissions in the following cases:

a) Before the tax authorities and competent agencies announce inspection and audit decisions;

b) The dossier is not within the scope or period of the tax inspection and audit set out in the tax inspection and audit decision.

For contents within the scope of an inspection or audit, the taxpayer is allowed to supplement the explanation dossier under tax law, inspection law, and cases implemented according to conclusions and regulations of competent specialized agencies related to the determination of the taxpayer's tax obligations.

...

Thus, according to the above regulation, the taxpayer is allowed to supplement the February 2025 personal income tax declaration form if there are errors, with a deadline for supplementary declaration of 10 years from the expiration date for submitting the February 2025 personal income tax declaration in the following cases:

- Before the tax authorities and competent agencies announce inspection and audit decisions;

- The dossier is not within the scope or period of the tax inspection and audit specified in the tax inspection and audit decision.