What is the deadline for submitting the January 2025 VAT return in Vietnam?

What is the deadline for submitting the January 2025 VAT return in Vietnam?

Based on the provisions of Clause 1, Article 44 of the 2019 Tax Administration Law regarding the time for submitting tax returns as follows:

Deadline for submitting tax returns

- The deadline for submitting a tax return for the type of tax declared monthly or quarterly is stipulated as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for cases declared and submitted monthly;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for cases declared and submitted quarterly.

- The deadline for submitting tax returns for taxes calculated annually is stipulated as follows:

a) No later than the last day of the third month from the end of the calendar or financial year for annual tax settlement records; no later than the last day of the first month of the calendar or financial year for annual tax returns;

b) No later than the last day of the fourth month from the end of the calendar year for personal income tax settlement records of individuals directly settling taxes;

c) No later than December 15 of the preceding year for estimated tax returns of business households, individuals paying taxes according to the estimated method; if business households, individuals are newly established, the deadline for submitting an estimated tax return is no later than 10 days from the start of the business.

...

Thus, according to the above regulation, the deadline for submitting the January 2025 VAT return is February 20, 2025.

What is the deadline for submitting the January 2025 VAT return in Vietnam? (Image from the Internet)

Which form should be used for the January 2025 VAT return in Vietnam?

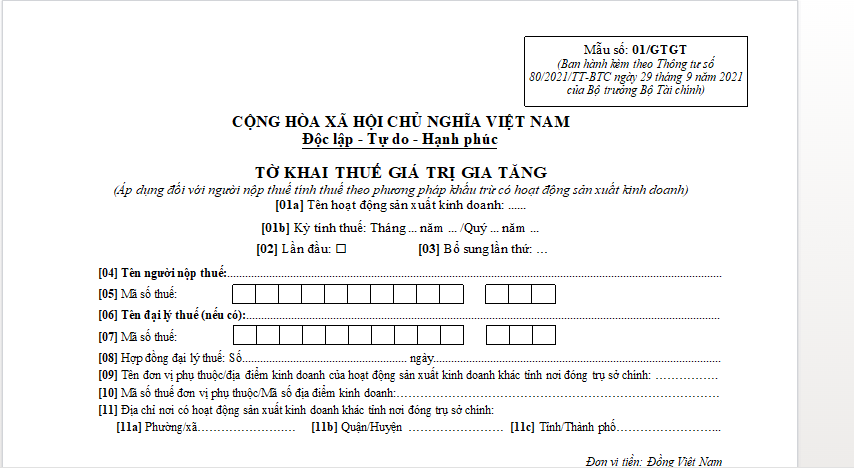

The latest VAT return form currently applied is Form No. 01/GTGT in Appendix II issued together with Circular 80/2021/TT-BTC.

Form No. 01/GTGT is as follows:

DOWNLOAD >>> January 2025 VAT return form

What are instructions for filling out the January 2025 VAT return form in Vietnam?

[1] The taxpayer chooses one of the following activities:

- Regular business production activities.

- Lottery activities, digital lottery.

- Oil and gas exploration activities.

- Infrastructure investment project, housing for transfer to another province other than the head office.

- Power production plant in another province other than the head office.

[2] Enter the VAT calculation period, specifically: enter the month, year for taxpayers subject to monthly VAT declaration, or enter the quarter, year for taxpayers subject to quarterly VAT declaration.

[3] Enter full name if the taxpayer is an individual. If the taxpayer is an organization, write the name of the organization according to the Business Registration Certificate/ Business Household Registration Certificate/ Establishment Decision or equivalent documents.

[4] Enter the complete tax identification number of the taxpayer.

[5] Enter the name of the tax agent if the taxpayer has a contract with a tax agent to declare VAT on their behalf.

[6] The taxpayer only declares information of dependent units/business locations located in other provinces where the head office is situated (name, tax identification number, address) at Indicators [09], [10], and [11] in the following cases:

- Declare VAT for real estate transfer activities of infrastructure investment projects, housing transfer (including cases of advance payment received from customers in progress) at the location where real estate transfers occur.

- Declare VAT at the location where the power production plant is situated.

Note: If there are multiple dependent units, business locations in different districts managed by the Tax Department, select one representative unit to declare in these indicators. If there are multiple dependent units, business locations in different districts managed by the Regional Tax Office, select one representative unit for the district managed by the Regional Tax Office to declare in these indicators.

[7] Declare the value of goods and services not subject to VAT declaration, calculation, and payment according to VAT law provisions.

[8] Declare the deductible tax reduction amount adjusted at Indicator II on the supplementary declaration (if any).

[9] Declare the deductible tax increase amount adjusted at Indicator II on the supplementary declaration (if any).

Note, for indicators [37] and [38] in the table: In cases where the tax authority, competent authority has issued conclusions, tax handling decisions with adjustments for previous tax periods, these should be declared in the tax return of the tax period receiving the conclusion, decision on tax handling (no need to supplement the tax return).

[10] Declare the VAT that is deductible but has not yet been requested for refund of the investment project transferred to the taxpayer for continued deduction (the VAT that is deductible but does not qualify for a refund and is not refunded that the taxpayer has separately declared on the investment project's tax return) when the investment project goes into operation or the VAT that is deductible but has not yet been requested for refund of the business activities of the dependent unit when ceasing operations,…

[11] Declare the total tax declared at indicators [28a] and [28b] of Forms No. 02/GTGT.