What is the deadline for submitting supplementary documents to non-agricultural land use tax declaration dossiers in Vietnam?

What are the cases of supplementation of non-agricultural land use tax declaration dossiers in Vietnam?

Under Clause 2, Article 16 of Circular 153/2011/TT-BTC, the regulations are as follows:

Tax declaration

...

2. Tax declaration in certain specific cases

...

b/ For non-agricultural production and business land and non-agricultural land specified in Article 2 of this Circular which is used for commercial purposes

Taxpayers shall submit tax declaration dossiers to district-level Tax Departments of localities where exist taxable land plots or to organizations or individuals authorized by tax agencies according to law.

2.3. Supplementary tax declaration:

a/ In case of arising elements leading to a change in tax bases which result in an increase or a decrease in the payable tax amount, the taxpayer shall make an supplementary declaration according to form No. 01/TK-SDDPNN or form No. 02/TK-SDDPNN within thirty (30) days after the date such elements arise;

b/ When detecting any errors or mistakes in the tax declaration dossier already submitted to the tax agency, which affect the payable tax amount, a taxpayer may make an supplementary declaration;

In case a taxpayer detects an error or a mistake in the tax declaration dossier already submitted lo the tax agency after March 31 of the subsequent year, the taxpayer may make an supplementary declaration (for annual declaration and general declaration) in this year.

supplementary tax declaration dossiers may be submitted to tax agencies on any working day.

supplementary tax declaration dossiers of institutional taxpayers must be submitted before tax agencies announce decisions on tax examination or inspection at their head offices.

Therefore, when detecting any errors or mistakes in the tax declaration dossier already submitted to the tax agency, which affects the payable tax amount, a taxpayer may make a supplementary declaration.

What is the deadline for submitting supplementary documents to non-agricultural land use tax declaration dossiers in Vietnam? (Image from the Internet)

What is the deadline for submitting supplementary documents to non-agricultural land use tax declaration dossiers in Vietnam?

Under Clause 3, Article 10 of Decree 126/2020/ND-CP, the regulations are as follows:

Deadlines for submission of declarations of land-related amounts, licensing fees, registration fees, fees for grant of rights and other amount payables prescribed by regulations of law on management and use of public property

...

3.

Non-agricultural land use tax

a) For organizations:

a.1) The first declaration shall be submitted within 30 days from the day on which non-agricultural land use tax is incurred.

a.2) Non-agricultural land use tax does not have to be re-declared if the payer or the amount payable is not changed.

a.3) In case of changes or errors in the submitted declaration that lead to an increase or decrease in the amount payable, the supplementary declaration shall be submitted within 30 days from the day on which the change occurs.

A supplementary declaration shall be submitted in case of changes or errors in the submitted declaration that lead to an increase or decrease in the amount payable.

b) For households and individuals:

b.1) The first declaration shall be submitted within 30 days from the day on which non-agricultural land use tax is incurred.

b.2) Non-agricultural land use tax does not have to be re-declared if the payer or the amount payable is not changed.

b.3) In case of changes that lead to an increase or decrease in the amount payable (except change in land price per m2 prescribed by the People’s Committee of the province), the supplementary declaration shall be submitted within 30 days from the day on which the change occurs.

b.4) In case the submitted declaration contains errors that lead to a change in the amount payable, a supplementary declaration shall be submitted in accordance with Article 47 of the Law on Tax administration.

b.5) The consolidated declaration dossier shall be submitted by March 31 of the calendar year preceding the tax year.

Thus, the deadline for submitting supplementary documents to non-agricultural land use tax declaration dossiers in Vietnam is no later than 30 days from the day on which the change occurs for both organizations and individuals required to declare non-agricultural land use tax.

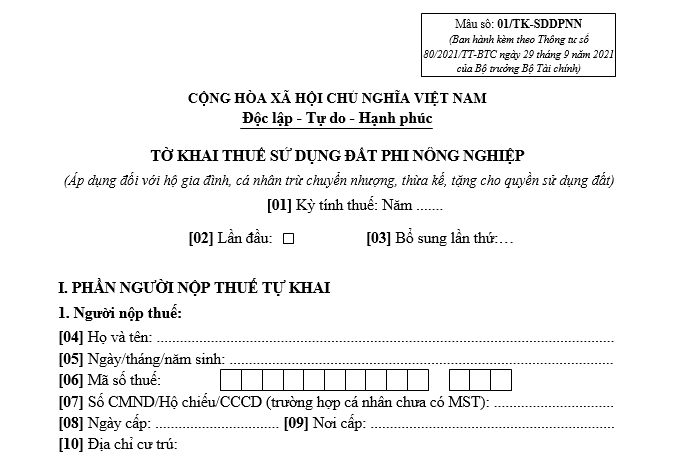

What is the non-agricultural land use tax declaration form - Form 01/TK-SDDPNN in Vietnam?

The non-agricultural land use tax declaration form (applicable to households and individuals, excluding transfer, inheritance, or gifting of land use rights) is Form 01/TK-SDDPNN issued with Circular 80/2021/TT-BTC:

Download Form 01/TK-SDDPNN - the non-agricultural land use tax declaration form: Here