What is the deadline for licensing fee payment in Vietnam for 2024?

What is the deadline for licensing fee payment in Vietnam for 2024?

Based on Clause 9, Article 18 of Decree 126/2020/ND-CP, the regulations on the deadline for payment of licensing fee are as follows:

Deadline for tax payment on amounts belonging to the state budget from land, water resource exploitation rights fees, mineral resource fees, sea use fees, registration fees, licensing fees

...

- Registration fee: The deadline for payment of the registration fee is no later than 30 days, starting from the date of issuance of the notice, except where the taxpayer is permitted to defer the registration fee debt.

9. Licensing fee:

a) The deadline for payment of the licensing fee is no later than January 30 each year.

b) For small and medium enterprises converted from household businesses (including dependent units, business locations of the enterprise) at the end of the exemption period of licensing fee (the fourth year from the year of establishment of the enterprise), the deadline for payment of licensing fee is as follows:

b.1) If the exemption period ends within the first 6 months of the year, the deadline for payment is no later than July 30 of the year the exemption period ends.

b.2) If the exemption period ends within the last 6 months of the year, the deadline for payment is no later than January 30 of the year following the end of the exemption period.

c) Household businesses and individual businesses that cease production and business activities and then resume, the deadline for payment is as follows:

c.1) If resuming activities in the first 6 months of the year: No later than July 30 of the year of resumption.

c.2) If resuming activities in the last 6 months of the year: No later than January 30 of the year following the year of resumption.

Thus, according to the above regulations, the deadline for payment of the licensing fee for 2024 is no later than January 30, 2025.

Additionally, the law also prescribes some additional deadlines for payment of the licensing fee as follows:

- For small and medium enterprises converted from household businesses (including dependent units, business locations of the enterprise) at the end of the exemption period (the fourth year from the year of establishment of the enterprise), the deadline is:

+ If the exemption period ends in the first 6 months of the year, the deadline is no later than July 30 of the year the exemption period ends.

+ If the exemption period ends in the last 6 months of the year, the deadline is no later than January 30 of the year following the end of the exemption period.

- For household businesses and individual businesses that cease production and business activities and then resume, the deadline is:

+ If resuming in the first 6 months of the year: No later than July 30 of the year of resumption.

+ If resuming in the last 6 months of the year: No later than January 30 of the year following the year of resumption.

What is the deadline for licensing fee payment in Vietnam for 2024? (Image from the Internet)

How much is the licensing fee for organizations engaged in production and business in Vietnam?

According to Clause 1, Article 4 of Decree 139/2016/ND-CP, the licensing fee for organizations engaged in production and business is as follows:

- Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year;

- Organizations with charter capital or investment capital of 10 billion VND or less: 2,000,000 VND/year;

- Branches, representative offices, business locations, public service providers, other economic organizations: 1,000,000 VND/year.

The licensing fee level for organizations regulated at points a and b, clause 1, Article 4 of Decree 139/2016/ND-CP is based on the charter capital recorded in the business registration certificate; if there is no charter capital, it is based on the investment capital recorded in the investment registration certificate.

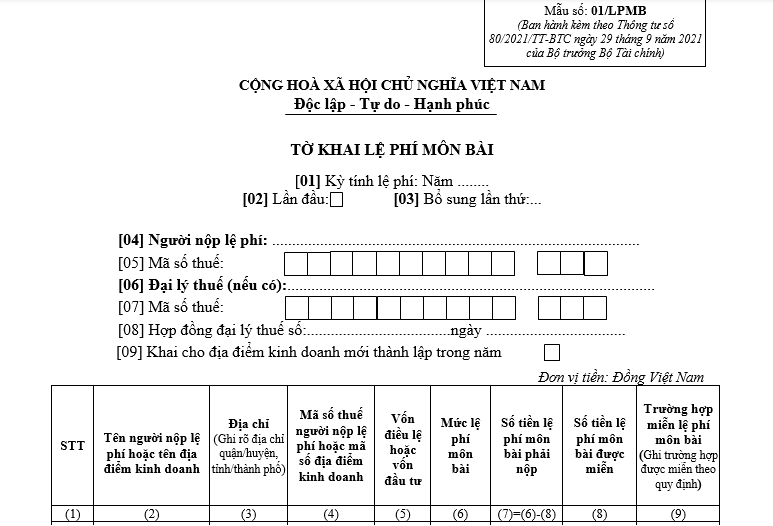

What is the form for the licensing fee declaration in Vietnam for 2024?

The form for the licensing fee declaration for 2024 is Form 01/LPMB issued together with Circular 80/2021/TT-BTC

Download the licensing fee declaration form

The form for the licensing fee declaration for 2024 appears as follows:

How to fill out the licensing fee declaration form:

- Item [01]: Declare the year for licensing fee calculation.

- Item [02]: Only check for the first time declaration.

- Item [03]: Only check for cases where the taxpayer (hereafter referred to as NNT and abbreviated as NNT) has submitted the declaration but then discovers changes in information about the declaration obligation and performs re-declaration for the declared period.

Note, NNT should only select one of the two items [02] or [03], not both simultaneously.

- Item [04] to item [05]: Declare information according to the taxpayer registration of NNT.

- Item [06] to item [08]: Declare tax agent information (if any).

- Item [09]: Only check in cases where NNT has declared LPMB and subsequently establishes a new business location.