What is the deadline for extension of the deadline submission of value-added tax for the tax period of September 2024 in Vietnam?

What is the deadline for extension of the deadline submission of value-added tax for the tax period of September 2024 in Vietnam?

Article 4 of Decree 64/2024/ND-CP stipulates the extension of VAT payment deadlines as follows:

Extension of tax payment and land rent deadlines

1. For value-added tax (excluding VAT on imports)

a) The tax payment deadline is extended for the VAT amount due (including the amount allocated to provincial-level areas other than the taxpayer's headquarters, the tax amount due for each occurrence) for the tax periods from May to September 2024 (for monthly VAT declarations) and the tax periods of Q2 2024, Q3 2024 (for quarterly VAT declarations) of the enterprises and organizations specified in Article 3 of this Decree. The extension period is 05 months for the VAT of May 2024, June 2024, and Q2 2024, 04 months for the VAT of July 2024, 03 months for the VAT of August 2024, 02 months for the VAT of September 2024 and Q3 2024. The extension period is calculated from the end of the VAT payment deadline according to the tax administration regulations.

Enterprises and organizations eligible for the extension shall submit monthly and quarterly VAT declarations according to current laws but are not required to pay the VAT reported in the submitted declarations. The VAT payment deadlines for the monthly and quarterly extensions are as follows:

...

The deadline for VAT payment for the tax period of September 2024 is no later than December 20, 2024.

The deadline for VAT payment for the tax period of Q2 2024 is no later than December 31, 2024.

The deadline for VAT payment for the tax period of Q3 2024 is no later than December 31, 2024.

...

For value-added tax (excluding VAT on imports), the deadline for VAT payment for the tax period of September 2024 is extended by 2 months, with the payment deadline being no later than December 20, 2024.

What is the deadline for extension of the deadline submission of value-added tax for the tax period of September 2024 in Vietnam? (Image from the Internet)

Do enterprises operating in the wastewater treatment and drainage sector in Vietnam qualify for the VAT payment extension for the tax period of September 2024?

Article 3 of Decree 64/2024/ND-CP stipulates:

Eligible subjects for extension

1. Enterprises, organizations, households, family businesses, and individuals operating in the following economic sectors:

a) Agriculture, forestry, and fisheries;

b) Manufacturing and processing of food products; textiles; apparel production; production of leather and related products; wood processing and production of wood, bamboo products (excluding beds, wardrobes, tables, and chairs); production of products from straw, thatch, and knitting materials; paper production and products from paper; production of rubber and plastic products; production of products from non-metallic minerals; metal production; mechanical processing; metal surface treatment and coating; production of electronic products, computers, and optical products; production of automobiles and other motor vehicles; production of beds, wardrobes, tables, and chairs;

c) Construction;

d) Publishing activities; film production, television program production, recording and music publishing;

dd) Crude oil and natural gas extraction (excluding the corporate income tax for crude oil, condensate, and natural gas collected according to agreements and contracts);

e) Production of beverages; printing, copying of various types of records; coking and refined petroleum products; production of chemicals and chemical products; production of fabricated metal products (excluding machinery and equipment); production of motorcycles and motorbikes; repair, maintenance, and installation of machinery and equipment;

g) Wastewater treatment and drainage.

...

Enterprises operating in the wastewater treatment and drainage sector qualify for the VAT payment extension for the tax period of September 2024.

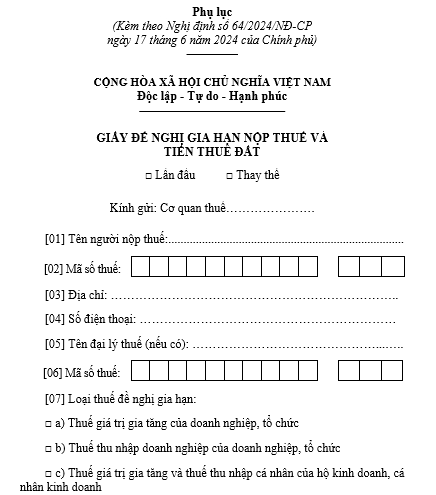

What is the Form for the request for tax payment extension in 2024 in Vietnam?

The form for the request for the extension of tax payment and land rent in 2024 is the form attached in the Appendix issued with Decree 64/2024/ND-CP:

>> Download Form for the request for the extension of tax payment and land rent in 2024: Download