What is the deadline for deadline extension for CIT payment in Vietnam for Quarter 2, 2024?

What is the deadline for submitting VAT returns in Vietnam for Quarter 2, 2024

Based on Clause 1, Article 55 of the 2019 Law on Tax Administration stipulated as follows:

Tax Submission Deadlines

1. In the case where a taxpayer calculates the tax, the deadline for tax submission is the latest by the last day of the tax return submission period. For supplementary tax returns, the deadline for tax submission is the period for filing tax returns for the tax period having errors or omissions.

For corporate income tax, the quarterly provisional payment must be submitted no later than the 30th of the first month of the following quarter.

For crude oil, the deadline for resource tax and corporate income tax payments is 35 days from the date of sale for domestically sold crude oil or from the date of customs clearance for exported crude oil.

For natural gas, the deadline for resource tax and corporate income tax payments is monthly.

...

It can be seen that the deadline for submitting VAT returns for Quarter 2, 2024, is July 30, 2024.

What is the deadline for deadline extension for CIT payment in Vietnam for Quarter 2, 2024? (Image from the Internet)

What is the deadline for deadline extension for CIT payment in Vietnam for Quarter 2, 2024?

In Article 4 of Decree 64/2024/ND-CP, it is stipulated as follows:

Extension of Tax and Land Rent Deadlines

1. For VAT (excluding VAT at the importation stage)

...

2. For corporate income tax

a) Extension of the deadline for the provisional payment of corporate income tax for Quarter 2 of the corporate income tax period of 2024 for enterprises and organizations subject to the provisions in Article 3 of this Decree. The extension period is 03 months from the end of the corporate income tax deadline as prescribed by law on tax administration.

b) In case enterprises or organizations mentioned in Article 3 of this Decree have branches or affiliated units filing separate corporate income tax returns with the tax agency directly managing the branches or affiliated units, these branches or units are also subject to the extension of corporate income tax payment. In case the branches or affiliated units of enterprises or organizations mentioned in Clauses 1, 2, and 3 of Article 3 of this Decree do not engage in business activities in eligible economic sectors, they are not subject to the extension of corporate income tax payment.

3. For VAT and personal income tax of business households and individuals

Extension of VAT and personal income tax payment deadlines for the tax amounts arising in 2024 from business households and individuals operating in industries or fields mentioned in Clauses 1, 2, and 3 of Article 3 of this Decree. Business households and individuals must pay the extended tax amounts by no later than December 30, 2024.

...

Therefore, the corporate income tax extension deadline for Quarter 2, 2024, is until October 30, 2024 (The extension period is 03 months).

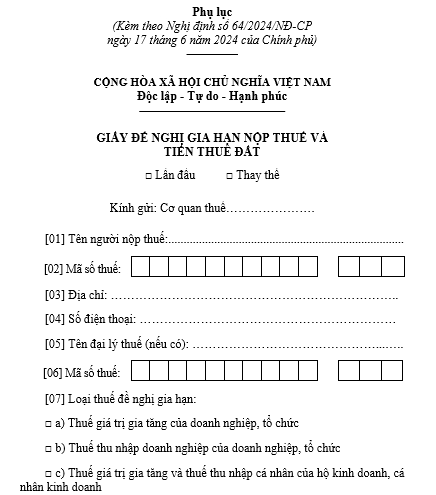

What is the request form for deadline extension of 2024 VAT payment in Vietnam?

The template for the Request for Extension of 2024 VAT Payment is included in the Appendix issued with Decree 64/2024/ND-CP.

>> Download Template for Request for Extension of 2024 VAT Payment: Download

Which entity is eligible for the 2024 tax payment deadline extension in Vietnam?

Based on Article 3 of Decree 64/2024/ND-CP, the following subjects are eligible for the extension of VAT, corporate income tax, and personal income tax payment deadlines in 2024:

(1) Enterprises, organizations, households, business households, and individuals engaged in the following economic sectors:

- Agriculture, forestry, and fisheries;

- Manufacturing, food processing; textiles; apparel production; leather and related products manufacturing; wood processing and wood, bamboo, and rattan products manufacturing (except beds, cabinets, tables, chairs); straw, rattan, and braiding materials products manufacturing; paper and paper products manufacturing; rubber and plastic products manufacturing; non-metallic mineral products manufacturing; metal production; mechanical processing; metal treatment and coating; electronics, computers, and optical products manufacturing; vehicle manufacturing; furniture production (beds, cabinets, tables, chairs);

- Construction;

- Publishing activities; film production, television program production, sound recording, and music publishing;

- Crude oil and natural gas extraction (excluding corporate income tax from crude oil, condensate, natural gas collected under agreements or contracts);

- Beverage production; reproduction of recorded media; coking coal production, refined petroleum products; chemical and chemical products manufacturing; fabricated metal products manufacturing (except machinery and equipment); motorcycle and motorbike manufacturing; machinery and equipment repair, maintenance, and installation;

- Wastewater treatment and wastewater management.

(2) Enterprises, organizations, households, business households, and individuals engaged in the following economic sectors:

- Transportation and warehousing; accommodation and food services; education and training; health and social assistance activities; real estate business;

- Labor and employment services; travel agency operations, tour operator businesses, and other related support services;

- Arts, entertainment, and recreational activities; library, archive, museum, and cultural activities; sporting, amusement, and recreation activities; film projection activities;

- Broadcasting and television; computer programming, consultancy, and related activities; information service activities;

- Support activities for mining.

(3) Enterprises, organizations, households, business households, and individuals involved in the production of priority industrial supporting products and key mechanical products.

(4) Small and micro-enterprises determined according to the provisions of the 2017 Law on Supporting Small and Medium Enterprises and Decree 80/2021/ND-CP of the Government of Vietnam detailing certain articles of the Law on Supporting Small and Medium Enterprises.

The economic sector or field of the enterprises, organizations, households, business households, and individuals mentioned above is the sector or field in which they engage in business activities and generate revenue in 2023 or 2024.