What is the date of the God of Wealth Day in 2025 in Vietnam? When is the deadline for submitting the VAT return in Vietnam for January 2025?

What is the date of the God of Wealth Day in 2025 in Vietnam?

The God of Wealth Day is an important occasion in the cultural beliefs of Vietnamese people and other East Asian countries. This day is celebrated on the 10th day of the first month of the lunar calendar each year to pay tribute and respect to the God of Wealth—a deity who oversees fortune and wealth among the people. According to traditional beliefs, properly worshipping the God of Wealth on this day will bring prosperity and affluence to the homeowner, especially those involved in business and trade, throughout the year.

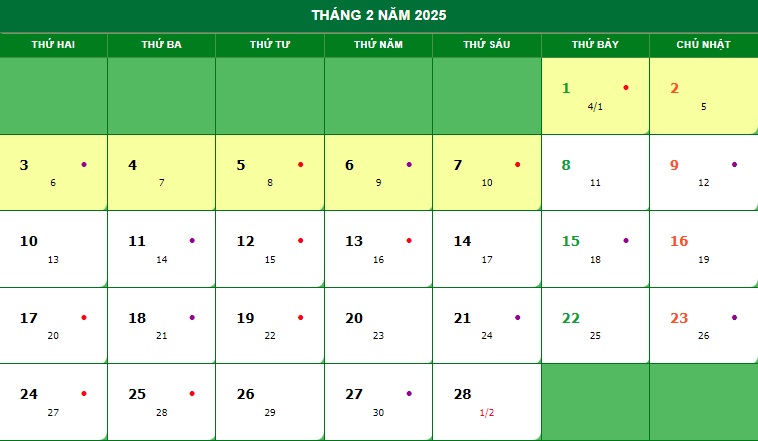

Based on the February 2025 calendar as follows:

Thus, the God of Wealth Day in 2025 will fall on Friday, February 7, 2025, on the Gregorian calendar (equivalent to the lunar date of January 10, 2025).

The God of Wealth Day 2025 not only serves as an opportunity to pray for fortune but also signifies unity and faith in the good things in life. It is also an opportunity for each individual to reflect on their business and trading goals and to start the new year with optimism, hope, and positivity.

What is the date of the God of Wealth Day in 2025 in Vietnam? (Image from the Internet)

When is the deadline for submitting the VAT return in Vietnam for January 2025?

Based on Clause 1, Article 44 of the Law on Tax Administration 2019 which stipulates the deadlines for submitting tax returns as follows:

Deadline for submitting tax returns

- The deadline for submitting tax returns on a monthly or quarterly basis is specified as follows:

a) No later than the 20th day of the following month in which the tax obligation arises for monthly submitting and payment;

b) No later than the last day of the first month of the subsequent quarter in which the tax obligation arises for quarterly submitting and payment.

- The deadline for submitting tax returns for taxes with an annual tax period is specified as follows:

a) No later than the last day of the third month after the end of the calendar year or fiscal year for annual tax settlement returns; and no later than the last day of the first month of the calendar year or fiscal year for annual tax returns;

b) No later than the last day of the fourth month after the end of the calendar year for the final personal income tax settlement returns for individuals directly settling taxes;

c) No later than December 15 of the preceding year for presumptive tax returns of business households and individuals who pay taxes via the presumptive method; in the case of new business households and individuals, the deadline for submitting presumptive tax returns is no later than 10 days from the start of business.

...

Accordingly, the deadline to submit the VAT return for January 2025 is February 20, 2025.

What is the fine for late submission of the January 2025 VAT return in Vietnam?

Based on Article 13 of Decree 125/2020/ND-CP, which stipulates penalties for late submission of the January 2025 VAT return as follows:

(1) A warning is issued for submitting the VAT return 1 to 5 days late with extenuating circumstances.

(2) A fine ranging from VND 2,000,000 to VND 5,000,000 is imposed for submitting the VAT return 1 to 30 days late, except for the cases stipulated in Clause 1, Article 13 of Decree 125/2020/ND-CP.

(3) A fine ranging from VND 5,000,000 to VND 8,000,000 is imposed for submitting the VAT return 31 to 60 days late.

(4) A fine ranging from VND 8,000,000 to VND 15,000,000 is imposed for any of the following actions:

- Submitting the VAT return 61 to 90 days late;

- Submitting the VAT return more than 91 days late without resulting in a payable tax amount;

- Failing to submit the VAT return without resulting in a payable tax amount;

(5) A fine ranging from VND 15,000,000 to VND 25,000,000 is imposed for submitting the VAT return more than 90 days late since the deadline, with a resulting payable tax amount, and where the taxpayer has paid the tax, late payment interest to the state budget prior to the tax authority's decision on tax inspection, or prior to the tax authority's drafting of a report on the late submission as stipulated in Clause 11, Article 143 of the Law on Tax Administration 2019.

In case the fine, when applied according to this clause, exceeds the tax amount on the tax return, the maximum fine equals the tax amount but must not be lower than the average of the fine framework specified in Clause 4, Article 13 of Decree 125/2020/ND-CP.

Additionally, individuals committing such violations must undertake remedial measures:

- Compulsory payment of the late tax payment into the state budget for violations under Clauses 1, 2, 3, 4, and 5 of Article 13 Decree 125/2020/ND-CP in cases where the late submission of the VAT return results in delayed tax payment;

- Compulsory submission of the tax return and accompanying appendices for violations specified in points c, d, Clause 4, Article 13 of Decree 125/2020/ND-CP.

Note: The fines for late submission of the VAT return mentioned above apply to violations committed by organizations. For individuals with similar violations, the fine is 1/2 of the penalty imposed on organizations (according to Clause 5, Article 5 of Decree 125/2020/ND-CP).