What is the date of the 25th day of Tet holiday 2025? Is overtime work on the 2025 Tet holiday subject to personal income tax in Vietnam?

What is the date of the 25th day of the 2025 Tet holidays in Vietnam?

The Tet holiday is an important traditional festival in many Asian countries, including Vietnam. It is an occasion for family and friends to gather, welcoming the new year with many positive things.

The Tet holiday 2025 is not only a holiday but also a distinctive cultural beauty of the Vietnamese people. Despite many changes in modern life, the meaning of Tet is always preserved and passed on to future generations.

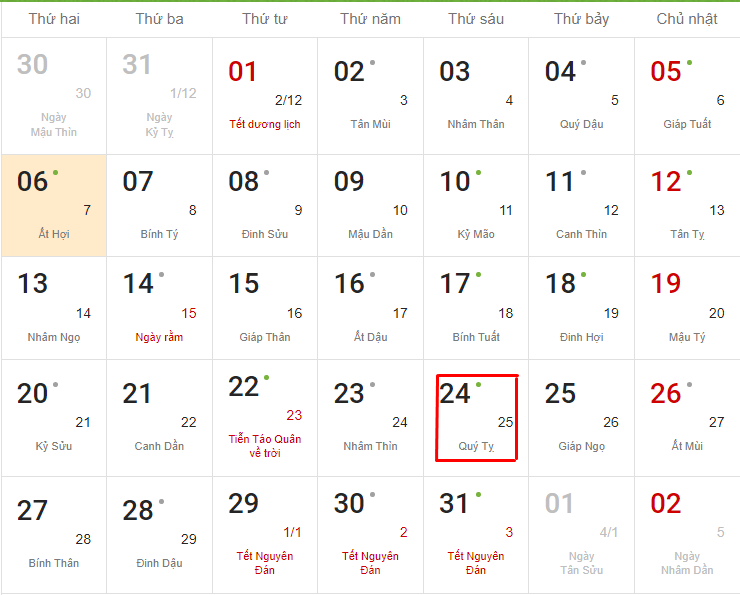

According to the perpetual calendar for 2025, the year 2025 will start from January 29, 2025, and end on February 16, 2026.

Thus, it can be seen that the 25th day of the Tet holiday will fall on January 24, 2025, in the Gregorian calendar of 2025.

Is overtime work on the 2025 Tet holiday subject to personal income tax in Vietnam?

Based on point i, clause 1, Article 3 of Circular 111/2013/TT-BTC, which stipulates exempted taxable income as follows:

Exempted Taxable Income

1. Based on the provisions of Article 4 of the Personal Income Tax Law and Article 4 of Decree No. 65/2013/ND-CP, exempted taxable income includes:

...

i) Income from wages and salaries earned from night work, overtime that is paid higher than daytime work and regular working hours as regulated by the Labor Code. Specifically:

i.1) The portion of wages and salaries received for night work, overtime that exceeds the daytime rate is tax exempt based on actual wages and salaries for night and overtime work minus (-) the standard daily rate.

Example 2: Mr. A receives a regular workday wage as stipulated by the Labor Code amounting to 40,000 VND/hour.

- In case the individual works overtime on regular weekdays and is paid 60,000 VND/hour, the tax-exempt income is:

60,000 VND/hour – 40,000 VND/hour = 20,000 VND/hour

- In case the individual works overtime on rest days or public holidays and is paid 80,000 VND/hour, the tax-exempt income is:

80,000 VND/hour – 40,000 VND/hour = 40,000 VND/hour

i.2) Organizations and individuals providing income must compile a list specifying night work and overtime, along with additional wages paid for night and overtime work. This list is kept by the income-paying entity and presented upon request by the tax authority.

...

The wages and salaries for employees working overtime during Tet will be paid higher than standard working hours as regulated by the Labor Code 2019.

According to the aforementioned provisions, it can be observed that employees working during the 2025 Tet holiday will be exempt from personal income tax on the portion of the wages paid in excess due to overtime work. However, ordinary daily wages are still subject to personal income tax.

What is the date of the 25th day of Tet holiday 2025? Is overtime work on the 2025 Tet holiday subject to personal income tax in Vietnam? (Image from the Internet)

What are regulations on personal income tax refund in Vietnam?

Below are some details concerning personal income tax refunds, including refund cases, receipt and response to refund dossiers, and the timeframe for processing refund dossiers as follows:

(1) Tax Refund Cases

According to clause 2, Article 8 of the Personal Income Tax Law 2007, provisions regarding tax management and refunds are as follows:

Tax Management and Refunds

1. Taxpayer registration, declaration, deduction, payment, finalization, refunds, handling of violations related to tax laws, and other tax management measures are conducted following tax management law regulations.

2. Individuals are entitled to tax refunds in the following cases:

a) The amount of tax paid is greater than the tax amount payable;

b) Individuals have paid tax but have taxable income below the taxable threshold;

c) Other cases as decided by a competent state authority.

Thus, the current tax refund cases are:

- The amount of tax paid is greater than the tax payable;

- Individuals have paid tax but have taxable income below the taxable threshold;

- Other cases as decided by a competent state authority.

(2) Receipt and Response to Tax Refund Dossiers

The receipt and response to tax refund dossiers are regulated by Article 72 of the Tax Administration Law 2019 as follows:

- Tax authorities are responsible for receiving tax refund dossiers as stipulated below:

+ Tax authorities directly managing the taxpayer receive tax refund dossiers for cases eligible for refunds under tax law regulations.

+ Tax authorities managing the revenue receive dossiers for refunding overpaid amounts; in cases of overpayment refunds pursuant to corporate or personal income tax finalizations, the tax authority that receives the tax finalization dossier also receives overpayment refund dossiers;

+ Customs agencies at locations managing revenue receive tax refund dossiers for cases eligible for refunds under tax laws; for foreign travelers and overseas Vietnamese departing with goods eligible for tax refund, the customs agency at the exit procedure site receives the tax refund dossier.

- Taxpayers submit tax refund dossiers through the following methods:

- Submit dossiers directly at the tax authority;

- Send dossiers through postal services;

- Send electronic dossiers via tax authority electronic transaction portals.

- Processing Timeframe:

- Within 03 working days from the date of receipt of the tax refund dossier, the tax authority must classify and notify the taxpayer regarding the acceptance of the dossier and the timeframe for resolving the tax refund dossier or notify in writing if the dossier is incomplete.

(3) Tax Refund Dossier Processing Timeframe

Based on Article 75 of the Tax Administration Law 2019, the processing timeframe for tax refund dossiers is regulated as follows:

- For dossiers eligible for refund first, no later than 06 working days from the tax authority's notice of dossier acceptance and processing time, the tax authority must decide to refund the tax to the taxpayer or inform about the transfer of the taxpayer's dossier to inspection before refund if applicable per clause 2, Article 73 of the Tax Administration Law 2019 or inform about non-refund if the dossier does not meet refund conditions.

- In cases where information declared in the tax refund dossier differs from the tax authority’s management information, the tax authority will issue a written notification for the taxpayer to explain and provide additional information.

- The time for explanation and provision of additional information is not included in the tax refund dossier processing timeframe.

- For dossiers subject to inspection before refund, no later than 40 days from the tax authority's written acceptance notice and timeframe provision for resolving tax refund dossiers, the tax authority must decide to refund the tax to the taxpayer or refuse the refund if the dossier does not meet conditions.

- Beyond the time limits stipulated in clauses 1 and 2 of Article 75 of the Tax Administration Law 2019, if the delay in the refund decision is due to the tax authorities' fault, besides paying out the refundable tax amount, the tax authority must also pay interest at 0.03%/day based on the overdue tax refund amount and days delayed.

- Funds for interest payment are sourced from the central budget according to state budget law provisions.