What is the current fee for land repurposing applied to individuals in Vietnam?

What is the current fee for land repurposing applied to individuals in Vietnam?

In cases where the State consents to allow a change in land use purpose, citizens must pay a land levy. The fee for changing land use purpose will depend on each specific parcel.

According to Article 8 of Decree 103/2024/ND-CP, which stipulates the land levy for households and individuals when the competent state agency issues a decision permitting the change of land use purpose to homestead land, the calculation is as follows:

| Land use fee when changing land use purpose to homestead land | = | Land use fee of the land type after changing the land use purpose | - | Land use fee, land rent of land types before changing the land use purpose (if any) |

Where:

- The land use fee of the land type after the change is calculated as follows:

| Land use fee of the land type after changing the land use purpose | = | Land area subject to land levy after changing the land use purpose as regulated in Article 4 of Decree 103/2024/ND-CP | x | Land price for calculating land levy as stipulated in Clause 1, Article 5 of Decree 103/2024/ND-CP |

In case the land levy of the land type after the purpose change is less than or equal to the land fee before the purpose change, then the land levy when changing the purpose is zero (=0).

- The land fee before the purpose change is calculated as follows:

+ For land before the change of purpose being agricultural land given by the State to households or individuals without collecting land levy, or being agricultural land legally transferred from other households or individuals, the land fee before the change is calculated by multiplying (=) the land area by the price of corresponding agricultural land in the land price list.

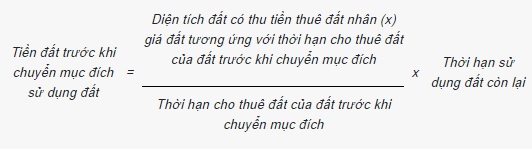

+ For agricultural land before the change of purpose leased by the State with a lump-sum land rent for the entire lease term, the calculation is as follows:

Where:

++ The land price corresponding to the lease term of the land before the change of purpose is the land price in the land price list for calculating lump-sum land rent for the entire lease term.

++ The remaining land use term is determined by subtracting (-) the time of already-used land before the purpose change from the land allocation or lease term before changing the land purpose.

If the remaining land use term determined by this formula is not a full year, it is calculated by month; if not a full month, if the period from 15 days onward is calculated as one full month and less than 15 days, no land levy is charged for these days.

++ For agricultural land before the change of purpose leased by the State annually paying land rent, the land fee before the change of purpose is zero (= 0).

- For non-agricultural land before the purpose change that is not homestead land, the land fee before the purpose change is calculated as follows:

+ If non-agricultural land recognition by the State for households or individuals with a long-term stable use according to the law on land, the land fee before changing use purpose equals one-time land rent for the entire non-agricultural production and business land tenure corresponding to the 70-year land price list at the time when a competent state agency issues the decision allowing the change of land use purpose.

+ If the land before the change is rental land with annual land rent payment, the pre-change land fee is zero (=0).

In cases where the land user has prepaid land rent for several years under the 1993 land law, or pre-paid for land compensation and clearance, and has been allowed by the state agency to deduct from the annual payable land rent by converting years and months fulfilled against financial obligations but not exhausted (not fully deducted) up to the time of changing the purpose, the prepaid land rent months or years that are not exhausted can be converted into money at the time-specific land rent unit price at the time of changing the purpose to determine the pre-change land fee deductible from the land levy.

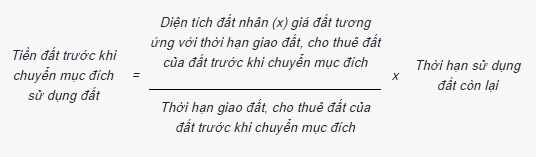

+ For pre-change non-agricultural leased land, paying the full lease rent for the entire term, the pre-change land fee is calculated as:

Where:

++ The land price corresponding to the land allocation or lease term before the change of purpose is the land price for calculating lump-sum rent for the entire lease period in the land price list.

++ The remaining land use term is determined by subtracting (-) the used land time before the purpose change from the allocation or lease period.

If the remaining land use term determined by this formula isn't a full year, it is calculated by the month; incomplete months from 15 days or more are rounded up to one month, and less than 15 days are not charged for land levy for these days.

>> See more: How much does it cost to convert garden land to residential land?

What is the current fee for land repurposing applied to individuals in Vietnam? (Image from the Internet)

Which cases require authorization from competent state agencies for a change in land use purpose in Vietnam?

According to Clause 1, Article 121 of the Land Law 2024, it stipulates cases requiring authorization from competent state agencies for changing land use purpose, including:

- Changing rice cultivation land, special-use forest land, protection forest land, production forest land to other agricultural land types;

- Changing agricultural land to non-agricultural land;

- Changing other land types to concentrated livestock land when implementing large-scale concentrated livestock farming projects;

- Changing non-agricultural land allocated by the State without land levy to other types of non-agricultural land allocated by the State with land levy or leased land;

- Changing non-agricultural land that is not homestead land to homestead land;

- Changing land for public work construction or for public purposes with business investment purposes to non-agricultural production and business land;

- Changing non-commercial land to commercial land.

Which entities are non-agricultural land use taxpayers in Vietnam?

Based on Article 4 of the Law on Non-agricultural Land Use Tax 2010, it regulates who is liable for non-agricultural land use tax as follows:

- Tax payers are organizations, households, and individuals with land use rights subject to tax as stipulated in Article 2 of the Law on Non-agricultural Land Use Tax 2010.

- In cases where organizations, households, and individuals have not been granted a Land Use Right Certificate, the land user is the taxpayer.

- Taxpayers in some specific cases are regulated as follows:

+ If the State leases land for investment projects, the land tenant is the taxpayer;

+ If persons with land use rights lease out the land under a contract, the taxpayer is determined based on the agreement in the contract. If there is no agreement on tax payment in the contract, the person with land use rights is the taxpayer;

+ If the land has been granted a certificate but is currently under dispute, before the dispute is resolved, the current land user is the taxpayer. Tax payment is not a basis for resolving disputes over land use rights;

+ If multiple people share land use rights to a parcel, the taxpayer is the legal representative of those with shared rights;

+ If a person with land use rights contributes business capital in the form of land use rights creating a new legal entity with land use rights subject to tax as regulated in Article 2 of the Law on Non-agricultural Land Use Tax 2010, the new legal entity is the taxpayer.