What is the confirmation form of participation in continuing professional development for tax agency employees in Vietnam in 2024?

What is the confirmation form of participation in continuing professional development for tax agency employees in Vietnam in 2024?

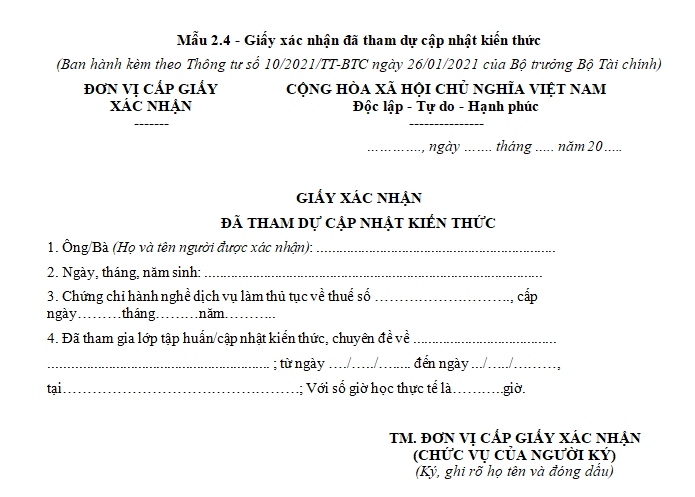

The confirmation form of participation in continuing professional development for Tax Agency Employees in 2024 is currently applied according to Form 2.4 of the Appendix issued with Circular 10/2021/TT-BTC;

DOWNLOAD >> Form 2.8 - Confirmation of Participation in continuing professional development for Tax Agency Employees in 2024

What is the content that tax agency employees need to attend for continuing professional developments in Vietnam?

Based on the provisions of Article 19 of Circular 10/2021/TT-BTC on content and materials for continuing professional developments for tax agency employees as follows:

Content and Materials for continuing professional developments

1. Content for continuing professional developments

a) Legal provisions on taxes, fees, charges, and related tax management content.

b) Legal provisions on corporate accounting.

Based on the content of continuing professional developments, depending on the actual situation, the General Department of Taxation will develop the framework program for the continuing professional developments for that year. The framework program will be issued before January 31 each year.

2. Materials for continuing professional developments

a) Materials for continuing professional developments must contain the content specified in Clause 1 of this Article.

b) Materials for continuing professional developments are presented in written or electronic data form.

Thus, the content for continuing professional developments for tax agency employees includes:

- Legal provisions on taxes, fees, charges, and related tax management content.

- Legal provisions on corporate accounting.

Based on the content of continuing professional developments, depending on the actual situation, the General Department of Taxation will develop the framework program for the continuing professional developments for that year. The framework program will be issued before January 31 each year.

See also: Framework program for continuing professional developments for tax procedure service practitioners in 2024 issued with Decision 22/QD-TCT in 2024.

What is the confirmation form of participation in continuing professional development for tax agency employees in Vietnam in 2024? (Image from the Internet)

How long is the continuing professional development for tax agency employees in Vietnam?

The duration of continuing professional development for tax agency employees is regulated in Article 20 of Circular 10/2021/TT-BTC as follows:

Article 20. Duration and form of continuing professional developments

1. The duration of continuing professional developments for tax agency employees and individuals registering for tax procedure service practice is determined as follows:

a) The minimum duration for continuing professional developments is 24 hours (equivalent to 03 days) annually. The hours for continuing professional developments are calculated cumulatively from January 01 to December 31 each year as the basis for practice registration or determining eligibility for practice in the following year.

b) continuing professional development hours are calculated at the rate of 01 learning hour equal to 01 continuing professional development hour. The duration counted as continuing professional development hours should not exceed 04 hours per session and no more than 08 hours per day.

c) The document proving continuing professional development hours is a confirmation of participation in continuing professional developments issued by the organizing unit.

2. Form of continuing professional developments

a) Participants may attend continuing professional development sessions in the form of direct or online classes organized by the units mentioned in Clause 2 of Article 21 of this Circular.

b) In the case where the participant attends training classes organized jointly by the Tax Department for taxpayers and those updating knowledge (if requiring confirmation), they should notify the organizing unit before attending the first session to enable the Tax Department to monitor and issue the confirmation of participation in continuing professional developments.

Therefore, the duration of continuing professional developments for tax agency employees is determined as follows:

+ The minimum duration for continuing professional developments is 24 hours (equivalent to 03 days) annually. The hours for continuing professional developments are calculated cumulatively from January 01 to December 31 each year as the basis for practice registration or determining eligibility for practice in the following year.

+ continuing professional development hours are calculated at the rate of 01 learning hour equal to 01 continuing professional development hour. The duration counted as continuing professional development hours should not exceed 04 hours per session and no more than 08 hours per day.

The document proving continuing professional development hours is a confirmation of participation in continuing professional developments issued by the organizing unit.