What is the confirmation form of eligibility for tax procedure services in Vietnam in 2024?

What are procedures for registration for practices by tax agent employees in Vietnam?

Pursuant to the provisions of Article 15 of Circular 10/2021/TT-BTC on the registration for practicing of tax agent employees as follows:

Registration for practicing of tax agent employees

1. Principles of registration for practicing of tax agent employees

a) The registration for practicing tax procedure services is carried out through the tax agent where the registrant is the legal representative of the tax agent or has a labor contract to work.

b) Tax agent employees may practice from the day the Tax Department announces their eligibility to practice tax procedure services.

c) At one time, a person holding a certificate for practicing tax procedure services can only practice at one tax agent.

d) Tax agent employees may not practice during the period of suspension or termination of practicing tax procedure services.

2. The legal representative of the tax agent is responsible before the law for checking the information and documents provided by the registrant for practicing tax procedure services; confirming the conditions as prescribed in Article 14 of this Circular for the tax agent employees.

3. The tax agent provides the information of the tax agent employees to the Tax Department (where the tax agent's headquarters is located) when registering for the business eligibility certificate for tax procedure services of the tax agent according to the provisions of Article 22 of this Circular or when notifying the change of information of tax agent employees according to the provisions at point a, clause 8, Article 24 of this Circular.

Thus, the registration for practicing tax procedure services is carried out through the tax agent where the registrant is the legal representative of the tax agent or has a labor contract to work.

What are procedures for registration for practices by tax agent employees in Vietnam? (Image from the Internet)

What is the time limit for the Tax Department to notify tax agent employees who are qualified for practicing tax procedure services in Vietnam?

Pursuant to the provisions of clause 1, Article 16 of Circular 10/2021/TT-BTC on the notification period for qualified tax agent employees for practicing tax procedure services as follows:

Management of practicing for tax agent employees

1. Notification of qualified tax agent employees for practicing.

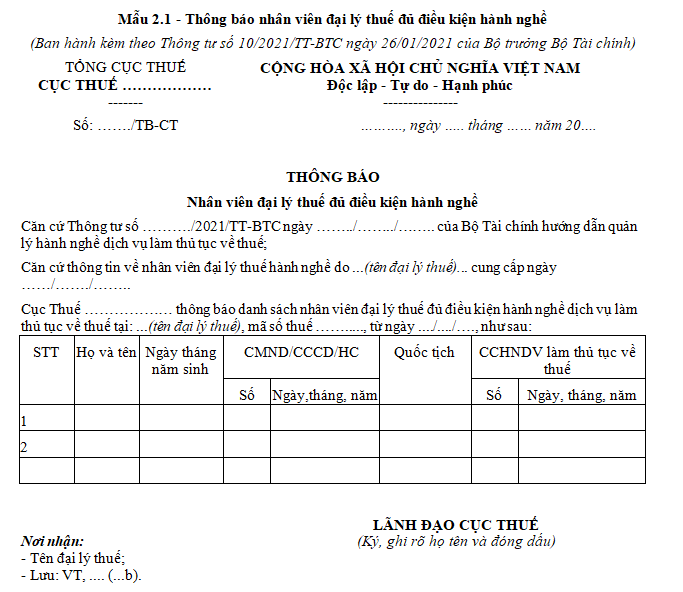

The Tax Department (where the tax agent's headquarters is located) checks the information of tax agent employees provided by the tax agent in the application for the business eligibility certificate for tax procedure services according to Form 2.6 or in the notification of changes to the information of tax agent employees according to Form 2.8 in the Appendix issued with this Circular. If eligible, within 5 working days from the day of receiving the complete dossier or notification from the tax agent, the Tax Department shall notify the qualified tax agent employees for practicing according to Form 2.1 in the Appendix issued with this Circular. If the tax agent employees are not eligible to practice, the Tax Department shall provide a written response to the tax agent stating the reasons.

2. Update of changes to information of tax agent employees.

Within 5 working days from the date of receiving the notification of changes to the information of tax agent employees, the Tax Department updates the information provided by the tax agent and synchronizes the updated information on the tax management system.

...

Thus, the Tax Department (where the tax agent's headquarters is located) checks the information of tax agent employees provided by the tax agent in the application for the business eligibility certificate for tax procedure services or in the notification of changes to the information of tax agent employees.

And within 5 working days from the day of receiving the complete dossier or notification from the tax agent, the Tax Department (where the tax agent's headquarters is located) is responsible for notifying the qualified tax agent employees for practicing tax procedure services.

In case the tax agent employees are not eligible to practice, the Tax Department shall provide a written response to the tax agent stating the reasons.

What is the confirmation form of eligibility for tax procedure services in Vietnam in 2024?

The latest confirmation form of eligibility for tax procedure services 2024 is applied according to Form 2.1 in the Appendix issued with Circular 10/2021/TT-BTC.

DOWNLOAD >> Latest confirmation form of eligibility for tax procedure services 2024