What is the CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam?

What is the CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam?

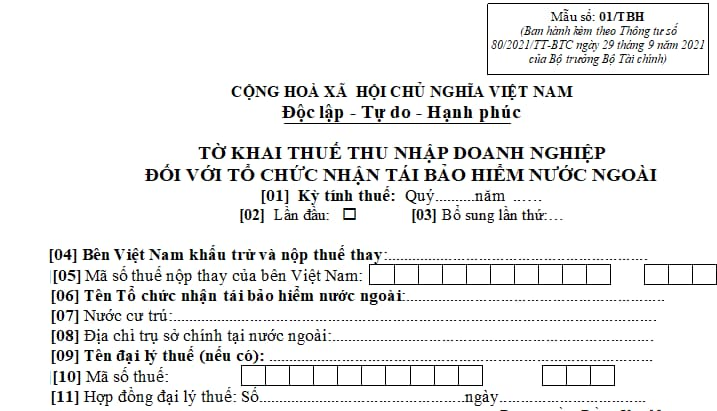

The CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam is stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC as follows:

Download the CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam: Here

What is the CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam? (Image from Internet)

What does the CIT declaration dossier of foreign reinsurers in Vietnam include?

Under Section 13.6 stipulated in Appendix 1 issued together with Decree 126/2020/ND-CP, the CIT declaration dossier of foreign reinsurers includes:

- The CIT declaration form for foreign reinsurers (Form 01/TBH issued together with Circular 80/2021/TT-BTC).

- Annex showing statement on reinsurance policies. For each type of contract, the taxpayer sends a certified copy to serve as a sample. The taxpayer is responsible for the accuracy of this statement. (Form 01-1/TBH issued together with Circular 80/2021/TT-BTC).

- A certified copy of the Business License or the practicing certificate.

Will foreign reinsurers in Vietnam declare CIT monthly or quarterly?

According to Article 8 of Decree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; tax finalization

1. The following taxes AND other amounts collected by tax authorities have to be declared monthly:

a) Value-added tax (VAT), personal income tax. Taxpayers who satisfy the requirements specified in Article 9 of this Decree may declare these taxes quarterly.

b) Excise duty.

c) Environment protection tax.

d) Resource royalty, except that specified in Point e of this Clause.

dd) Fees and charges payable to state budget (except those collected by diplomatic missions of Vietnam as prescribed in Article 12 of this Decree; customs fees, goods, luggage and vehicle transit charges).

e) For extraction and sale of natural gas: resource royalty; corporate income tax; special tax of Vietsovpetro JV in block 09.1of Vietnam - Russia Agreement dated December 27, 2010 on cooperation in geological survey and petroleum extraction in the continental shelves of the Socialist Republic of Vietnam by Vietsovpetro JV; profit on natural gas received by the host country.

2. The following taxes and other amounts shall be declared quarterly:

a) Corporate income tax incurred by foreign airliners and foreign reinsurers.

b) VAT, corporate income tax, personal income tax declared on behalf of pledgors by credit institutions and third parties authorized by credit institutions to manage the collateral pending settlement.

c) Personal income tax deducted by income payers that are eligible to declare VAT quarterly and also decide to declare personal income tax quarterly; individuals earning salaries or remunerations (hereinafter referred to as “salary earners”) who decide to declare personal income tax quarterly with tax authorities.

d) Taxes and other amounts payable to state budget declared and paid on behalf of individuals by other organizations or individuals that are eligible to declare VAT quarterly and decide to declare tax on behalf of these individuals quarterly, except for the case specified in Point g Clause 4 of this Article.

dd) Surcharges when crude oil price increases (except petroleum activities of Vietsovpetro JV in block 09.1).

3. The following taxes and other amounts shall be declared annually:

a) Licensing fees.

b) Personal income tax on individuals working as lottery, insurance, multi-level marketing agents that remains after deduction and ha to be paid at the end of the year.

c) Presumptive taxes and other amounts payable by household businesses and individual businesses; lessors that decide to declare tax annually

d) Non-agricultural land use tax.

In case a taxpayer has the land use right (LUR) of more than one land plots in the same district or different districts in the same province, annually declare tax on each land plot and on the entire area of homestead land. The taxpayer is not required to declare tax on the entire area of homestead land in the following cases:

d.1) The taxpayer has the LUR of one or some land plots in the same district with the total area not exceeding the limit on homestead land area in that district.

d.2) The taxpayer has the LUR of more than land plots different districts, none of which exceed the limit and the total area of levied land does not exceeding the limit on homestead land area in that district.

dd) Agriculture land levy.

e) Annually paid land rents and water surface rents.

...

Thus, the corporate income tax for foreign reinsurers is declared quarterly.