What is the CIT declaration form - Form 01/HKNN applicable to foreign airlines in Vietnam?

What is the CIT declaration form - Form 01/HKNN applicable to foreign airlines in Vietnam?

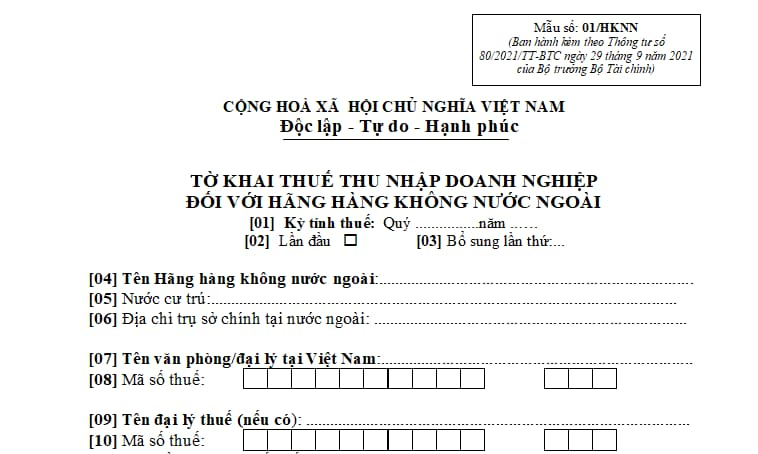

CIT declaration form - Form 01/HKNN applicable to foreign airlines is stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC as follows:

Download CIT declaration form - Form 01/HKNN applicable to foreign airlines: Here

What is the CIT declaration form - Form 01/HKNN applicable to foreign airlines in Vietnam? (Image from the Internet)

Will foreign airlines in Vietnam declare CIT monthly or quarterly?

According to Article 8 of Decree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; tax finalization

1. The following taxes AND other amounts collected by tax authorities have to be declared monthly:

a) Value-added tax (VAT), personal income tax. Taxpayers who satisfy the requirements specified in Article 9 of this Decree may declare these taxes quarterly.

b) Excise duty.

c) Environment protection tax.

d) Resource royalty, except that specified in Point e of this Clause.

dd) Fees and charges payable to state budget (except those collected by diplomatic missions of Vietnam as prescribed in Article 12 of this Decree; customs fees, goods, luggage and vehicle transit charges).

e) For extraction and sale of natural gas: resource royalty; corporate income tax; special tax of Vietsovpetro JV in block 09.1of Vietnam - Russia Agreement dated December 27, 2010 on cooperation in geological survey and petroleum extraction in the continental shelves of the Socialist Republic of Vietnam by Vietsovpetro JV; profit on natural gas received by the host country.

2. The following taxes and other amounts shall be declared quarterly:

a) Corporate income tax incurred by foreign airliners and foreign reinsurers.

b) VAT, corporate income tax, personal income tax declared on behalf of pledgors by credit institutions and third parties authorized by credit institutions to manage the collateral pending settlement.

c) Personal income tax deducted by income payers that are eligible to declare VAT quarterly and also decide to declare personal income tax quarterly; individuals earning salaries or remunerations (hereinafter referred to as “salary earners”) who decide to declare personal income tax quarterly with tax authorities.

d) Taxes and other amounts payable to state budget declared and paid on behalf of individuals by other organizations or individuals that are eligible to declare VAT quarterly and decide to declare tax on behalf of these individuals quarterly, except for the case specified in Point g Clause 4 of this Article.

dd) Surcharges when crude oil price increases (except petroleum activities of Vietsovpetro JV in block 09.1).

...

Therefore, the CIT for foreign airlines is declared quarterly.

What is the deadline for submission of CIT declaration dossiers for foreign airlines in Vietnam?

According to Article 44 of the Law on Tax Administration 2019:

Deadlines for submission of tax declaration dossiers

1. Deadlines for submission of tax declaration dossiers of taxes declared monthly and quarterly:

a) For taxes declared monthly: the 20th of the month succeeding the month in which tax is incurred;

b) For taxes declared quarterly: the last day of the first month of the succeeding quarter.

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual personal income tax statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

c) For presumptive tax declarations prepared by household businesses and individual businesses: the 15th of December of the preceding year. For new household businesses and individual businesses: within 10 days from the date of commencement of the business.

3. For declaration of taxes that are declared and paid upon incurrence: the 10th day from the day on which tax is incurred.

4. For tax declaration dossiers upon shutdown, contract termination, business conversion or business re-arrangement: the 45th day from the occurrence of the event.

5. The Government shall specify the deadlines for submission of statements of farming land levies, non-farming land levies; land levies; land rents, water surface rents; mineral extraction licensing fee; water resource extraction licensing fee; registration fee; licensing fees; other amounts payable to state budget in accordance with regulations of law on management and use of public property; multinational profit reports.

6. Deadlines for submission of customs dossiers of exports and imports are specified by the Law on Customs.

7. In case a taxpayer declares tax electronically on the last day of the time limit for declaration and the information portal of the tax authority is not functional, the taxpayer may submits the electronic declaration on the next day after the online portal is functional again.

Therefore, the deadline for submission of CIT declaration dossiers for foreign airlines in Vietnam is no later than the last day of the first month of the succeeding quarter.