What is the chart of accounts in Vietnam according to Circular 200?

What is the chart of accounts in Vietnam according to Circular 200?

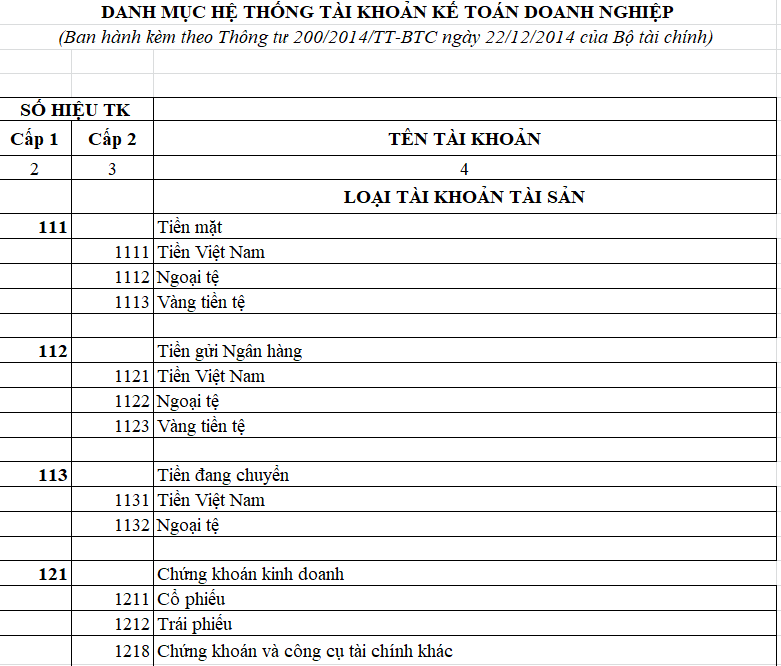

In Appendix 1 issued together with Circular 200/2014/TT-BTC, the chart of accounts according to Circular 200 is stipulated as follows:

See the chart of accounts according to Circular 200 : here

Note: Circular 200/2014/TT-BTC is applicable to enterprises across all sectors and all types of economic components.

Small and medium enterprises currently using the accounting regime for small and medium enterprises may adopt the provisions of Circular 200 to suit their business characteristics and management needs.

What is the chart of accounts in Vietnam according to Circular 200? (Picture from the Internet)

What are regulations on monetary unit in accounting and changes in monetary unit in accounting in Vietnam?

Pursuant to Article 3 Circular 200/2014/TT-BTC, the regulations are as follows:

monetary unit in Accounting

“monetary unit in accounting” refers to the Vietnamese Dong (the national symbol is “đ”; the international symbol is “VND”) used for bookkeeping, preparing, and presenting the financial statements of the enterprise. In cases where the accounting unit mainly engages in transactions in foreign currencies, meeting the standards prescribed in Article 4 of this Circular, it may select a foreign monetary unit as the unit for bookkeeping .

The monetary unit in accounting is the Vietnamese Dong.

If the accounting unit mainly conducts transactions in foreign currencies and meets the standards prescribed in Article 4 Circular 200/2014/TT-BTC, it may select a foreign monetary unit as the accounting unit.

Furthermore, Article 7 Circular 200/2014/TT-BTC stipulates that when there are significant changes in management and business operations leading to the monetary unit used in economic transactions no longer meeting the standards specified in Clauses 2 and 3, Article 4 Circular 200/2014/TT-BTC, the enterprise may change the monetary unit. The change from one bookkeeping monetary unit to another can only be performed at the beginning of a new accounting period.

Enterprises must notify the direct tax administration authority of any monetary unit changes in accounting no later than 10 working days from the end of the accounting period.

What are regulations on selection of monetary unit in accounting in Vietnam?

Based on Article 4 Circular 200/2014/TT-BTC, the selection of monetary unit in accounting is specified as follows:

- Enterprises with primary transactions in foreign currencies, based on the Accounting Law, should consider and decide on the selection of accounting monetary unit and be responsible for that decision before the law. When choosing the accounting monetary unit, enterprises must notify the direct tax administration authority.

- The accounting monetary unit is the monetary unit:

+ Primarily used in sales transactions, service provision, significantly affecting the prices of goods and services, and is usually the monetary unit used for pricing and payment; and

+ Primarily used in purchasing goods and services, significantly affecting labor costs, materials, and other production and business expenses, typically the monetary unit used for these payments.

- The following factors are also considered and provide evidence for the unit's accounting monetary unit:

+ The monetary unit used for mobilizing financial resources (such as issuing shares, bonds);

+ The monetary unit regularly earned from business activities and retained.

- The accounting monetary unit reflects the transactions, events, and conditions related to the unit's operations. Once determined, the accounting monetary unit cannot be changed unless there are significant changes in these transactions, events, and conditions.

What are the rules for cash accounting in Vietnam?

Pursuant to Article 11 Circular 200/2014/TT-BTC, the rules for cash accounting are regulated as follows:

- Accountants must maintain continuous daily records in the accounting books, according to the order of occurrence of transactions such as receipts, payments, incoming, and outgoing money, foreign currencies, and calculate the remaining balance at the cash fund and each bank account at any time for verification and reconciliation purposes.

- Amounts deposited by other enterprises and individuals in the form of deposits and savings at the enterprise are managed and accounted for as if they belong to the enterprise.

- When receiving or disbursing money, receipt vouchers, and payment vouchers must be available with required signatures according to accounting document policies.

- Accountants must track money in detail according to the original monetary unit. In cases of transactions in foreign currencies, they must convert foreign currencies to Vietnamese Dong according to the principle:

+ Debit side of money accounts applies the actual exchange rate;

+ Credit side of money accounts applies the weighted average exchange rate recorded in the books.

- At the time of preparing financial statements as per legal regulations, enterprises must re-evaluate the balances of foreign monetary unit and monetary gold according to the actual exchange rate.