What is the bid sheet form in Vietnam according to Circular 11/2022/TT-BCT?

What is the form of bid sheet in Vietnam according to Circular 11/2022/TT-BCT?

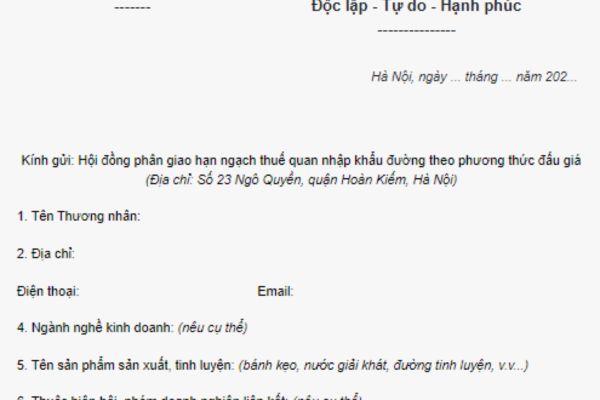

The bid sheet for businesses participating in the allocation of import sugar tariff quotas via auctions is implemented according to the Template in the Appendix issued with Circular 11/2022/TT-BCT. Below is the template for the bid sheet:

DOWNLOAD >>>> bid sheet

When shall the bid sheet of enterprises participating in the allocation of import sugar tariff quotas via auctions be opened in Vietnam?

According to the provisions of Article 11 Circular 11/2022/TT-BCT, each enterprise submits only one application dossier proposing to participate in the allocation of import sugar tariff quotas via auctions, including:

Application Dossier for Participation in the Allocation of Import Sugar Tariff Quotas via auctions

1. Each enterprise submits only one application dossier proposing to participate in the allocation of import sugar tariff quotas via auctions, including:

a) bid sheet (according to the Template in the Appendix issued with this Circular). Each enterprise can submit bids with registered prices being the same or different for 01 (one) unit price and the maximum registered quantity not exceeding 20 (twenty) unit prices. Each unit price has a registered quantity of 1,000 (one thousand) tons.

The bid sheet must be placed in a separate envelope, sealed, signed by the enterprise at the edges of the envelope and placed into the application dossier for participation in the allocation of import sugar tariff quotas via auctions. This bid sheet can only be opened at the Auction Session.

b) Certificate of Business Registration or Certificate of Enterprise Registration or Certificate of Investment or equivalent documents: 01 certified copy, stamped as a true copy by the enterprise.

c) Document confirming the advance deposit into the account of the Ministry of Industry and Trade: 01 certified copy, stamped as a true copy by the enterprise.

2. The application dossier for participation in the allocation of import sugar tariff quotas via auctions must be sealed, with a seal and clearly state on the outside the following contents:

a) Application dossier for participation in the allocation of import sugar tariff quotas via auctions.

b) Name of the enterprise.

c) Detailed contact information of the enterprise (address, phone number, fax number, email address).

3. Receiving place and time of application dossiers

a) After the announcement of the Auction Session, enterprises send the application dossier in accordance with clause 1 and clause 2 of this Article by postal service or directly to the standing section of the Auction Council (Export-Import Department - Ministry of Industry and Trade, address 23 Ngo Quyen, Hoan Kiem, Hanoi).

b) The time for receiving application dossiers is announced in the Notice of Invitation to participate in the allocation of import sugar tariff quotas via auctions.

c) The time of receipt of application dossiers is based on the date stamp of the incoming correspondence of the Ministry of Industry and Trade.

Based on the regulations, the bid sheet of enterprises participating in the allocation of import sugar tariff quotas via auctions is placed in a separate envelope, sealed, signed by the enterprise at the edges of the envelope and placed into the application dossier for participation in the allocation of import sugar tariff quotas via auctions.

And the bid sheet of enterprises participating in the allocation of import sugar tariff quotas via auctions can only be opened at the Auction Session.

What is the bid sheet form in Vietnam according to Circular 11/2022/TT-BCT? (Image from Internet)

What are conditions of the successful bid sheet for allocating sugar import tariff quota via auctions in Vietnam?

The procedure for the allocation of import sugar tariff quotas via auctions is stipulated in Article 14 Circular 11/2022/TT-BCT as follows:

Procedure for the Allocation of Import Sugar Tariff Quotas via auctions

1. At the Auction Session, the Auction Council opens the envelopes of the bid sheets of enterprises qualified to participate in the allocation of import sugar tariff quotas via auctions. After that, the Council announces the entire auction results of all enterprises selected to participate in the Auction Session.

2. The enterprise winning the auction is the one with a bid sheet offering a high price in descending order until the entire quantity of import sugar tariff quotas is auctioned off, but not less than the starting price.

In cases where enterprises submit bid sheets with equal prices and the total registered tariff quotas exceed the remaining tariff quotas, the quotas will be divided according to the number of enterprises registered at each bid sheet. In cases where the divided quotas are fractional, it will be handled by rounding rules or according to the decision of the Chairman of the Auction Council.

Enterprises winning the auction are those with bid sheets offering prices in descending order until the entire quantity of import sugar tariff quotas to be auctioned is sold but not less than the starting price.

- In cases where enterprises submit bid sheets with equal prices with total registered tariff quotas exceeding the remaining tariff quotas, the quotas will be divided according to the number of enterprises registered on each bid sheet.

- In cases where the divided quotas are fractional, rounding rules will be applied or the decision of the Chairman of the Auction Council will be followed.