What is the basis for import duty reduction in Vietnam?

What is the basis for import duty reduction in Vietnam?

Under Article 18 of the Law on Export and Import Duties 2016, regulations are as follows:

Tax reduction

1. Exports and imports that are damaged or lost under customs supervision and the damage or loss is verified by a competent organization, tax reduction shall be granted.

The level of reduction shall be proportional to the loss of goods. Tax is exempt if the exports or imports are completely damaged or lost.

2. The procedures for tax reduction shall comply with regulations of law on tax administration.

Thus, the basis for import duty reduction in Vietnam will be based on the actual loss percentage of the goods.

In the case of wholly damaged or lost imports, tax payment is not required.

What does the application for import duty reduction in Vietnam include?

The application for import duty reduction is specified in Clause 2, Article 32 of Decree 134/2016/ND-CP, amended and supplemented by Clause 16, Article 1 of Decree 18/2021/ND-CP, including:

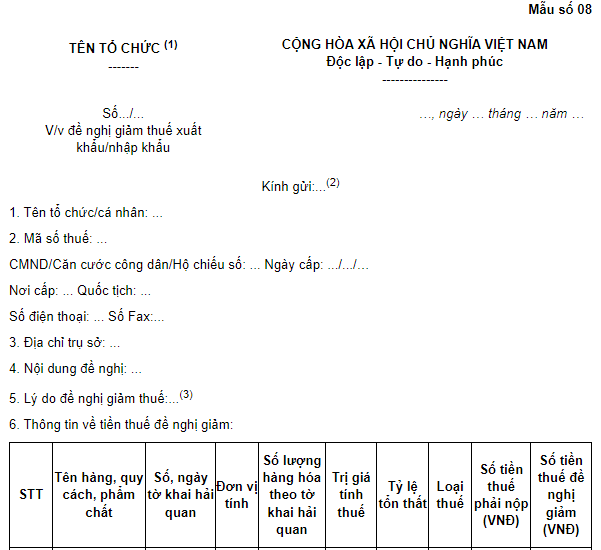

- Official dispatch requesting tax reduction from the taxpayer sent via the electronic data processing system of the customs authority according to the information criteria in Form No. 3 Appendix 7a or the official dispatch requesting tax reduction according to Form No. 08 in Appendix 7 issued together with Decree 134/2016/ND-CP: 01 original copy;

- The insurance contract or insurance payout notice issued by the insurer (if any), or the insurer’s confirmation if the insurance contract does not cover tax indemnification; the contract or agreement on compensation issued by the shipping company in case the damage is caused by the shipping company (if any): 01 photocopy;

- A confirmation of damage issued by a local authority e.g. confirmation of conflagration issued by the local fire department, confirmation issued by one of the following bodies: police authority of the commune, the People’s Committee of the commune; management board of the industrial zone, export processing zone or economic zone; border checkpoint management board; port authority, airport authority where the force majeure event (natural disaster, epidemic, accident) occurs and causes damage to the imported materials or equipment: 01 original copy.

- Confirmation of loss or damage of goods issued by an assessment service provider: 01 original copy.

Additionally, the Customs Department will evaluate the application for import duty reduction within 30 days.

According to Clause 3, Article 32 of Decree 134/2016/ND-CP (amended by Clause 16, Article 1 of Decree 18/2021/ND-CP), the regulations are as follows:

Export and import duty reduction

...

3. Procedures and authority for granting duty reduction:

a) The taxpayer shall submit an application to the customs official while following customs procedures or within 30 working days from the issuance date of the confirmation of loss or damage of goods;

b) If a satisfactory application is submitted while following customs procedures, the Sub-department of Customs shall process the application, carry out a physical inspection, inspect the eligibility for duty reduction and decide whether to grant duty reduction before customs procedures are completed as prescribed Article 23 of the Law on Customs;

c) If the application for duty reduction is submitted after customs procedures are completed:

Within 30 days from the receipt of the satisfactory application, the Provincial/Municipal Customs Department shall compile a dossier, verify the information, inspect the accuracy and adequacy of the application and issue a duty reduction decision according to Form No. 12 in Appendix VII hereof or inform the taxpayer of their ineligibility for duty reduction and the duty payable. If the application is not satisfactory, the customs authority shall inform the taxpayer within 03 working days from the day on which the application is received.

If a physical inspection of goods that have been released from the customs controlled area is necessary basis for duty reduction, a decision on post-clearance inspection shall be delivered to the taxpayer and the tasks specified in this Point shall be carried out within 40 days from the day on which adequate documents are received.

...

Thus, within 30 days from the receipt of the satisfactory application, the Provincial/Municipal Customs Department shall compile a dossier, verify the information, inspect the accuracy and adequacy of the application and issue a duty reduction decision according to Form No. 12 Appendix VII issued with Decree 18/2021/ND-CP or inform the taxpayer of their ineligibility for duty reduction and the duty payable.

If the application is not satisfactory, the customs authority shall inform the taxpayer within 03 working days from the day on which the application is received.

If a physical inspection of goods that have been released from the customs controlled area is necessary basis for duty reduction, a decision on post-clearance inspection shall be delivered to the taxpayer and the tasks specified in this Point shall be carried out within 40 days from the day on which adequate documents are received.

What is the basis for import duty reduction in Vietnam?

What is the application form for import duty reduction in Vietnam?

Pursuant to Form No. 08 in Appendix VII issued with Decree 134/2016/ND-CP, as replaced by Point D, Clause 2, Article 2 of Decree 18/2021/ND-CP, the application form for import duty reduction is as follows:

Download the newest application form for import duty reduction.