What is the application form for tax inspection postponement in Vietnam?

What is the application form for tax inspection postponement in Vietnam?

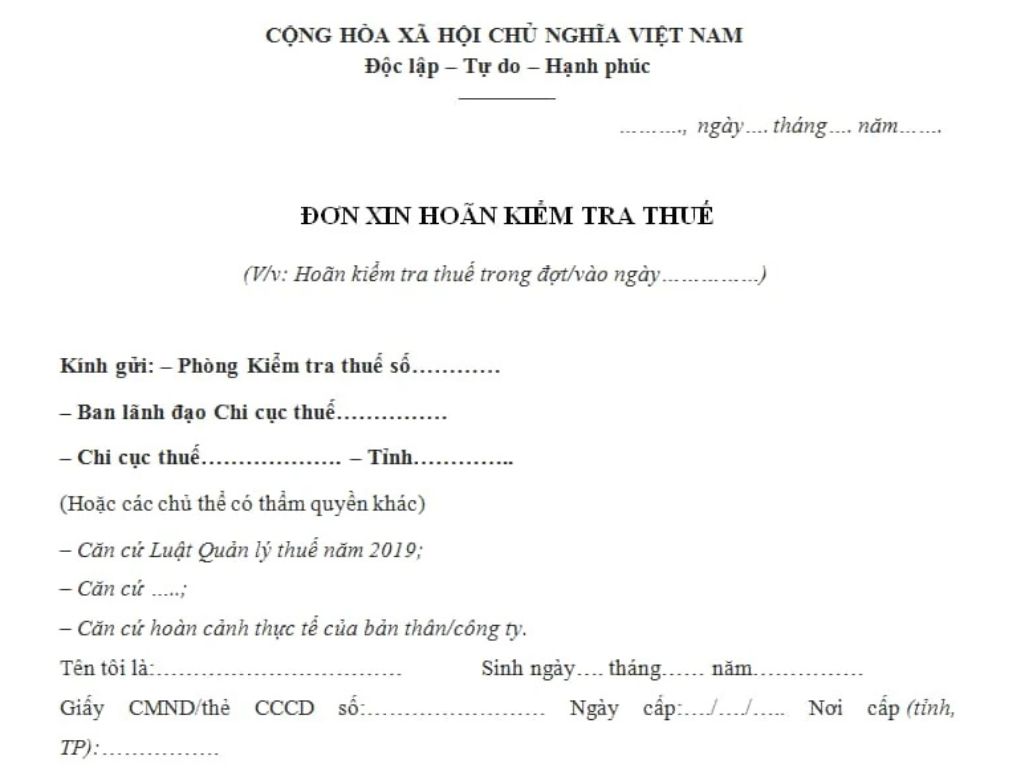

Currently, the law does not establish a regulation for an official letter template requesting a postponement of a tax inspection. However, you can refer to the latest template for such a request below.

>>Template for Official Letter to Postpone Tax Inspection Download

What is the application form for tax inspection postponement in Vietnam? (Image from the Internet)

Shall taxpayers request to postpone the tax inspection in Vietnam?

According to Point c, Clause 5, Article 72 Circular 80/2021/TT-BTC, regulations on inspection at the taxpayer's headquarters are detailed as follows:

Inspection at the Taxpayer's Headquarters

...

5. Order and procedures for tax inspection at the taxpayer's headquarters

a) Issue a Tax Inspection Decision

The tax authority issues a tax inspection decision for cases prescribed in Article 110 of the Law on Tax Administration. Tax inspection at the taxpayer's headquarters is only conducted when there is a tax inspection decision at the taxpayer's headquarters.

The tax authority issues a Tax Inspection Decision for content and periods with risks, excluding tax refund inspections. The Tax Inspection Decision is prepared according to form No. 04/KTT issued with Annex I of this Circular.

The inspection duration is determined in accordance with Clause 4, Article 110 of the Law on Tax Administration. In the case of an extension, the Inspection Team Leader shall report to the competent person to issue an Extension Decision according to form No. 05/KTT issued with Annex I of this Circular.

b) The tax inspection pursuant to the Tax Inspection Decision must commence within 10 working days, from the date of issuance of the Tax Inspection Decision, except when it is necessary to annul the Tax Inspection Decision using form No. 06/KTT issued with Annex I of this Circular or to postpone the inspection.

When tax inspection begins, the Tax Inspection Team Leader is responsible for announcing the Tax Inspection Decision, preparing an Announcement Record, and explaining the content of the Tax Inspection Decision for the taxpayer to understand and comply. The Announcement Record of the Tax Inspection Decision is prepared according to form No. 07/KTT issued with Annex I of this Circular.

c) In cases where the taxpayer provides written request to postpone the inspection period, the document must clearly state the reasons and time for postponement, or when the tax authority has force majeure reasons to postpone the inspection, the tax authority must issue a written notification to the taxpayer before the expiration of the announcement period of the inspection decision, using form No. 08/KTT issued with Annex I of this Circular.

During the inspection, if force majeure reasons arise that prevent the continuation of the inspection, the Inspection Team Leader must report to the Decision maker for suspension. The suspension time is not counted in the inspection duration.

d) If during the tax inspection there is a need to adjust the Inspection Decision (replace the Team Leader, members, or add members to the inspection team, supplement content, inspection period, or adjust to reduce members, content, inspection period), the Inspection Team Leader must report to the competent person to issue an Adjusted Inspection Decision. The adjustment is carried out according to forms No. 09/KTT, 10/KTT, 11/KTT issued with Annex I of this Circular.

....

Thus, taxpayers may request to postpone the tax inspection period, but they must submit a written request stating the reasons and requested postponement time.

* Additionally, the tax inspection postponements will also be implemented if the tax authority has force majeure reasons and will notify the business before the expiration of the period to announce the inspection decision.

When shall taxpayers receive the tax inspection decision in Vietnam?

Based on Clause 3, Article 110 of the Law on Tax Administration 2019, the regulation is as follows:

Tax Inspection at the Taxpayer's Headquarters

...

3. The tax inspection decision must be sent to the taxpayer within 03 working days and announced within 10 working days from the signing date. Before announcing the inspection decision, if the taxpayer can prove that the declared tax amount is correct and has paid the full tax amount due, the tax authority will cancel the tax inspection decision.

4. Procedures for tax inspection are regulated as follows:

a) Announce the tax inspection decision at the commencement of tax inspection;

b) Compare declared content with accounting books, accounting documents, financial statements, tax risk analysis results, inspection information data at the tax authority's headquarters, related documents, the actual state within the scope and content of the tax inspection decision;

c) The inspection duration is determined in the inspection decision but must not exceed 10 working days at the taxpayer’s headquarters. The duration is counted from the date of the inspection decision announcement; if the inspection scope is broad and content complex, the person deciding the inspection may extend once but not more than 10 working days at the taxpayer’s headquarters;

d) Prepare a tax inspection record within 05 working days from the end of the inspection period;

đ) Handle under authority or propose the competent authority handle according to the inspection results.

5. Post-customs inspection is implemented according to customs law.

Accordingly, the tax inspection decision at the taxpayer's headquarters must be sent to the taxpayer within 03 working days and announced within 10 working days from the signing date.

Before announcing the inspection decision, if the taxpayer proves the declared tax is correct and has paid the full amount, the tax authority cancels the tax inspection decision.