What is the application form for tax deferral - Form No. 01/GHAN in Vietnam?

What is the application form for tax deferral - Form No. 01/GHAN in Vietnam?

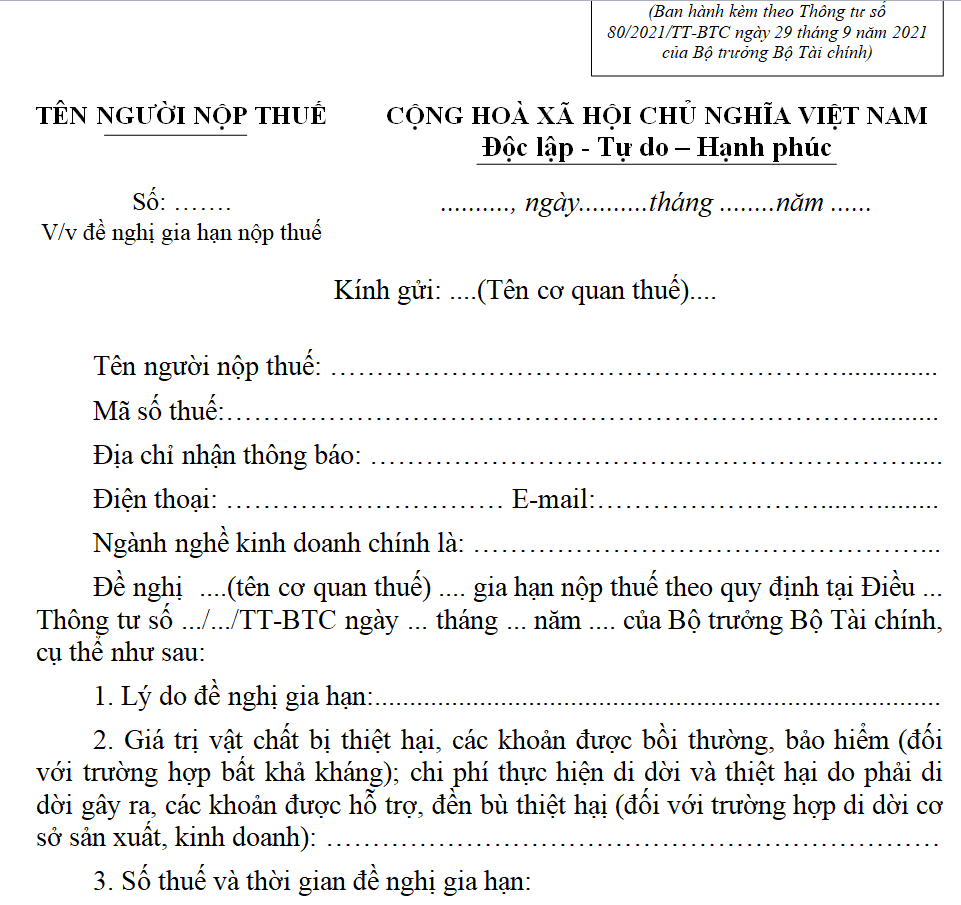

The application form for tax deferral - Form No. 01/GHAN in Vietnam issued with Appendix 1 of Circular 80/2021/TT-BTC is as follows:

>>> Download the application form for tax deferral - Form No. 01/GHAN in Vietnam

What is the application form for tax deferral - Form No. 01/GHAN in Vietnam? (Image from Internet)

What does the application for tax deferral in Vietnam include?

Under Clause 2, Article 24 of Circular 80/2021/TT-BTC, the application for tax deferral includes:

[1]In case of a natural disaster, epidemic, conflagration or accident specified in Point a Clause 27 Article 3 of the Law on Tax Administration 2019, the application shall contain:

- The application form No. 01/GHAN in Appendix I hereof;

- Documents issued by competent authorities confirming the time, location of the natural disaster, epidemic, conflagration or accident (original copies or copies certified by the taxpayer);

- Documents about physical damage determined by the taxpayer or the taxpayer's legal representative, who is responsible for the accuracy of the physical damage determined;

- Documents (original copies or copies certified by the taxpayer) attributing responsibility of specific organizations and individuals for paying compensation (if any);

- Documents (original copies or copies certified by the taxpayer) relevant to payment of compensation (if any).

[2] In other force majeure events specified in Clause 1 Article 3 of Decree 126/2020/ND-CP, the application shall contain:

- The application form made in Form No. 01/GHAN (download) issued with Appendix 1 of Circular 80/2021/TT-BTC;

- Documents about physical damage determined by the taxpayer or the taxpayer's legal representative, who is responsible for the accuracy of the physical damage determined;

- Documents confirming the time and location of the force majeure event issued by competent authorities; documents proving that business suspension or shutdown is caused by the war, riot, strike (original copies or copies certified by the taxpayer);

- Documents proving that the risk is not subjectively caused by the taxpayer and that the taxpayer is not financially capable of making payment to state budget if that is the case (original copies or certified true copies).

- Documents (original copies or copies certified by the taxpayer) relevant to insurance payout provided by the insurer (if any).

[3] In case of relocation of the business establishment specified in Point b Clause 1 Article 62 of the Law on Tax Administration 2019, the application shall contain:

- The application form made in Form No. 01/GHAN (download) issued with Appendix 1 of Circular 80/2021/TT-BTC;;

- The decision on relocation of the business establishment issued by a competent authority (original copy or copy certified by the taxpayer);

- The relocation scheme or plan which specifies the taxpayer's plan and schedule for relocation (original copy or copy certified by the taxpayer);

* Upon completion of the application, the tax authority receives the application for tax deferral via the following methods: (Article 65 of the Law on Tax Administration 2019)

- in person at the tax authorities;

- by post;

- electronically through online portals or tax authorities.

* The tax authority processes the application for tax deferral as follows:

- If the application is valid, send a notice of eligibility for tax deferral to the taxpayer within 10 working days from the receipt of the application;

- If the application is invalid, send a notice to the taxpayer within 03 working days from the receipt of the application.

Which authority shall decide tax deferral in special cases in Vietnam?

Under Article 63 of the Law on Tax Administration 2019:

Tax deferral in special cases

The Government shall decide tax deferral for entities or business lines facing special difficulties in specific periods of time. Tax deferral must not lead to changes to the estimated state budget revenues decided by the National Assembly.

Additionally, tax deferral in special cases is guided by Article 19 of Decree 126/2020/ND-CP as follows:

At certain times when certain groups of taxpayers, industries or businesses are facing difficulties, the Ministry of Finance shall take charge and cooperate with relevant ministries and central authorities in proposing groups of taxpayers, taxes and other amounts eligible for deferral to the Government. Tax deferral shall not affect state budget revenue estimate approved by the National Assembly.

Thus, the Government of Vietnam is the authority that decides on tax deferral in special cases.