What is the application form for joining the Communist Party of Vietnam? Do members of Communist Party of Vietnam have to pay union dues?

What is the application form for joining the Communist Party of Vietnam?

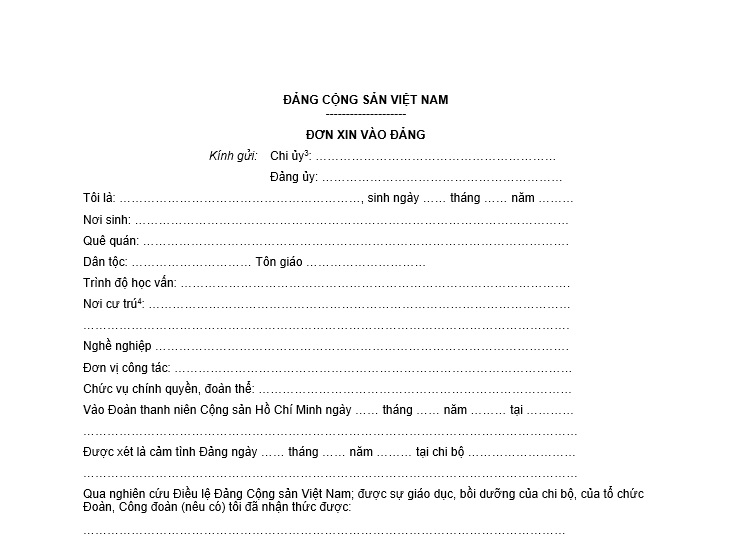

Currently, the application form for joining the Communist Party of Vietnam is Form 1-KND issued along with Guideline 12-HD/BTCTW of 2022.

The application form for joining the Communist Party of Vietnam appears as follows:

The latest application form for joining the Communist Party of Vietnam...Download

What is the application form for joining the Communist Party of Vietnam? (Image from the Internet)

Do members of Communist Party of Vietnam have to pay union dues?

Pursuant to Article 23 of the Regulation on the management of financial and assets of the union, collection, distribution of revenue sources, and reward, penalty for financial collection, issued along with Decision 1908/QD-TLD of 2016, which provides regulations on subjects, contribution levels, and salary used as a basis for calculating union dues as follows:

Subjects, Contribution Levels, and Salary Basis for Union Dues

- Union members in grassroots unions in state agencies; political organizations, socio-political organizations, socio-political-professional organizations, social organizations, socio-professional organizations; units under people's armed forces; public service providers receiving salaries according to the pay scale and grades prescribed by the State: the monthly union fee contribution level is 1% of the salary used as the basis for social insurance contribution according to the law on Social Insurance.

The salary used as the basis for social insurance contribution includes rank salary, position salary, salary according to labor contracts, employment contracts, and position allowances, seniority allowances exceeding the framework, and seniority allowances of the profession. When the salary used as the basis for social insurance contribution changes, the salary used as the basis for union fee contribution also changes in accordance with the law on Social Insurance.

- Union members in grassroots unions of state-owned enterprises (including the union of state-held dominant shareholding joint-stock companies): the monthly union fee contribution level is 1% of the net salary (salary after deductions for social insurance, health insurance, unemployment insurance, and personal income tax of the union member), but the maximum monthly union fee contribution level is only 10% of the statutory pay rate as prescribed by the State.

- Union members in grassroots unions of non-state enterprises (including the union of joint-stock companies not dominated by the state); non-public service units receiving salaries not according to the pay scale and grades prescribed by the State; cooperatives; foreign organizations, international organizations operating on Vietnamese territory; foreign executive offices in business cooperation contracts in Vietnam; union members working abroad: the monthly union fee contribution level is 1% of the salary used as the basis for social insurance contribution according to the law on Social Insurance, but the maximum monthly union fee contribution level is only 10% of the statutory pay rate as prescribed by the State.

- Grassroots unions mentioned in Clauses 2 and 3 of this Article can collect union fees from union members monthly at 1% of the net salary (salary after deductions for social insurance, health insurance, unemployment insurance, and personal income tax of the union member) or set a higher collection rate than 1% of the salary used as the basis for social insurance contribution if approved by the expanded grassroots union executive committee (from union team leader and above) through a Resolution, documented and specifically regulated in the internal expenditure regulations of the grassroots union. The amount collected above the regulation mentioned in Clauses 2 and 3 of this Article is left 100% to the grassroots union to supplement activities according to necessity; when reporting financial settlements, the grassroots union must separate the additional union fees collected according to the prescribed form to calculate the amount to be submitted to higher levels.

- Union members in trade unions, grassroots unions of enterprises unable to determine the salary for union fee calculation; union members not subject to social insurance contribution: contribute a fixed rate but the lowest contribution is 1% of the statutory pay rate as prescribed by the State.

- Union members receiving social insurance allowance from 01 month or more, during the time of receiving the allowance are exempt from union fees; union members without employment, income, or on personal leave from 01 month or more without salary are also exempt from union fees.

Furthermore, Article 45 of the Charter of the Communist Party of Vietnam of Vietnam 2011 states:

members of Communist Party of Vietnam within the age range of the Union must engage and work within the Union organization.

From the above regulations, it shows that CPV members within the union age range must engage and work within the Union organization and thus continue to contribute union fees.

What is the membership fee contribution of CPV members?

Based on Section 1, Part B of the Regulations on membership fee Policies issued with Decision 342/QD-TW of 2010, which regulates the subjects and monthly membership fee contributions. Specifically:

Monthly income of a CPV member for calculating membership fee contributions includes: salary, some allowances; wages; living expenses; other income. members of Communist Party of Vietnam who can determine regular income contribute membership fees as a percentage (%) of monthly income (excluding personal income tax); CPV members with undetermined income have a specified monthly contribution rate for each type of subject.

| Fee Payers | Monthly membership fee Contribution |

| members of Communist Party of Vietnam in administrative agencies, political-social organizations, armed force units | A monthly membership fee of 1% of salary, allowances, wages, and living expenses |

| members of Communist Party of Vietnam receiving social insurance salary | A monthly membership fee of 0.5% of social insurance salary |

| members of Communist Party of Vietnam working in enterprises, public service providers, economic organizations | A monthly membership fee of 1% of wage, salary, and other income from the unit's salary fund |

| Other members of Communist Party of Vietnam in the country (including agricultural, rural CPV members, student CPV members...) | membership fee contribution ranging from 2,000 VND to 30,000 VND/month. For CPV members beyond working age, the contribution is 50% of that of working-age CPV members. |

| members of Communist Party of Vietnam living, studying, working abroad: | |

| (1) members of Communist Party of Vietnam working in Vietnam's representative agencies abroad; CPV members who are foreign-sponsored students or sponsored from the state budget | A membership fee of 1% of the monthly living expenses. |

| (2) Self-financing students; labor-export CPV members; CPV members accompanying families, independently making a living | A monthly membership fee ranging from 2 to 5 USD |

| (3) members of Communist Party of Vietnam who are owners or co-owners of enterprises, commercial zones, service stores | A minimum monthly membership fee of 10 USD |

| members of Communist Party of Vietnam in particularly difficult circumstances | If a request for exemption or reduction in membership fee is submitted, the party cell considers it and reports to the grassroots party committee for a decision. |

Encouraging CPV members from all the above categories to voluntarily contribute higher membership fees than the prescribed rates, provided they have the consent of the party cell committee.