What is the application form for early retirement/resignation in Vietnam according to Decree 178? Is pension income subject to personal income tax in Vietnam?

What is the application form for early retirement/resignation in Vietnam according to Decree 178?

On February 14, 2025, the Ministry of Finance issued Official Dispatch 1767/BTC-TCCB in 2025 Download providing guidance on implementing policies for early retirement and resignation according to Decree 178/2024/ND-CP, applicable to organizations and units belonging to and under the Ministry of Finance.

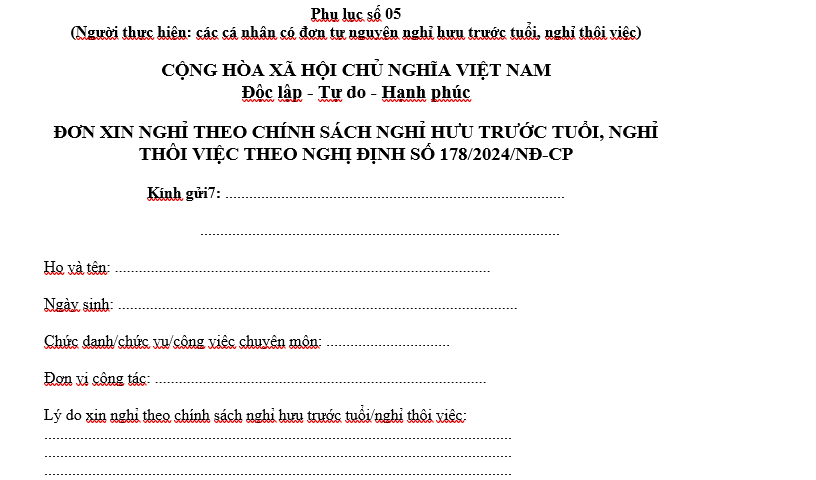

The Ministry of Finance provides a sample application form for early retirement and resignation according to Decree 178 in Appendix 05 issued with Official Dispatch 1767/BTC-TCCB in 2025 as follows:

Download the application form for early retirement and resignation according to Decree 178

Download Official Dispatch 1767/BTC-TCCB in 2025

What is the application form for early retirement/resignation in Vietnam according to Decree 178? Is pension income subject to personal income tax in Vietnam? (Image from the Internet)

Vietnam: What benefits do early retirees receive under Decree 178?

According to Article 7 of Decree 178/2024/ND-CP, policies for officials opting for early retirement when streamlining the apparatus are as follows:

[1] Entitlement to a lump-sum retirement allowance for early retirement:

- For those retiring within the first 12 months from the date of the reorganization decision by the competent authority:

+ For individuals from 5 years or less to the prescribed retirement age in Appendix I and Appendix II attached to Decree 135/2020/ND-CP, an allowance equal to 1 month's current salary multiplied by the number of early retirement months compared to the retirement date.

+ For individuals with over 5 to 10 years to the prescribed retirement age in Appendix I attached to Decree 135/2020/ND-CP, an allowance equal to 0.9 months' current salary multiplied by 60 months.

- For those retiring from the 13th month onward from the date of the reorganization decision by the competent authority, they will receive 0.5 times the allowance specified in point a, clause 1, Article 7 of Decree 178/2024/ND-CP.

[2] Entitlement to early retirement policies based on mandatory social insurance contributions and years of early retirement as follows:

- For individuals from 2 to 5 years to the prescribed retirement age in Appendix I attached to Decree 135/2020/ND-CP, with sufficient mandatory social insurance contributions to receive a pension according to social insurance law, in addition to the pension as per social insurance law, the following policies are available:

+ No pension rate reduction due to early retirement;

+ An allowance of 5 months' current salary for each early retirement year compared to the retirement age in Appendix I of Decree 135/2020/ND-CP;

+ An allowance of 5 months' current salary for the first 20 years of contributions. From the 21st year, an additional 0.5 month's current salary for each compulsory contribution year.

- For individuals over 5 to 10 years to the prescribed retirement age in Appendix I of Decree 135/2020/ND-CP, with sufficient mandatory social insurance contributions for a pension as per social insurance law, additional policies include:

+ No pension rate reduction due to early retirement;

+ An allowance of 4 months' current salary for each early retirement year compared to the retirement age in Appendix I of Decree 135/2020/ND-CP;

+ An allowance of 5 months' current salary for the first 20 years of contributions, and from the 21st year, 0.5 month's current salary for each year.

- For individuals from 2 to 5 years to the retirement age in Appendix II of Decree 135/2020/ND-CP with sufficient contributions and over 15 years of hazardous work, or work in regionally difficult economic conditions as defined before January 1, 2021, additional policies include:

+ No pension rate reduction due to early retirement;

+ An allowance of 5 months' current salary for each early retirement year compared to the retirement age in Appendix II of Decree 135/2020/ND-CP;

+ An allowance of 5 months' current salary for the first 20 years of contributions. Starting the 21st year, 0.5 month's current salary for each year.

- For individuals less than 2 years from the retirement age in Appendix I of Decree 135/2020/ND-CP, the pension is according to social insurance law without rate reduction due to early retirement.

- For individuals less than 2 years from the retirement age in Appendix II of Decree 135/2020/ND-CP, with over 15 years in hazardous roles or difficult regions before January 1, 2021, they receive a pension without reduction under social insurance law.

[3] Officials and public employees retiring early under clauses 1 and 2 of Article 7 of Decree 178/2024/ND-CP fall under the merit commendation category for contributions according to the Law on Emulation and Commendation and Decree 98/2023/ND-CP. If lacking the requisite service time at retirement, the remaining term of their leadership position shall be considered for merit evaluation. For those not eligible under the specified commendation categories, the competent authority may provide suitable awards.

Is pension income subject to personal income tax in Vietnam?

Pursuant to clause 10, Article 4 of the Personal Income Tax Law 2007 (amended by clause 3, Article 2 of the Tax Amendment Law 2014; amended by clause 2, Article 1 of the Amended Personal Income Tax Law 2012) regarding tax-exempt income:

Tax-Exempt Income

...

- Nightshift pay and overtime pay that is higher than standard daytime and regular hours payment.

10. Pension payments made by the Social Insurance Fund, and monthly pensions paid by voluntary pension funds.

- Income from scholarships, including:

a) Scholarships sourced from state budgets;

b) Scholarships sourced from domestic and international organizations under educational support programs.

...

Therefore, under the above regulations, pension income is exempt from personal income tax.