What is the application for reissuance of certificate of tax registration or TIN notification in Vietnam?

What is the application for reissuance of certificate of tax registration or TIN notification in Vietnam?

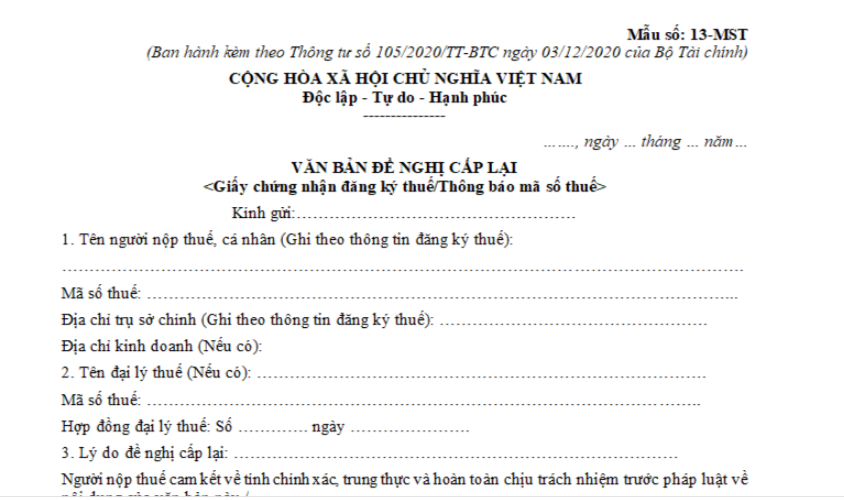

Application for reissuance of certificate of tax registration or TIN notification according to Form No. 13-MST issued together with Circular 105/2020/TT-BTC is as follows:

>> Download Application for reissuance of certificate of tax registration or TIN notification according to Form No. 13-MST

What is the application for reissuance of certificate of tax registration or TIN notification in Vietnam? (Image from Internet)

How many days does the tax authority issue or re-issue the taxpayer registration certificate in Vietnam?

Based on Clause 1, Article 34 of the Law on Tax Administration 2019 which provides for the issuance of the taxpayer registration certificate as follows:

Issuance of Taxpayer Registration Certificate

1. The tax authority shall issue the taxpayer registration certificate to the taxpayer within 03 working days from the date of receipt of the complete taxpayer registration file submitted by the taxpayer in accordance with regulations. The taxpayer registration certificate information includes:

a) Name of the taxpayer;

b) TIN;

c) Number, date, month, year of the business registration certificate or establishment and operation license or investment registration certificate for organizations, individuals engaged in business activities; number, date, month, year of the establishment decision for organizations not subject to business registration; information on identity card, citizen identification card, or passport for individuals not subject to business registration;

2. The tax authority shall notify the TIN to the taxpayer to replace the taxpayer registration certificate in the following cases:

a) Individuals authorizing organizations, individuals to pay income and register taxes on behalf of individuals and their dependents;

b) Individuals register taxes through tax declaration files;

c) Organizations, individuals register taxes to withhold and pay taxes on behalf of others;

d) Individuals register taxes for their dependents.

3. In case of loss, tearing, damage, or burning of the taxpayer registration certificate or the TIN notification, the tax authority shall re-issue within 02 working days from the date of receipt of the complete request file submitted by the taxpayer in accordance with regulations.

Thus, according to the above regulations, the tax authority shall issue the taxpayer registration certificate to the taxpayer within 03 working days from the date of receipt of the complete taxpayer registration file submitted by the taxpayer in accordance with regulations.

The tax authority shall re-issue within 02 working days from the date of receipt of the complete request file submitted by the taxpayer in case of loss, tearing, damage, or burning of the taxpayer registration certificate or TIN notification.

What are regulations on use of TINs in Vietnam?

At Article 35 of the Law on Tax Administration 2019, the regulation on the use of TINs by the subjects issued with TINs is as follows:

- Taxpayers must enter the issued TIN on invoices, documents, and materials when conducting business transactions; opening deposit accounts at commercial banks, other credit institutions; tax declaration, tax payment, tax exemptions, tax reductions, tax refunds, tax non-collection, customs declaration, and other tax transactions concerning all obligations to pay the state budget, including cases where the taxpayer operates production and business activities in various locations.

- Taxpayers must provide the TIN to the related agencies or organizations or enter the TIN on the application files when carrying out administrative procedures under the one-stop-shop mechanism with the tax administration agency.

- The tax administration agency, State Treasury, commercial banks, and the organizations authorized by the tax agency to collect taxes shall use the taxpayer's TIN in tax management and tax collection to the state budget.

- Commercial banks, other credit institutions must enter the TIN in the account opening files and transaction documents via the account of the taxpayer.

- Other organizations and individuals in involving in tax management use the issued TIN of the taxpayer when providing information related to tax obligation determination.

- When foreign payments are made by Vietnamese parties to organizations or individuals conducting cross-border business based on a digital intermediary platform without a physical presence in Vietnam, the issued TIN must be used to deduct, pay on behalf.

- When the personal identification number is issued to all residents, it shall be used in place of the TIN.