What is the address of Binh Thanh District Tax Department? What are the duties and powers of the Binh Thanh District Tax Department?

What is the address of Binh Thanh District Tax Department?

According to the Information Portal of the Binh Thanh District Tax Department, the contact details are as follows:

(1) Contact Information:

- Agency Name: Binh Thanh District Tax Department

- Address: 368 Bach Dang, Ward 14, Binh Thanh District, Ho Chi Minh City.

- Phone Number: (028) 355 10304

- Fax: 028 38412370

- Working Hours:

+ Morning from 08:00 to 12:00.

+ Afternoon from 13:00 to 17:00 daily.

(2) Phone Directory of Binh Thanh District Tax Department:

| No. | DEPARTMENT | PHONE NUMBER |

|---|---|---|

| 1 | General – Operations - Estimates - Propaganda - Taxpayer Support | Invoice: 028 38031795 Tax Policy: 028 35510304 |

| 2 | Declaration – Tax Accounting - IT | 028 38434314 |

| 3 | Internal Audit | 028 35080030 |

| 4 | Debt Management and Tax Debt Enforcement | 028 35080032 |

| 5 | Administration – Human Resources - Finance - Management - Issuing | 028 35019937 |

| 6 | Registration and Other Fees | 028 35511572 |

| 7 | Tax Inspection Department No. 1 | 028 35080034 |

| 8 | Tax Inspection Department No. 2 | 028 35080035 |

| 9 | Tax Inspection Department No. 3 | 028 35080036 |

| 10 | Tax Inspection Department No. 4 | 028 35080037 |

| 11 | Tax Inspection Department No. 5 | 028 35180038 |

| 12 | Audit – Tax Inspection | 028 35180039 |

| 13 | Business Household and Individual Management No. 1 (Wards 1, 2, 3, 5, 6, 7, 11, 12, 13, 14, Ba Chieu Market) | 028 38434314 |

| 14 | Business Household and Individual Management No. 2 (Wards 15, 17, 19, 21, 22, 24, 26, 27, 28, Thanh Da Market, Thi Nghe Market) | 028 35180039 |

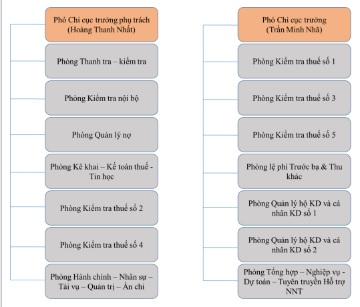

(3) Organizational Chart of Binh Thanh District Tax Department:

Thus, the Binh Thanh District Tax Department is located at: 368 Bach Dang, Ward 14, Binh Thanh District, Ho Chi Minh City.

What is the address of Binh Thanh District Tax Department? (Image from Internet)

What are the duties and powers of the Binh Thanh District Tax Department?

Based on Article 2 of Decision 110/QD-BTC of 2019 (supplemented by Clause 1, Article 1 of Decision 812/QD-BTC of 2021), the duties and powers of the Binh Thanh District Tax Department are prescribed as follows:

- Organize and implement uniformly the legal documents on tax, tax management, and other related legal documents; the procedures and methods of tax management in the locality.

- Organize and implement the annual tax revenue estimates; compile, analyze, and evaluate tax management; advise local party committees and authorities on the establishment and enforcement of state budget revenue estimates, and on tax management in the locality; take the lead and closely coordinate with other sectors, agencies, and units to accomplish the assigned tasks.

- Organize tax policy propaganda, guidance, and explanation to taxpayers; assist taxpayers in fulfilling their tax obligations according to legal conformity.

- Propose to the Director of the Tax Department issues that require amendments, supplements to tax legal documents, professional procedures, internal management regulations, and issues beyond the handling authority of the Tax Department.

- Organize tax management assignments for taxpayers within the management scope of the Tax Department: taxpayer registration; tax declaration; tax calculation; tax notification; tax payment; tax refund; tax deduction; tax exemption, reduction; tax debt and penalty deletion; tax accounting for taxpayers; urge taxpayers to fulfill tax obligations fully and promptly into the state budget.

- Manage taxpayer information; build an information database about taxpayers in the locality.

- Organize technical and professional measures for risk management in tax administration activities.

- Inspect and supervise tax declaration, tax refund, tax deduction, tax exemption, reduction, tax payment, and compliance with tax policies and laws by taxpayers and organizations and individuals authorized to collect taxes according to the decentralization and management authority of the Head of the Tax Department.

- Tax Departments with revenue exceeding 5,000 billion VND/year (excluding oil revenue and land revenue); managing over 10,000 enterprises are given additional tasks of direct tax specialized inspection.

- Decide or propose competent authorities to decide on tax exemption, reduction; tax refund; tax declaration filing extension, tax payment extension; tax debt and penalty deletion, penalty exemption according to legal regulations.

- Entitled to require taxpayers, state agencies, and other relevant organizations and individuals to provide promptly necessary information for tax revenue management; request competent authorities to handle organizations and individuals not fulfilling their responsibility in cooperating with tax authorities to perform state budget revenue tasks.

- Entitled to determine tax, implement measures to enforce administrative tax decisions according to legal regulations; announce on mass media about tax law violations of taxpayers.

- Compensate taxpayers for damages caused by tax authorities' errors, according to legal regulations; keep taxpayer information confidential; confirm the tax obligation fulfillment of taxpayers according to legal regulations.

- Organize the implementation of tax statistics, tax management, management of invoices, tax stamps; compile reports on tax collection results and other reports serving the direction and administration of superior agencies, the equivalent People's Committee and related agencies; summarize and evaluate the situation and operational results of the Tax Department.

- Organize and resolve tax complaints and denunciations and complaints and denunciations related to the execution of official duties of tax officials under the management authority of the Head of the Tax Department according to legal regulations.

- Handle administrative violations on tax, compile dossiers to request competent agencies to prosecute organizations and individuals violating tax laws according to the Law on Tax Management and other related legal regulations.

- Appraise and determine taxpayers’ payable taxes as requested by competent state agencies.

- Implement tax system reform tasks aiming to improve operational quality, standardize procedures, improve tax management processes and provide information to facilitate taxpayers in fulfilling tax policies and laws.

- Organize the reception and implementation of application software, IT infrastructure meeting the requirements of modernizing tax administration work, and internal management work into the activities of the Tax Department.

- Manage the organizational apparatus, staffing, labor; organize training and fostering of the Tax Department staff according to state regulations and the Ministry of Finance's decentralization.

- Manage funds, assets assigned, archive files, documents, and tax stamps according to legal regulations and industry regulations.

- Perform other tasks as assigned by the Director of the Tax Department.

What are regulations on leadership of the Binh Thanh District Tax Department?

Based on Article 4 of Decision 110/QD-BTC of 2019, the leadership of the Binh Thanh District Tax Department is regulated as follows:

- The Tax Department consists of a Head and several Deputy Heads as prescribed by law.

+ The Head of the Tax Department is responsible to the Director of the Tax Department and the law for all activities of the Tax Department in the locality.

+ Deputy Heads are responsible to the Head and the law for the assigned work areas they are in charge of.

- The appointment, dismissal, demotion, discipline, and transfer of the Tax Department’s leadership are carried out in accordance with legal regulations and the Ministry of Finance's staff management decentralization regulations.