What is the absolute tax rate for environmental protection tax in Vietnam?

What is the absolute tax rate for environmental protection tax in Vietnam?

According to the provisions set out in Clause 2, Article 2 of the Law on Environmental Protection Tax 2010, the definition of the absolute tax rate in environmental protection tax is as follows:

Explanation of Terms

In this Law, the terms below are understood as follows:

1. Environmental protection tax is an indirect tax levied on products and goods (hereinafter referred to as goods) that cause adverse environmental impact when used.

2. The absolute tax rate is the tax rate specified as a monetary amount per taxable unit of goods.

...

Thus, according to the above provision, the absolute tax rate in environmental protection tax is the tax rate specified as a monetary amount per taxable unit of goods.

What is the absolute tax rate for environmental protection tax in Vietnam? (Image from the Internet)

Is the absolute tax rate used as a basis for calculating environmental protection tax in Vietnam?

According to the provisions set out in Article 6 of the Law on Environmental Protection Tax 2010 as follows:

- The basis for calculating environmental protection tax is the taxable quantity of goods and the absolute tax rate.

- The taxable quantity of goods is regulated as follows:

+ For domestically produced goods, the taxable quantity of goods is the quantity of goods produced and sold, exchanged, internally consumed, or gifted;

+ For imported goods, the taxable quantity of goods is the quantity of imported goods.

- The absolute tax rate for tax calculation is stipulated in Article 8 of the Law on Environmental Protection Tax 2010.

According to the above regulation, the basis for calculating environmental protection tax will be According to the taxable quantity of goods and the absolute tax rate.

Additionally, the basis for determining the absolute tax rate is also guided in Article 5 of Circular 152/2011/TT-BTC (supplemented by Article 3 of Circular 159/2012/TT-BTC and amended by Article 1 of Circular 106/2018/TT-BTC) as follows:

The basis for calculating environmental protection tax is the taxable quantity of goods and the absolute tax rate.

- The taxable quantity of goods is regulated as follows:

+ For domestically produced goods, the taxable quantity of goods is the quantity of goods produced and sold, exchanged, internally consumed, gifted, promoted, or advertised.

+ For imported goods, the taxable quantity of goods is the quantity of imported goods.

For cases where the taxable quantity of environmental protection tax levied goods is measured in units different from the units specified for tax calculations at the tax rate table issued by the Standing Committee of the National Assembly, it must be converted to the measurement units specified at the tax rate table for tax calculation.

+ For goods that are mixed fuels containing gasoline, oil, lubricants derived from fossil oils, and biofuels, the taxable quantity in the period is the quantity of fossil oil-based gasoline, oil, and lubricants contained in the imported or produced mixed fuels sold, exchanged, gifted, or consumed internally, converted to the measurement units specified for tax calculation for the respective goods.

The determination method is as follows:

The taxable quantity of fossil oil-based gasoline, oil, and lubricants = Quantity of mixed fuels imported, produced, sold, consumed, exchanged, gifted x Percentage (%) of fossil oil-based gasoline, oil, and lubricants in the mixed fuels.

According to the technical standards for producing mixed fuels approved by competent authorities (including cases with changes in the percentage (%) of fossil oil-based gasoline, oil, and lubricants in the mixed fuels), the taxpayer is responsible for self-calculating, declaring, and paying environmental protection tax on the quantity of fossil oil-based gasoline, oil, and lubricants.

Additionally, the taxpayer is responsible for notifying the tax authority about the percentage (%) of fossil oil-based gasoline, oil, and lubricants in the mixed fuels and must submit it along with the tax declaration of the following month when starting to sell (or change the percentage of) mixed fuels.

Thus, the absolute tax rate will indeed be used as the basis for calculating environmental protection tax.

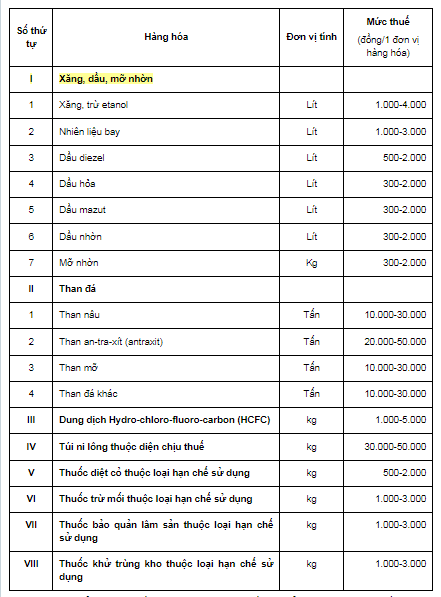

What is the tariff table for the absolute tax rate in Vietnam?

According to the provisions set out in Article 8 of the Law on Environmental Protection Tax 2010, the tariff table for the absolute tax rate is defined as follows:

- The absolute tax rate is specified according to the tariff table below:

- According to the tariff table stipulated in Clause 1, Article 8 of the Law on Environmental Protection Tax 2010, the Standing Committee of the National Assembly defines the specific tax rates for each type of taxable goods ensuring the following principles:

+ The tax rate for taxable goods aligns with the State's socio-economic development policy in each period;

+ The tax rate for taxable goods is determined according to the degree of adverse impact on the environment caused by the goods.