What is the 2024 self-improvement commitment form for members of Communist Party of Vietnam? What is the membership fee for members of Communist Party of Vietnam?

What is the 2024 self-improvement commitment form for members of Communist Party of Vietnam?

Pursuant to Official Dispatch 2952-CV/BTCTW of 2017, it is stipulated that every year each cadre and party member shall draft a self-improvement commitment for personal development.

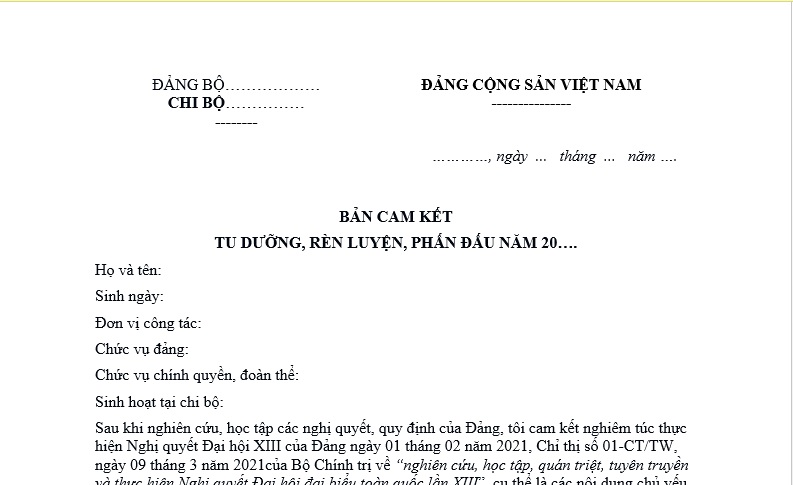

The 2024 self-improvement commitment form for members of Communist Party of Vietnam is as follows:

Download the 2024 self-improvement commitment form for members of Communist Party of Vietnam.

What is the 2024 self-improvement commitment form for members of Communist Party of Vietnam? (Image from the Internet)

What is the membership fee for members of Communist Party of Vietnam?

Pursuant to Section 1, Part B of the regulation on membership fee policies issued with Decision 342/QD-TW of 2010, there are stipulations on the subjects and monthly dues. Specifically:

The monthly income for party members to calculate membership fee includes salaries, certain allowances; wages; living expenses; other income. members of Communist Party of Vietnam who can determine their regular income shall contribute dues based on a percentage (%) of their monthly income (excluding personal income tax); those who cannot determine their income are subject to specific monthly dues for each category.

Below are the current membership fee for members of Communist Party of Vietnam:

| Fee Paying Category | Monthly membership fee |

| members of Communist Party of Vietnam in administrative agencies, socio-political organizations, armed forces units | Monthly dues of 1% of salary, allowances, wages, living expenses |

| members of Communist Party of Vietnam receiving social insurance salary | Monthly dues of 0.5% of the social insurance salary |

| members of Communist Party of Vietnam working in businesses, public service providers, economic organizations | Monthly dues of 1% of salary, wages, and other income from the unit’s salary fund |

| Other members of Communist Party of Vietnam domestically (including agricultural, rural members, student members...) | Dues range from 2,000 to 30,000 VND/month. For members outside the working age, dues are 50% of those within working age. |

| members of Communist Party of Vietnam studying or working abroad: | |

| (1) Members working in Vietnamese overseas representative offices; students abroad sponsored by an agreement or the state budget | Monthly dues of 1% of living expenses. |

| (2) Members studying abroad self-financed; labor export workers; following family, free entrepreneurs | Monthly dues of 2 to 5 USD |

| (3) Members who are sole or joint foreign business owners, commercial centre/store owners | Monthly minimum dues of 10 USD |

| members of Communist Party of Vietnam with special difficulties | If a request for exemption or reduction in dues is made, the party cell considers and reports to the base level party committee for decision. |

Note: Party members in all categories above are encouraged to voluntarily pay higher than the stipulated dues but must have the cell committee’s approval.

What are regulations on management and use of CPV membership fee in Vietnam?

According to Section 2, Part B of Decision 342-QD/TW of 2010, it is clearly stated as follows:

(1) Deduction and Submission of Collected membership fee

- Domestically:

+ Subordinate branches of the grassroots party committee can keep 30% to 50%, submitting 50% to 70% to upper-level party committees.

+ Grassroots party organizations in communes, wards, commune-level towns keep 90%, submitting 10% to upper-level party committees.

+ Other Communist Party organizations keep 70%, submitting 30% to upper-level party committees.

+ Each upper-level base keeps 50%, submitting 50% to higher committees.

- Abroad:

+ Branches under overseas party committees keep 30%, submitting 70% to upper-level committees. The Communist Party committees in foreign countries keep 50%, submitting 50% to the Communist Party Committee abroad.

+ Collected foreign dues submit 100% to the Central Office of the Communist Party.

- Bloc party committees under provincial and city Communist Party committees submit 50% to the financial agencies of these regions. Central level bloc committees, Central Military Communist Party committees, and Central Public Security Communist Party committees keep 50%, submitting 50% to the Central Office of the Communist Party.

(2) Management and Use of membership fee

- Retained membership fee at any level are balanced into the working fund for party tasks at that level. For district, town, city administrations; provinces, centrally managed cities; Central Military and Public Security Communist Party committees; and party finance agencies, the retained membership fee not calculated within the recurrent expense limits of the agency, are pooled into a reserve fund for that Communist Party level; this fund supplements committee activities and supports difficult subordinate party organizations; committee expenditure decisions derive from this reserve fund.

- Party committees are responsible for consolidating the status of collecting, submitting, and using fees within their level and throughout the party, submitting reports to higher-level committees. The Central Office of the Communist Party is responsible for a comprehensive report on fee management and use for the entire Communist Party, reporting to the Central Executive Committee.