What is the 2024 Schedule of Import and Export Tariffs in Vietnam?

What is the 2024 Schedule of Import and Export Tariffs in Vietnam?

The 2024 Schedule of Import and Export Tariffs is stipulated in Decree 26/2023/ND-CP regarding the export tariff, preferential import tariff, list of goods and absolute tax rates, mixed tax, import tax beyond tariff quota as follows:

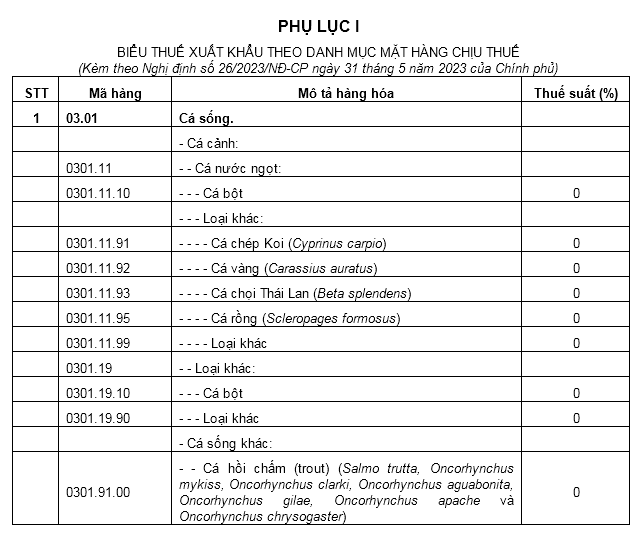

* Regarding the 2024 Export Tariff Schedule

It will be specified in Appendix 1 issued together with Decree 26/2023/ND-CP, including commodity codes (HS codes), commodity descriptions, and export tax rates stipulated for each group of taxable commodities.

In cases where exported goods are not listed in the Export Tariff Schedule, the declarant shall declare the HS code of the corresponding exported goods according to the 8-digit HS code in the Preferential Import Tariff Schedule specified in Section 1 of Appendix 2 issued together with Decree 26/2023/ND-CP, and it is not required to declare the tax rate on the export declaration.

Download the 2024 Export Tariff Schedule

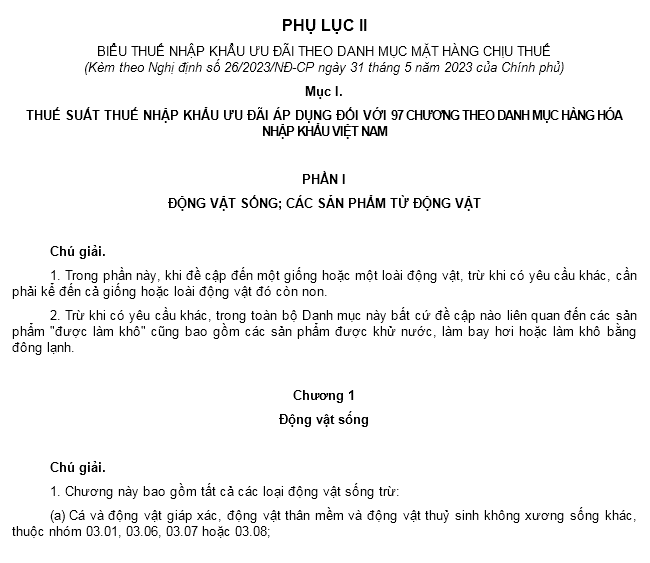

* Import Tariff Schedule 2024

It will be stipulated in Appendix 2 issued together with Decree 26/2023/ND-CP, including:

- Section 1: Specifies the preferential import tariff rates for 97 chapters according to the Vietnam Export and Import Goods Catalog.

- Section 2: Specifies the list of goods and preferential import tariff rates for certain items under Chapter 98 as follows:

Download the 2024 Import Tariff Schedule

What is the 2024 Schedule of Import and Export Tariffs in Vietnam? (Image from the Internet)

When do postal service companies pay import and export duties?

According to Article 3 of the 2016 Law on Export and import duties, taxpayers for export and import duties include:

- Owners of exported and imported goods.

- Organizations entrusted with exportation and importation.

- Individuals on exit and entry with goods for export, import, sending, or receiving goods through Vietnam's checkpoints and borders.

- Authorized persons, guarantors, and those paying taxes on behalf of the taxpayers, including:

+ Customs procedure agents authorized by taxpayers to pay export and import duties;

+ Enterprises providing postal services, international express delivery services when paying taxes on behalf of taxpayers;

+ Credit institutions or other organizations operating under the 2010 Law on Credit Institutions when they guarantee or pay taxes on behalf of taxpayers;

+ Individuals authorized by goods owners when goods are gifts from individuals; luggage sent before or after the trip of individuals on exit and entry;

+ Branches of enterprises authorized to pay taxes on behalf of the enterprise;

+ Others authorized to pay taxes on behalf of the taxpayers according to the law.

- Individuals collecting and transporting goods within the tax-free quota of border residents but not using them for production or consumption within the domestic market and foreign traders allowed to trade export and import goods at border markets under the law.

- Individuals with goods for export, import not subject to tax, exempt from tax, but later fall under taxable subjects as per the law.

- Other cases as prescribed by law.

Thus, it is noted that when postal service providers are authorized, they will pay taxes on behalf of the taxpayers.

How to calculate import and export duties in Vietnam in 2024?

The basis for calculating import and export duties in 2024 is as follows:

[1] Export Tax Calculation Basis (Article 5 of the 2016 Law on Export and import duties):

- The basis for calculating export tax for goods applying the percentage tax calculation method:

+ The export tax amount is determined based on the taxable value and the percentage tax rate (%) for each item at the time of tax calculation.

+ The export tax rate for goods is specified for each item in the export tariff.

In cases where goods are exported to countries, groups of countries, or territories that have preferential tariffs agreements with Vietnam, the agreements will be applied.

- The basis for calculating export tax for goods applying the absolute tax calculation method, the mixed tax calculation method:

+ The tax amount applying the absolute tax calculation method for exported goods is determined based on the actual quantity of exported goods and the absolute tax rate per unit of goods at the time of tax calculation.

+ The tax amount applying the mixed tax calculation method for exported goods is determined as the total tax amount calculated as a percentage and the absolute tax amount as stipulated above.

[2] Import Tax Calculation Basis (Article 6 of the 2016 Law on Export and import duties):

- The basis for calculating import tax for goods applying the percentage tax calculation method:

+ The import tax amount is determined based on the taxable value and the percentage tax rate (%) for each item at the time of tax calculation.

+ Import tax rates include preferential tax rates, special preferential tax rates, and normal tax rates and are applied as follows:

++ Preferential tax rates apply to imported goods originating from countries, groups of countries, or territories granting most-favored-nation treatment in trade relations with Vietnam; goods from non-tariff zones imported into the domestic market meeting the origin conditions of such countries, groups of countries, or territories granting most-favored-nation treatment in trade relations with Vietnam;

++ Special preferential tax rates apply to imported goods originating from countries, groups of countries, or territories having special preferential trade tax agreements with Vietnam; goods from non-tariff zones imported into the domestic market meeting the origin conditions of such countries, groups of countries, or territories having special preferential trade tax agreements with Vietnam;

++ Normal tax rates apply to imported goods not falling into the above categories. Normal tax rates are stipulated at 150% of the preferential tax rate for each corresponding item. In cases where the preferential tax rate is 0%, the Prime Minister of the Government of Vietnam will decide on the application of the normal tax rate.

- The basis for calculating import tax for goods applying the absolute tax calculation method, the mixed tax calculation method:

+ The tax amount applying the absolute tax calculation method for imported goods is determined based on the actual quantity of imported goods and the absolute tax rate per unit of goods at the time of tax calculation.

+ The tax amount applying the mixed tax calculation method for imported goods is determined as the total tax amount calculated as a percentage and the absolute tax amount as stipulated above.