What is the 2024 commitment form not to use illegal invoices in Vietnam?

What is the 2024 commitment form not to use illegal invoices in Vietnam?

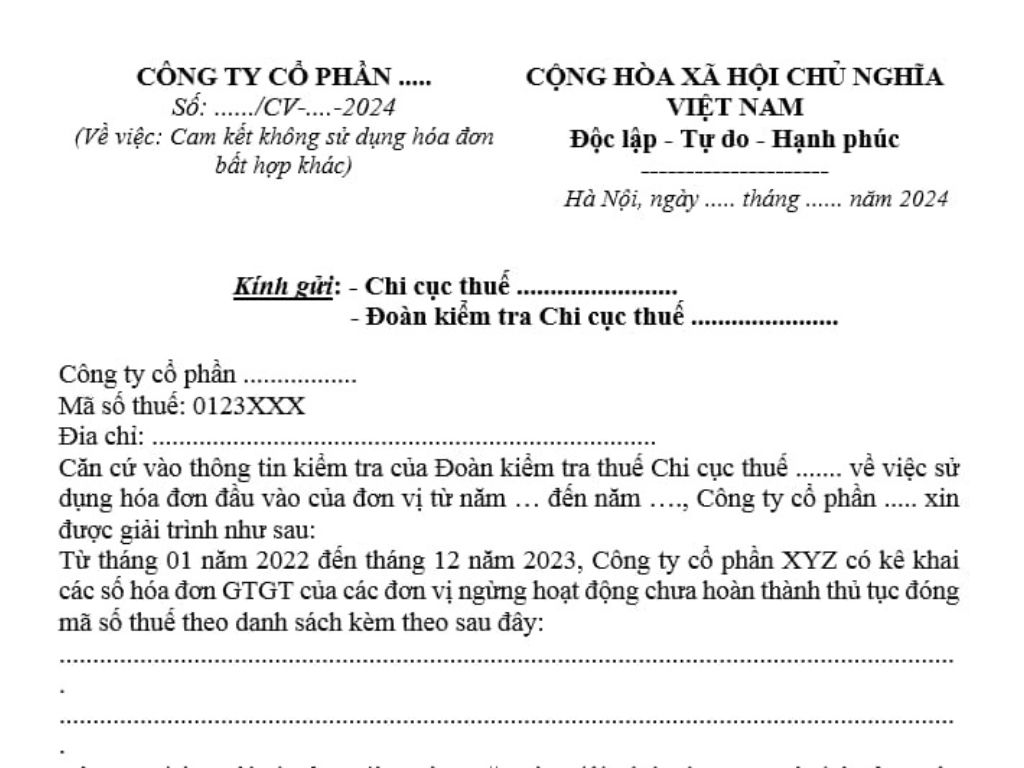

Currently, the law has not issued a regulation on the standard form for the commitment not to use illegal invoices with the latest update. However, a reference form for a commitment not to use illegal invoices, updated for 2024, can be found below:

Latest commitment form not to use illegal invoices download here

What is the 2024 commitment form not to use illegal invoices in Vietnam? (Image from the Internet)

What acts are illegal use of invoices in Vietnam?

Pursuant to Clause 2, Article 4 of Decree 125/2020/ND-CP, the use of invoices, records in the following cases is considered illegal use of invoices, records:

- Invoices, records not fully stating mandatory contents as prescribed; erased or altered invoices that are not conformable;

- Fake invoices, records (invoices, records have recorded targets, business contents but the sale of goods, services is not genuine in part or in whole); invoices that do not reflect the actual value incurred or the creation of fake or forged invoices;

- Invoices with discrepancies in the value of goods, services, or discrepancies in mandatory criteria between invoice copies;

- Invoices used for circulation rotation during transportation or using invoices of these goods, services to verify other goods, services;

- Invoices, records from other organizations, individuals (except invoices from tax agencies and cases authorized to create invoices) to legitimize goods, purchased services or goods, services sold out;

- Invoices, records that tax agencies, police authorities, or other competent agencies have concluded are used illegally.

What are regulations on the use of illegal invoices and records in Vietnam?

According to Clause 1, Article 28 of Decree 125/2020/ND-CP, the administrative penalty for the act of using illegal invoices, records is as follows:

Penalty for the act of using illegal invoices, illegal use of invoices

1. A fine from 20,000,000 VND to 50,000,000 VND for the act of using illegal invoices, illegal use of invoices as prescribed in Article 4 of this Decree, except in cases stipulated at Point d, Clause 1, Article 16, and Point d, Clause 1, Article 17 of this Decree.

Simultaneously, based on Clause 4, Article 7 of Decree 125/2020/ND-CP, it is specified:

Forms of Penalty, Remedial Measures, and Principles of Applying Fines in Administrative Sanctions on Taxes, Invoices

...

4. Principles of applying fines

a) The fine levels specified in Articles 10, 11, 12, 13, 14, 15, Clauses 1, 2 of Article 19, and Chapter III of this Decree apply to organizations.

For taxpayers who are households, business households, the fine level as for individuals applies.

b) When determining the fine level for tax violators who have both aggravating and mitigating circumstances, the aggravating circumstances shall be reduced following the principle that one mitigating circumstance reduces one aggravating circumstance.

c) Mitigating or aggravating circumstances that have been used to determine the penalty framework shall not be used to determine the specific monetary fine according to Point d of this Clause.

d) When fined, the specific fine level for a tax procedure violation, invoice action, and actions under Article 19 of this Decree is the average level of the penalty framework prescribed for such action. If there are mitigating circumstances, each can reduce by 10% of the average fine level of the penalty framework, but the fine level for such action cannot be reduced below the minimum level of the penalty framework; if there are aggravating circumstances, each can increase by 10% of the average fine level of the penalty framework, but the fine level for such action cannot exceed the maximum level of the penalty framework.

In Clause 5, Article 5 of Decree 125/2020/ND-CP, it is specified:

Principles of imposing administrative penalties on taxes, invoices

...

5. For the same administrative tax violation, the fine level for organizations is double the fine level for individuals, except for the fines for actions stipulated in Articles 16, 17, and 18 of this Decree.

Thus, according to the above regulation, organizations using illegal invoices may be subject to an administrative penalty from 20,000,000 VND to 50,000,000 VND.

In the case of individual violators, they may face an administrative penalty from 10,000,000 VND to 25,000,000 VND.

- Note: The form of administrative penalty for the act of using illegal invoices mentioned above does not apply in the following cases:

+ Using illegal invoices to account for the value of purchased goods, services to reduce the amount of payable tax or increase the amount of refundable tax, exempted, reduced tax, but when the tax authority audits, inspects, the buyer proves that the illegal invoice use violation belongs to the seller, and the buyer has fully accounted for according to the regulations.

+ Using illegal invoices to declare tax to reduce the amount of payable tax or increase the refundable tax, exempted, or reduced tax amount.