What is "Tết Nguyên Tiêu"? When does "Tết Nguyên Tiêu" take place in Vietnam in 2025? Are Vietnamese tax officials eligible for any days off on "Tết Nguyên Tiêu" 2025?

What is "Tết Nguyên Tiêu"? When does "Tết Nguyên Tiêu" take place in Vietnam in 2025?

"Tết Nguyên Tiêu", also known as the Full Moon of the First Lunar Month (15/01 lunar calendar), is the first full moon day of the new lunar year. This is an important festival in East Asian culture, especially in Vietnam and China.

Specifically, "Tết Nguyên Tiêu" is the first full moon night of the new year, where "Nguyên" means the first, and "Tiêu" means night. This day is also known as Tet Thuong Nguyên to distinguish it from Tet Trung Nguyên (15/07) and Tet Ha Nguyên (15/10). For Buddhists, "Tết Nguyên Tiêu" is of particular importance, as expressed in the saying: “Offering throughout the year is not as meaningful as the Full Moon of January” or “Worshiping Buddha all year round is not as meaningful as the Full Moon of January”.

On this occasion, each family often prepares a tray of offerings to express their respect to Buddha, ancestors, and to pray for a peaceful and prosperous new year. Depending on the customs of each region and economic conditions, the offering tray may vary, but whether simple or sumptuous, all express gratitude and respect toward ancestors.

"Tết Nguyên Tiêu" was introduced into Vietnam during the Northern domination period and differs from China's "Tết Nguyên Tiêu" due to the influence of Vietnamese customs. For the Chinese, this is the Lantern Festival, where lanterns are released to pray for a peaceful new year, whereas in Vietnam on this day, Buddhists gather to visit pagodas and pray for family safety. Pagodas usually organize Medicine Master Rites and recite Sutras throughout the first lunar month, calling upon Buddhists to chant and wish for everyone’s happiness at the beginning of the new year.

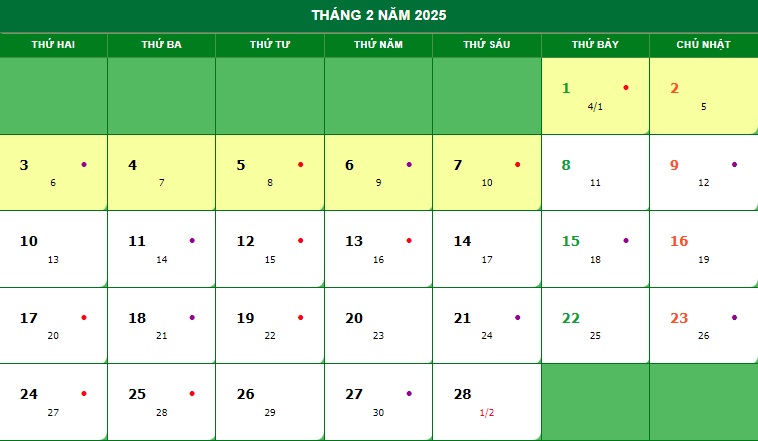

Specifically, according to the Perpetual Calendar for February 2025 is as follows:

Thus, "Tết Nguyên Tiêu" 2025 falls on February 12, 2025 (Wednesday), which is the 15th of the First Lunar Month of the Year of the Snake (2025) according to the lunar calendar.

What is "Tết Nguyên Tiêu"? When does "Tết Nguyên Tiêu" take place in Vietnam in 2025? (Image from the Internet)

Are Vietnamese tax officials eligible for any days off on "Tết Nguyên Tiêu" 2025?

Based on Article 112 of the Labor Code 2019 which stipulates holidays and Tet as follows:

Holidays and Tet

- Employees are entitled to leave with full pay on the following public and Tet holidays:

a) New Year's Day: 01 day (January 01 of the Gregorian calendar);

b) Lunar New Year: 05 days;

c) Victory Day: 01 day (April 30 of the Gregorian calendar);

d) International Labor Day: 01 day (May 01 of the Gregorian calendar);

e) National Day: 02 days (September 02 of the Gregorian calendar and 01 day immediately before or after it);

f) Hung Kings’ Commemoration Day: 01 day (March 10 of the lunar calendar).- Foreign employees working in Vietnam, in addition to the holidays prescribed in Clause 1 of this Article, are also entitled to one traditional national day and one national day of their country.

- Annually, based on actual conditions, the Prime Minister of the Government of Vietnam decides specifically the leave days prescribed in Points b and e Clause 1 of this Article.

"Tết Nguyên Tiêu" 2025 is not included in the defined public or Tet holidays that tax officials are entitled to leave with full pay.

However, tax officials can still request leave on "Tết Nguyên Tiêu" 2025 through the following means:

(1) Paid Leave

According to Article 114 of the Labor Code 2019, employees are entitled to 12 - 16 days of leave per year if working continuously. Therefore, if tax officials have remaining leave or can request advance leave, they can use it to visit graves during the Clear and Bright Festival 2025.

(2) Combining Leave

Based on Clause 4 Article 113 of the Labor Code 2019, tax officials can negotiate with their agency or superiors to take leave in multiple instances or combine leave for up to 03 years at a time.

If superiors approve combined leave, tax officials will receive full pay for those leave days.

(3) Unpaid Leave

Tax officials can negotiate with their agency or superiors for unpaid leave if they’ve exhausted their annual leave or wish to save their leave days.

Note: Taking additional leave by combining leave or unpaid leave must be agreed upon and authorized by superiors or the agency; unauthorized leave is considered job abandonment.

What are the positions of Vietnamese tax officials?

Based on Clause 2 Article 3 of Circular 29/2022/TT-BTC detailing the positions of tax officials as follows:

| Position | Classification Code |

| Senior Tax Examiner | 06.036 |

| Principal Tax Examiner | 06.037 |

| Tax Examiner | 06.038 |

| Intermediate Tax Examiner | 06.039 |

| Tax Clerk | 06.040 |

Among them:

(1) Senior Tax Examiner:

Based on Clause 1 Article 9 of Circular 29/2022/TT-BTC, the senior tax examiner is an official with the highest professional skill level in the tax field, appointed to leadership positions at the General Department level, departments, and equivalent, and provincial, municipal Tax Departments responsible for advising on state tax management at the General Department of Taxation and provincial/municipal Tax Departments, and conducting tax operations at a complex level within provinces, multiple provinces, or nationwide.

(2) Principal Tax Examiner:

Based on Clause 1 Article 10 of Circular 29/2022/TT-BTC, the principal tax examiner is an official with a high skill level in the tax sector, assisting leaders in conducting tax management or directly carrying out specific tax operations as assigned at units within the tax sector.

(3) Tax Examiner

Based on Clause 1 Article 11 of Circular 29/2022/TT-BTC, a tax examiner is an official with basic professional skills in the tax sector, directly performing work segments of tax management operations.

(4) Intermediate Tax Examiner

Based on Clause 1 Article 12 of Circular 29/2022/TT-BTC, an intermediate tax examiner is an official who executes specialized professional tasks within the tax sector, directly participating in specific operations of tax management at the unit.

(5) Tax Clerk

Based on Clause 1 Article 13 of Circular 29/2022/TT-BTC, a tax clerk is an official executing simple professional tasks in the tax sector, directly handling specific operations of tax management as assigned by the unit.