What is sub-item 1701 in tax administration? Besides sub-item 1701, what other sub-items are there related to value added tax in Vietnam?

What is sub-item 1701 in tax administration in Vietnam?

According to point b, clause 1, Article 4 of Circular 324/2016/TT-BTC, a sub-item (also known as an economic content code - NDKT) is a detailed classification of an Item, used to classify revenue and expenditure of the state budget in detail according to management objects in each Item.

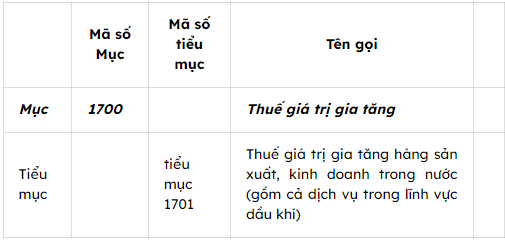

Based on Appendix 3 of the List, sub-items issued together with Circular 324/2016/TT-BTC as supplemented by Clause 5, Article 1 of Circular 93/2019/TT-BTC, sub-item 1701 is regulated as follows:

Thus, sub-item 1701 can be understood as a specific code stipulated in the state budget coding system, used to classify in detail revenues related to Value Added Tax (VAT) on invoices and accounting documents. Specifically, sub-item 1701 is used to record the VAT amount arising from:

- Goods and services produced and traded domestically: Includes all types of goods and services produced and traded in Vietnam, except for cases exempted from VAT or eligible for VAT refund according to VAT law.

- Services in the oil and gas sector: Activities related to exploration, extraction, processing, transportation, and consumption of oil and gas, which are subject to VAT and use sub-item code 1701.

What is sub-item 1701 in tax administration? Besides sub-item 1701, what other sub-items are there related to value added tax in Vietnam? (Image from the Internet)

In tax administration, besides sub-item 1701, what other sub-items are there related to value added tax in Vietnam?

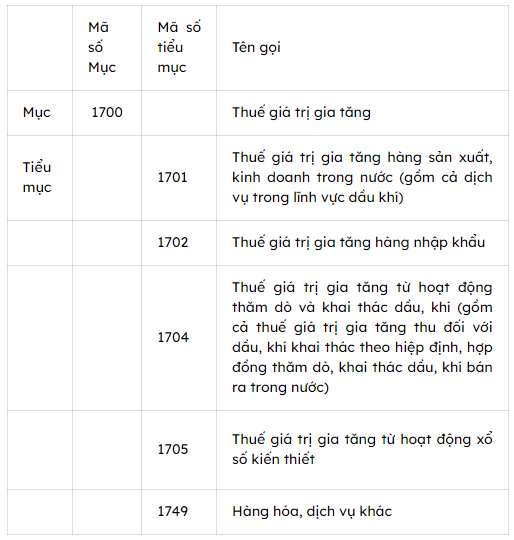

In tax administration, besides sub-item 1701, to determine what other sub-items are related to value added tax, we must refer to point b, clause 1, Article 4 of Circular 324/2016/TT-BTC, along with Appendix 3 of the List and sub-items issued together with Circular 324/2016/TT-BTC, which stipulates the VAT sub-items for 2024 as follows:

Thus, according to the above regulations in tax administration, besides sub-item 1701, there are other sub-items related to value added tax as follows:

[1] 1702: VAT on imported goods

[2] 1704: VAT from exploration and extraction activities of oil and gas (including VAT on oil and gas extracted under agreements or contracts for domestic sale)

[3] 1705: VAT from lottery activities

[4] 1749: Other goods and services.

What are specific regulations on current specific tax rates in Vietnam according to law?

Based on Article 8 of the Law on Value Added Tax 2008 (amended by Clause 3, Article 1 of the Law on Amendments to the Law on Value Added Tax 2013, Article 1 of the Law on Amendments to the Law on Value Added Tax, the Law on Special Consumption Tax, and the Law on Tax Administration 2016, Article 3 of the Law on Amendments to Various Tax Laws 2014) and Decree 72/2024/ND-CP regulating VAT rates, the details are as follows:

[1] Tax rate of 0%

Applicable to exported goods and services, international transportation, and goods and services not subject to VAT as stipulated in Article 5 of the Law on Value Added Tax 2008 upon export, except in the following cases:

- Transfer of technology, transfer of intellectual property rights abroad.

- Reinsurance services abroad;

- Credit provision services;

- Capital transfer;

- Derivative financial services;

- Postal and telecommunications services;

- Exported products stipulated in Clause 23, Article 5 of the Law on Value Added Tax 2008.

Exported goods and services are those consumed outside Vietnam, in the non-tariff zone; goods and services provided to foreign customers as stipulated by the Government of Vietnam.

[2] Tax rate of 5%

Applicable to the following goods and services:

- Clean water for production and daily use;

- Ores for fertilizer production; pesticides and growth stimulators for animals and crops;

- Excavation and dredging services for agricultural production canals, ponds; cultivation, care, and pest control for plants; preliminary processing and preservation of agricultural products;

- Unprocessed agricultural and seafood products, except products stipulated in Clause 1, Article 5 of this Law;

- Preliminary processed rubber latex; preliminary processed turpentine; nets, cords, and fibers for weaving fishing nets;

- Fresh food; unprocessed forest products, except wood, bamboo shoots, and products stipulated in Clause 1, Article 5 of the Law on Value Added Tax 2008;

- Sugar; by-products in sugar production, including molasses, bagasse, filter mud;

- Products made of jute, rush, bamboo, straw, coconut shells, water hyacinth, and other handicrafts made from agricultural waste; preliminary processed cotton; newsprint;

- Medical equipment, tools, sanitation cotton, medical bandages; preventive and curative medicines; pharmaceutical products and medicinal materials as raw materials for medicine production;

- Teaching and learning aids, including models, drawings, boards, chalk, rulers, compasses, and specialized teaching, research, and scientific experiment equipment and tools;

- Cultural, exhibition, sport activities; art performances, film production; import, distribution, and screening of movies;

- Toys for children; books of all kinds, except those specified in Clause 15, Article 5 of the Law on Value Added Tax 2008;

- Science and technology services according to the Law on Science and Technology.

- Sale, lease, and lease-purchase of social housing according to the Housing Law.

[3] Tax rate of 8%

Applicable to certain goods and services eligible for VAT reduction (from 10% to 8%).

[4] Tax rate of 10%

Applicable to goods and services not subject to the 0%, 5%, or 8% tax rates.

Thus, according to the regulations, the current specific tax rates applied are 0%, 5%, 10% or 8% depending on the specific subject.