What is HCFC solution in environmental protection tax in Vietnam?

What is HCFC solution in environmental protection tax in Vietnam?

Based on Article 2 of the Law on Environmental Protection Tax 2010, the definition of HCFC solution in environmental protection tax is as follows:

Definitions

In this Law, the following terms are understood as follows:

1. Environmental protection tax is an indirect tax levied on products and goods (hereinafter collectively referred to as goods) that, when used, adversely affect the environment.

2. Absolute tax rate is the tax rate stipulated by an amount of money per unit of taxable goods.

3. Taxable plastic bags are bags and packaging made from single polyethylene film, technically known as foamy plastic bags.

4. Hydro-chloro-fluoro-carbon (HCFC) solution is a group of ozone-depleting substances used as refrigerants.

Thus, according to the above regulation, the HCFC solution in environmental protection tax has the full name of hydro-chloro-fluoro-carbon; it is a group of ozone-depleting substances used as refrigerants.

What is HCFC solution in environmental protection tax in Vietnam? (Image from the Internet)

Is HCFC solution subject to environmental protection tax in Vietnam?

According to Article 3 of the Law on Environmental Protection Tax 2010, which stipulates the subjects to be taxed under environmental protection tax as follows:

Taxable Objects

1. Gasoline, oil, and grease, including:

a) Gasoline, except ethanol;

b) Jet fuel;

c) Diesel oil;

d) Kerosene;

dd) Mazut oil;

e) Lubricating oil;

g) Grease.

2. Coal, including:

a) Brown coal;

b) Anthracite coal;

c) Fat coal;

d) Other types of coal.

3. Hydro-chloro-fluoro-carbon (HCFC) solution.

4. Taxable plastic bags.

5. Herbicides restricted for use.

6. Termiticides restricted for use.

7. Wood preservatives restricted for use.

8. Warehouse disinfectants restricted for use.

9. In case it is deemed necessary to add other taxable objects to match each period, the Standing Committee of the National Assembly shall consider and stipulate.

The Government of Vietnam shall detail this Article.

Accordingly, the HCFC solution (hydro-chloro-fluoro-carbon) is one of the substances subject to environmental protection tax.

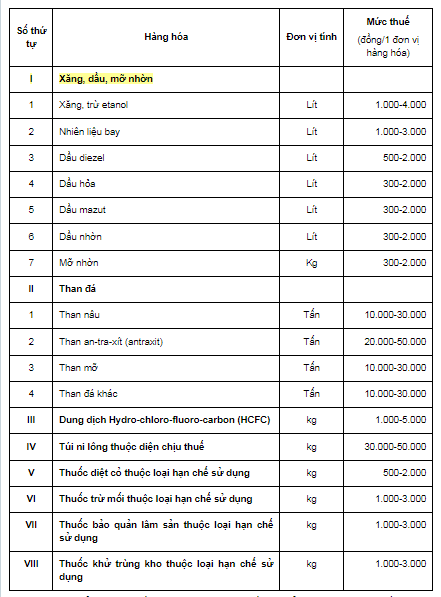

Additionally, the tax rate for HCFC solution (hydro-chloro-fluoro-carbon) is based on Article 8 of the Law on Environmental Protection Tax 2010, which provides for the tax framework as follows:

- The absolute tax rate is stipulated according to the following tax framework:

- Based on the tax framework stipulated in Clause 1, Article 8 of the Law on Environmental Protection Tax 2010, the Standing Committee of the National Assembly stipulates the specific tax rate for each type of taxable goods, ensuring the following principles:

+ The tax rate on taxable goods is appropriate to the State’s socio-economic development policy in each period;

+ The tax rate on taxable goods is determined according to the degree of environmental harm caused by the goods.

Thus, the HCFC solution (hydro-chloro-fluoro-carbon) is subject to a tax rate of 1,000-5,000 VND per unit of goods (1kg).

Regulations on Environmental Protection Tax Refund

Article 11 of the Law on Environmental Protection Tax 2010 stipulates the refund of environmental protection tax as follows:

Taxpayers of environmental protection tax are refunded the paid tax in the following cases:

- Imported goods still in storage, warehouse at the checkpoint, and under the supervision of the Customs authority which are re-exported abroad;

- Imported goods delivered or sold to foreign countries through agents in Vietnam; gasoline, oil sold to the transportation vehicles of foreign firms on the route through Vietnamese ports or to Vietnamese transportation vehicles on international routes as regulated by law;

- Temporarily imported goods for re-export under the form of temporary import for re-export business.

- Imported goods re-exported abroad by importers;

- Temporarily imported goods for attending fairs, exhibitions, product introductions as regulated by law when re-exported abroad.

In addition, the tax refund is also guided in Article 8 of Circular 152/2011/TT-BTC, specifically as follows:

Taxpayers of environmental protection tax are refunded the paid tax in some cases as follows:

- Imported goods still in storage, warehouse at the checkpoint, and under the supervision of the Customs authority which are re-exported abroad.

- Imported goods delivered or sold to foreign countries through agents in Vietnam; gasoline, oil sold to the transportation vehicles of foreign firms on the route through Vietnamese ports or to Vietnamese transportation vehicles on international routes as regulated by law.

- Temporarily imported goods for re-export under the form of temporary import for re-export business shall be refunded the environmental protection tax paid corresponding to the re-exported goods quantity.

- Imported goods re-exported abroad by importers (including returned goods) shall be refunded the environmental protection tax paid for the re-exported goods quantity.

- Temporarily imported goods for attending fairs, exhibitions, product introductions shall be refunded the environmental protection tax paid corresponding to the re-exported goods quantity when re-exported abroad.

The environmental protection tax refund according to this Article is only implemented for actually exported goods.

The procedures, dossiers, sequence, and competence for resolving environmental protection tax refunds for exported goods are implemented following the regulations on the resolution of import tax refunds according to the law on export tax, import tax.