What is Form 04 SS-HDDT on notification of erroneous invoices in Vietnam? What is the deadline for submitting Form 04/SS-HDDT in 2024?

What is Form 04 SS-HDDT on notification of erroneous invoices in Vietnam?

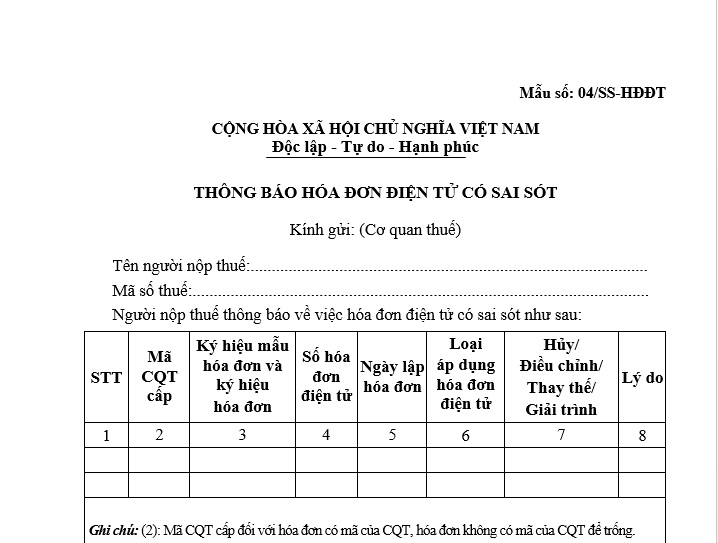

Form 04/SS-HDDT is the notification form of erroneous invoices stipulated in Appendix 1A issued together with Decree 123/2020/ND-CP.

Form 04/SS-HDDT is as follows:

The latest Form 04/SS-HDDT for notifying erroneous invoices...Download

What is Form 04 SS-HDDT on notification of erroneous invoices in Vietnam? (Image from the Internet)

When to Submit Form 04 SS-HDDT on notification of erroneous invoices to the Tax Authority?

Based on clauses 1 and 2 of Article 19 Decree 123/2020/ND-CP which stipulates the handling of erroneous invoices. Specifically:

Handling of erroneous invoices

1. In cases where the seller discovers that the e-invoice issued with a tax authority code but not yet sent to the buyer has errors, the seller shall notify the tax authority using Form 04/SS-HDDT in Appendix IA issued together with this Decree regarding the cancellation of said erroneous e-invoice and subsequently issue a new e-invoice. The seller shall digitally sign and send this new e-invoice to the tax authority for coding, which will replace the erroneous invoice for the buyer. The tax authority will cancel the faulty e-invoice stored in their system that was previously coded.

2. In cases where an e-invoice with or without a tax authority code has been sent to the buyer and is found to have errors by either the buyer or seller, the handling is as follows:

a) In instances where there is an error in the buyer's name or address but not in the tax code, and there are no other errors, the seller shall inform the buyer about the invoice error without having to issue a new invoice. The seller must inform the tax authority of such erroneous invoices using Form 04/SS-HDDT in Appendix IA issued with this Decree, except for cases where the non-coded e-invoice has not yet been sent to the tax authority.

b) In cases of tax code errors, errors in the amount on the invoice, discrepancies in the tax rate, tax amount, or goods not being as per the specification or quality mentioned on the invoice, the following choices are available for using e-invoices:

b1) The seller can issue an e-correction invoice for the erroneous invoice. If there is an agreement between the seller and buyer to issue a document before issuing the correction invoice, then both parties shall prepare a document specifying the errors and then the seller will issue the correction invoice.

A correction e-invoice for an erroneous invoice must state “Adjustment for invoice Form No... symbol... No... date... month... year”.

b2) The seller issues a new e-invoice to replace the erroneous e-invoice, unless there is an agreement between the seller and buyer to issue a document before issuing a replacement invoice. They shall prepare a document specifying the errors and then the seller will issue the replacement invoice.

A new e-invoice replacing the erroneous invoice must state “Replaces invoice Form No... symbol... No... date... month... year”.

The seller shall digitally sign on the new invoice after adjustment or replacement and send it to the buyer in case of non-coded invoices, or send it to the tax authority to obtain an invoice code before sending it to the buyer in cases where coded invoices are used.

c) For the aviation industry, modified or complete replacement invoices for air transport documents are considered adjustment invoices and do not require “Adjustment for invoice Form No... symbol... date... month... year”. Airlines may issue their own invoices for completed or replaced transport documents previously issued by agents.

...

Thus, Form 04/SS-HDDT must be sent to the tax authority in the case of opting to cancel the erroneous invoice and issuing a notification to the tax authority to create a new invoice.

What is the deadline for submitting Form 04/SS-HDDT in 2024?

Based on clause 1 Article 7 Circular 78/2021/TT-BTC, the following is stipulated:

Handling of e-invoices, Cumulative Data of e-invoices Sent to the Tax Authority in Certain Instances of Error

- For e-invoices:

a) In cases where an e-invoice already issued has errors necessitating a new code from the tax authority, or the invoice requires correction or replacement as stipulated in Article 19 of Decree 123/2020/ND-CP, the seller may choose to use Form 04/SS-HDDT in Appendix IA issued with Decree 123/2020/ND-CP to inform the tax authority of adjustments for each erroneous invoice or inform adjustments for multiple erroneous invoices and submit the notification as per Form 04/SS-HDDT to the tax authority at any time, but no later than the last day of the value-added tax declaration period in which the adjusted e-invoice arises;

b) In cases where the seller issues an invoice when collecting payment in advance or during service provision as per Clause 2 Article 9 of Decree 123/2020/ND-CP and subsequently the service provision is cancelled or terminated, the seller shall cancel the issued e-invoice and inform the tax authority of the cancellation using Form 04/SS-HDDT in Appendix IA issued with Decree 123/2020/ND-CP;

c) In cases where an e-invoice with errors is already adjusted or replaced per point b Clause 2 Article 19 of Decree 123/2020/ND-CP, if further errors are discovered, the seller shall follow the already applied method in first-time error handling for all subsequent actions;

d) Following the notification deadline stated in Form 01/TB-RSDT in Appendix IB issued with Decree 123/2020/ND-CP, the seller shall inform the tax authority using Form 04/SS-HDDT in Appendix IA issued with Decree 123/2020/ND-CP regarding the verification of the issued e-invoice with errors, clearly stating the verification basis as per the tax authority’s Form 01/TB-RSDT notification, including notification number and date;

dd) In cases where the e-invoice issued lacks model code, invoice code, or invoice number, the seller shall only perform adjustments without cancellation or replacement;

e) Regarding errors in monetary values on the invoice: record increases (positive sign), decreases (negative sign) accurately reflecting the actual adjustment.

Thus, the deadline for submitting Form 04/SS-HDDT is no later than the last day of the tax declaration period in which the adjusted e-invoice arises.

For example, if a business discovers an invoice error in November 2024 (i.e., Q4). The deadline for the company to submit Form 04/SS-HDDT notification to the tax authority is November 30, 2024 (if declared monthly) or December 31, 2024 (if declared quarterly).