What is a related-party transaction? How to fill out the appendix for information on related relations and related-party transaction in Vietnam?

What is a related-party transaction?

Based on Clause 22, Article 3 of the 2019 Law on Tax Administration, the explanation of terms defines related-party transactions as follows:

Explanation of Terms

In this Law, the following terms are understood as follows:

....

- Parties with a related relationship are parties that directly or indirectly participate in the management, control, or investment in a company; parties under the direct or indirect management or control of a single organization or individual; parties with a single organization or individual investing in them; companies managed or controlled by individuals with close family ties.

22. A related-party transaction is a transaction between parties with a related relationship.

- An independent transaction is a transaction between parties without a related relationship.

...

According to Clause 1, Article 5 of Decree 132/2020/ND-CP, parties with related relationships are parties having one of the following relationships:

Parties with Related Relationships

- Parties with a related relationship (hereinafter referred to as "related parties") are parties having one of the following relationships:

a) One party directly or indirectly participates in the management, control, investment, or capital contribution to the other party;

b) Parties directly or indirectly under the management, control, investment, or capital contribution by another party.

...

Thus, related-party transactions are transactions between two or more parties having a special relationship, such as management, control, capital contribution, or family relationship, where parties have mutual influence in management, control, or capital contribution. These transactions must comply with the principle of independent transaction pricing to ensure transparency and prevent tax base erosion for the state budget.

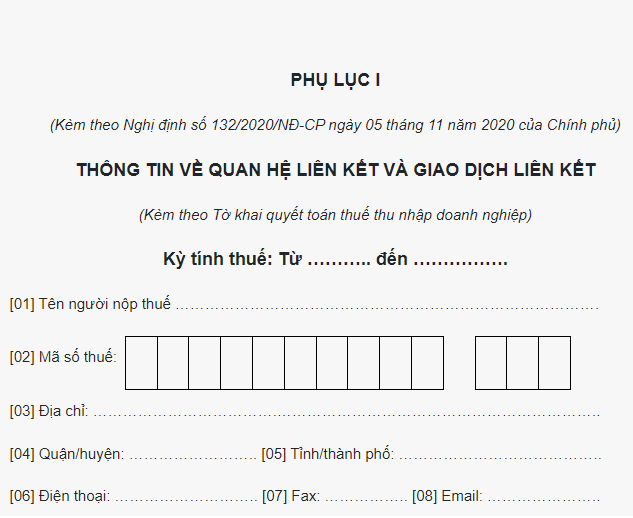

What is a related-party transaction? How to fill out the appendix for information on related relations and related-party transaction in Vietnam? (Image from the Internet)

How to fill out the appendix for information on related parties and related-party transaction in Vietnam?

Guidance for Declaring Certain Indicators

A. Tax Period:

Enter information corresponding to the tax period on the Corporate Income Tax Finalization Declaration. The tax period is determined according to the provisions of the Corporate Income Tax Law.

B. General Information of the Taxpayer:

Indicators from [01] to [10] are recorded based on the corresponding information declared on the Corporate Income Tax Finalization Declaration.

C. Section I. Information on Related Parties:

Column (2): Enter the full name of each related party:

If the related party is an organization in Vietnam, enter the information as per the business registration certificate; if an individual, enter based on identity card, citizen ID card, or passport.

If the related party is an organization or individual outside Vietnam, enter information from documents that establish the related relationship, such as business registration certificates, contracts, or transaction agreements with the related party.

Column (3): Enter the country or territory where the related party resides.

Column (4): Enter the tax code of the related parties:

If the related party is an organization or individual in Vietnam, complete the tax code.

If the related party is an organization or individual outside Vietnam, enter the tax code or taxpayer identification number, if unavailable, state the reason.

Column (5): Based on regulations in Clause 2, Article 5 of Decree No. .../2020/ND-CP, taxpayers with related-party transaction need to declare the form of the related relationship with each party by marking "x" in the corresponding box. If the related party falls under various forms of relationships, taxpayers should mark the appropriate boxes.

D. Section II. Cases Exempted from Declaration, Exempted from Preparing Files for Determining Transaction Pricing:

If the taxpayer falls under cases exempted from declaration or exempted from preparing files for determining transaction pricing according to Article 19 of Decree No. .../2020/ND-CP, mark “x” in the corresponding box in Column (3).

In cases exempted from declaration, exempted from preparing files for determining transaction pricing according to Clause 1, Article 19 of Decree No. .../2020/ND-CP, the taxpayer only needs to mark the box in Column (3) and is not required to declare sections III and IV of Appendix I according to Decree No. .../2020/ND-CP.

If the taxpayer is exempted from preparing files for determining transaction pricing according to Point a or Point c, Clause 2, Article 19 of Decree No. .../2020/ND-CP, they need to declare sections III and IV following the guidelines in sections D.1 and E.

If the taxpayer is exempted from preparing files for determining transaction pricing according to Point b, Clause 2, Article 19 of Decree No. .../2020/ND-CP, they need to declare following the guidelines in sections D.2 and E.

Note: the information on how to fill out the appendix for information on related parties and related-party transaction above is for reference only!

Declarer download detailed guidance file for Appendix I.... here

Download the appendix for information on related parties and related-party transaction in Vietnam?

Below is the downloadable appendix form for information on related parties and related-party transaction as follows:

Based on Decree 132/2020/ND-CP the appendix form is as follows:

Download the appendix for information on related parties and related-party transaction...here