What incomes do the partially progressive tariff apply to in Vietnam?

What incomes do the partially progressive tariff apply to in Vietnam?

According to Clause 1, Article 22 of the Law on Personal Income Tax 2007, it is stipulated as follows:

partially progressive tariff

- The partially progressive tariff applies to taxable income as specified in Clause 1, Article 21 of this Law.

...

Thus, the partially progressive tariff applies to taxable income from business, salary, and wages.

Taxable income from business, salary, and wages is the total taxable income as stipulated in Article 10 and Article 11 of the Law on Personal Income Tax 2007, minus the contributions to social insurance, health insurance, unemployment insurance, professional liability insurance for some mandatory insurance sectors, voluntary retirement fund, and deductions as specified in Article 19 and Article 20 of the Law on Personal Income Tax 2007.

Note: The regulations concerning the determination of tax for business individuals in Clause 1, Article 21 have been annulled by Clause 4, Article 6 of the Law Amending Laws on Taxation 2014.

What incomes do the partially progressive tariff apply to in Vietnam? (Image from the Internet)

How to calculate personal income tax from salary and wages according to the partially progressive tariff in Vietnam?

According to the provisions in Article 7, Article 8 of Circular 111/2013/TT-BTC, personal income tax from the salary and wages of resident individuals is determined by the following formula:

Personal Income Tax from Salary and Wages = Taxable Income from Salary and Wages x Tax Rate

Where:

(1) Taxable Income = Taxable Revenue - Deductions

Taxable Revenue = Total Income - Exempted Items

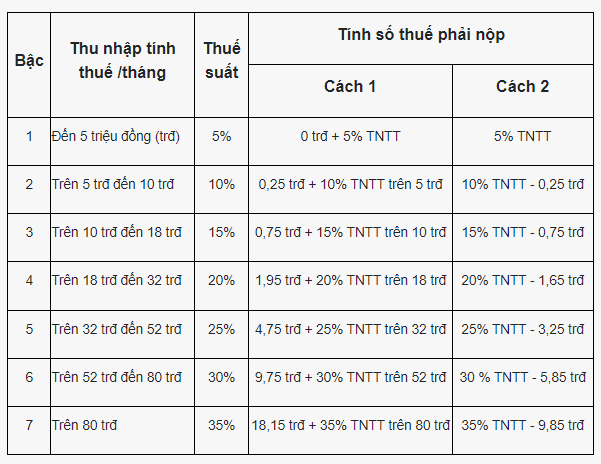

(2) Tax Rate as per Clause 2, Article 7 Circular 111/2013/TT-BTC

However, Appendix 01/PL-TNCN issued with Circular 111/2013/TT-BTC guides two methods for calculating tax according to the partially progressive tariff for income from salary and wages, specifically as follows:

Note: The guidance above applies to income from the salary and wages of resident individuals.

According to Article 18 of Circular 111/2013/TT-BTC, personal income tax from the salary and wages of non-resident individuals is determined as follows:

Personal Income Tax from Salary and Wages = Taxable Salary and Wages x Personal Income Tax Rate 20%

What is the minimum income subject to personal income tax in Vietnam?

According to Article 2 of Circular 111/2013/TT-BTC, it is stipulated as follows:

Taxable Income

…

2. Income from Salary and Wages

Income from salary and wages is the income received by employees from employers, including:

a) Salaries, wages, and income in the form of money or non-cash that is akin to salary and wages.

b) Various allowances, except for the following allowances and assistance:

b.1) Monthly preferential allowance and one-time support according to the law on preferential treatment for people with meritorious services.

b.2) Monthly allowance, one-time support for individuals participating in national defense, international duties, and youth volunteering tasks that have been completed.

b.3) National defense, security allowances; allowances for armed forces.

b.4) Hazardous, dangerous job allowances for sectors or jobs with hazardous elements.

b.5) Attraction allowances, regional allowances.

b.6) Sudden hardship assistance, occupational accident allowances, occupational disease allowances, one-time childbirth or adoption allowances, maternity leave benefits, recovery benefits post-maternity, allowances for reduced labor ability, retirement support, monthly pension, severance, job loss allowances, unemployment assistance, and other support as regulated by the Labor Code and the Law on Social Insurance.

b.7) Support for social protection beneficiaries according to law.

b.8) Service allowances for senior leaders.

…

In addition, according to Article 1 of Resolution 954/2020/UBTVQH14, it is stipulated as follows:

Family Circumstance Deduction

Adjust the family deduction level as stipulated in Clause 1, Article 19 of the Law on Personal Income Tax No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13, as follows:

1. Deduction for taxpayers is 11 million VND/month (132 million VND/year);

2. Deduction for each dependent is 4.4 million VND/month.

Thus, for individuals without dependents, they must pay personal income tax if their total income from salary and wages exceeds 11 million VND/month.