What goods and services shall be recorded on Target 26 on Form 01/GTGT on tax declaration form in Vietnam?

What goods and services shall be recorded on Target 26 on Form 01/GTGT on tax declaration form in Vietnam?

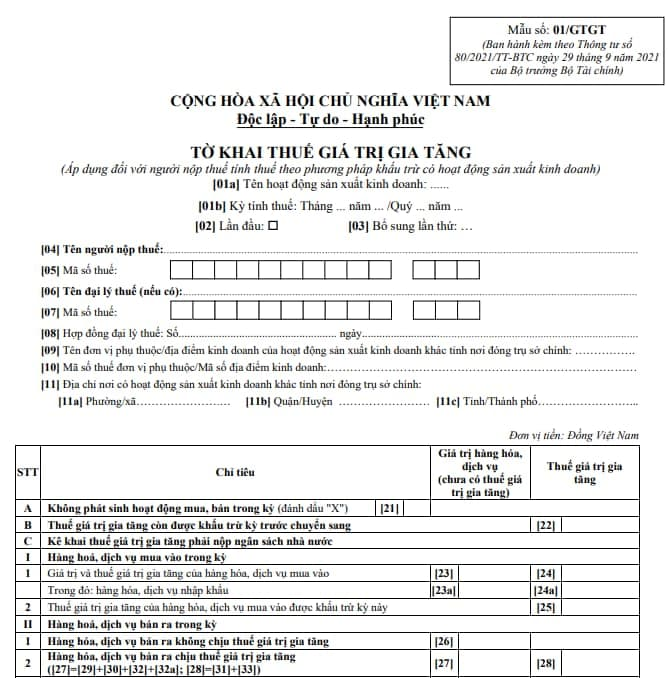

Currently, the VAT declaration form is regulated in Form 01/GTGT in Appendix 2 issued together with Circular 80/2021/TT-BTC as follows:

Download Tax Declaration Form 01/GTGT: Here

Target 26, when preparing the VAT declaration form according to Form 01/GTGT, will fill in the invoice for goods and services not subject to VAT.

What goods and services shall be recorded on Target 26 on Form 01/GTGT on tax declaration form in Vietnam? (Image from Internet)

How to prepare quarterly and monthly Form 01/GTGT on tax declaration form on HTKK system in Vietnam?

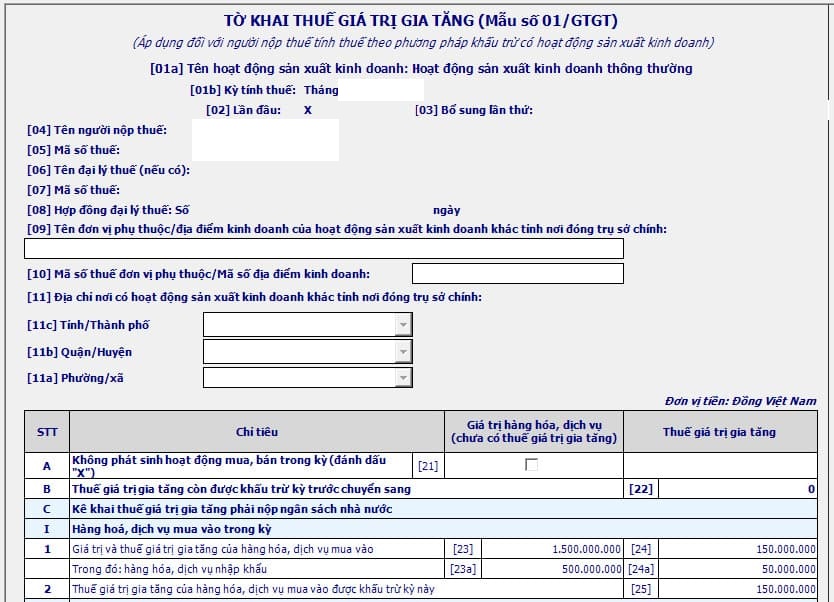

Step 1: Select the VAT Declaration

Log in to HTKK software => Select: "Value Added Tax" => Choose: "VAT Declaration (01/GTGT)(TT80/2021)"

Step 2: Select the Tax Period:

On the Tax Period Selection tab, the taxpayer selects as follows:

- Select where to file the VAT declaration:

The software automatically displays according to the initial declaration information of the enterprise on HTKK software (modifiable)

- Choose the VAT declaration period monthly or quarterly:

If the taxpayer meets the conditions to declare taxes quarterly as below, they can declare taxes quarterly, specifically:

+ Enterprises are subject to monthly value-added tax declaration if the total sales revenue of goods and services provided from the previous immediate year does not exceed 50 billion VND and can declare value-added tax quarterly. Sales revenue is determined based on the VAT declarations of the tax periods in the calendar year.

In the case where the taxpayer centrally declares at the head office for dependent units or business locations, the sales revenue includes both the dependent units' and business locations' revenue.

+ In the case of a new enterprise starting operations, it may choose to declare VAT quarterly. After completing a full 12 months of business, from the beginning of the following calendar year which completes 12 months, the declaration of VAT will follow the sales revenue of the prior calendar year (full 12 months) for monthly or quarterly tax periods.

=> If the enterprise does not meet the above conditions, it must declare VAT on a monthly basis.

Note:

+ The taxpayer is responsible for determining whether they qualify for quarterly tax declaration according to the regulations.

+ Taxpayers who qualify for quarterly tax declarations can choose to declare taxes monthly or quarterly consistently throughout the calendar year.

- Choose the declaration status as "First time" or "Supplementary":

Tick "First Time Declaration" if this is the first time the enterprise is preparing a VAT declaration for that tax period.

If the taxpayer finds that the initial tax declaration filed with the tax authorities has errors, they must submit a supplementary declaration accordingly.

Note: From the moment the Etax System issues a Notification accepting the tax declaration for the "First Time" submission, subsequent tax declarations for the same tax period and business activities will be "Supplementary". Enterprises must file "Supplementary" declarations as per the regulations on supplementary filings.

- Select the category of business activity:

The software defaults to select "Regular Business Activity".

If the enterprise is declaring VAT for other activities listed below, they must select and declare according to the actual business activities:

+ Traditional lottery activities, computer-based lottery.

+ Oil and gas exploration and exploitation activities.

+ Investment projects in infrastructure, housing for transfer other than where the head office is located in the province.

+ Power plants other than where the head office is located in the province.

Note: If the taxpayer has multiple business activities as above, they must file multiple tax declarations, choosing one business activity per declaration in response to the respective declaration information.

- Select the appendix to attach to the declaration (if any):

If your enterprise has activities related to the following appendixes, check the respective appendix to declare:

+ Appendix on the allocation table for value-added tax payable to localities benefitting from hydropower production revenues, Form 01-2/GTGT issued with Appendix II of Circular 80/2021/TT-BTC.

+ Appendix on the allocation table for value-added tax payable to localities benefitting from computer-based lottery business revenues, Form 01-3/GTGT issued with Appendix II of Circular 80/2021/TT-BTC.

+ Appendix on the allocation of value-added tax payable to the locality enjoying the revenue source (except hydropower production, computer-based lottery business), Form 01-6/GTGT issued with Appendix II of Circular 80/2021/TT-BTC.

+ Appendix “PL_GiamThue_GTGT_23_24” to declare goods and services with reduced VAT for the first half of 2024: If in the declaration period of the 1st quarter/2024 or 2nd quarter/2024, your company sells goods or services with reduced VAT according to Decree 94/2023/ND-CP regulating the policy of VAT reduction according to Resolution 110/2023/QH15, then choose the Appendix “PL_GiamThue_GTGT_23_24” to declare reduced VAT goods and services into it.

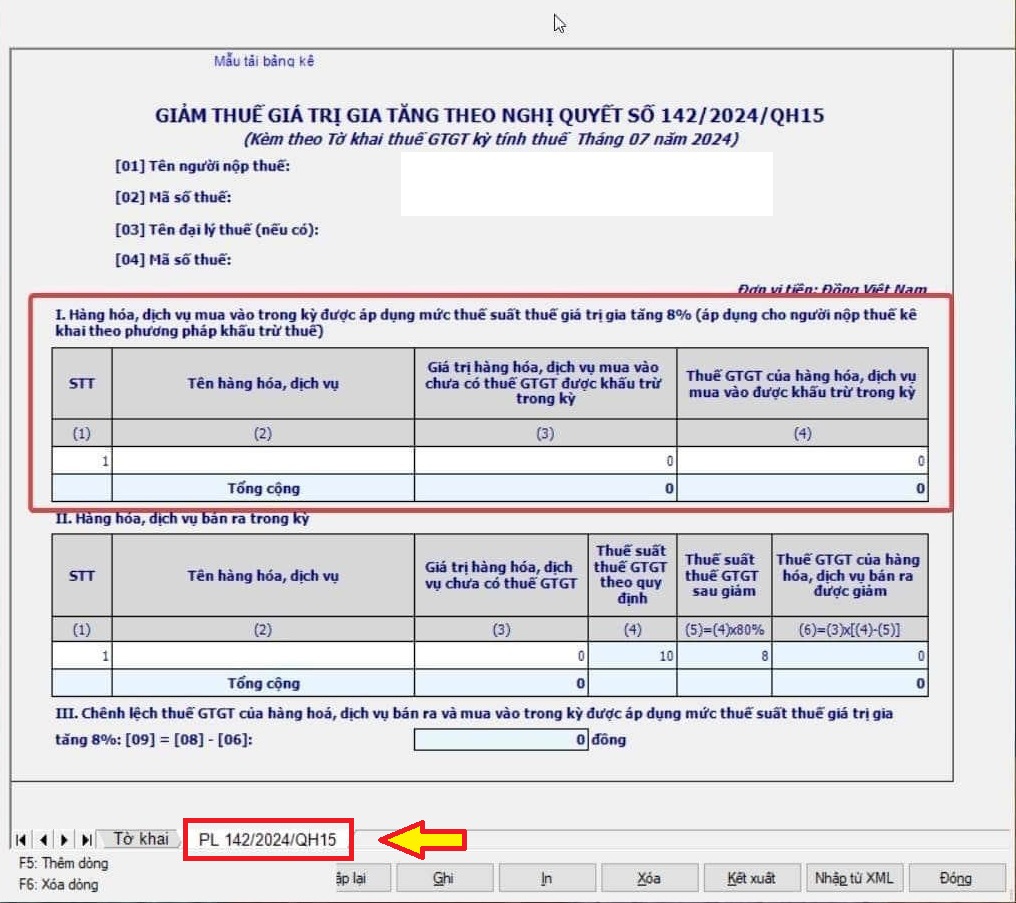

+ Appendix “PL 142/2024/QH15” for declaring goods and services with reduced VAT for the last half of 2024:

If during the 3rd quarter/2024, 4th quarter/2024 (for enterprises declaring quarterly) or during the month 7 to 12/2024 (for enterprises declaring monthly), your company sells goods, services with reduced VAT according to Decree 72/2024/ND-CP regulating VAT reduction according to Resolution 142/2024/QH15, then choose the Appendix “PL 142/2024/QH15” to declare goods, services with reduced VAT to 8% into it.

Note: From the HTKK 5.2.2 software upgrade version on August 16, 2024, the appendix for tax reduction "PL 142/2024/QH15" became available.

- Click "Agree" for the HTKK software to display the VAT declaration Form 01/GTGT.

- To declare the VAT reduction appendix according to Resolution 142/2024/QH15, the taxpayer selects as follows:

What is the form for goods and services not eligible for VAT reduction in Vietnam?

In Article 1 of Decree 72/2024/ND-CP, VAT reduction is implemented for groups of goods and services currently applying the 10% tax rate, except for the following groups:

- Telecommunications, finance, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products.

Details in Appendix I issued with Decree 72/2024/ND-CP.

- Products subject to special consumption tax.

Details in Appendix II issued with Decree 72/2024/ND-CP.

- Information technology according to IT law.

Details in Appendix III issued with Decree 72/2024/ND-CP.

- The reduction of VAT for each type of goods and services specified in Clause 1 Article 1 of Decree 72/2024/ND-CP is applied consistently at the stages of import, production, processing, and commercial business. For coal mined and sold (including cases where coal is mined, then sorted, and classified according to a closed procedure before being sold), it is eligible for VAT reduction. Coal in Appendix I issued with Decree 72/2024/ND-CP at stages other than mining sales is not eligible for VAT reduction.

Corporations and economic groups implementing closed processes to new sales are also eligible for VAT reduction for coal mined and sold.

In cases where goods and services in Appendices I, II, and III issued with Decree 72/2024/ND-CP fall into the categories not subject to VAT or subject to 5% VAT as per the VAT Law, they will follow the VAT Law regulations and will not be eligible for VAT reduction.