What does the application for non-agricultural land tax exemption or reduction in Vietnam include?

Will non-agricultural land users in Vietnam be eligible for tax exemption and reduction?

Under Article 52 Circular 80/2021/TT-BTC:

Procedures, documentation and the cases in which tax authorities issue notices and decisions on tax exemption or tax reduction

1. The tax authority shall issue a notice or decision on tax exemption or tax reduction in the following cases:

a) Exemption of PIT on the incomes prescribed in Clauses 1, 2, 3, 4, 5, 6 Article 4 of the Law on Personal Income Tax;

b) Reduction of tax payable by individuals, household businesses and individual businesses facing difficulties due to natural disasters, conflagrations, accidents, fatal diseases that affect their ability to pay tax;

c) Reduction of excise tax payable by taxpayers that produce goods subject to excise tax and are facing difficulties due to natural disasters, conflagrations, accidents according to regulations of law on excise tax;

d) Exemption, reduction of resource royalty payable by taxpayers that are affected by natural disasters, conflagration or accidents that cause damage to the resources on which resource royalty is paid;

dd) Exemption and reduction of non-agricultural land use tax:

e) Exemption and reduction of non-agricultural land use tax shall be granted in accordance with regulations of the Law on Use of Non-agricultural Land and the National Assembly’s Resolutions;

g) Exemption, reduction of land rents, water surface rents and land levies;

h) Exemption of registration fees.

2. Procedures and documentation of tax exemption and tax reduction in the cases specified in Clause 1 of this Article shall comply with Articles 53 through 61 of this Circular

Thus, non-agricultural land users in Vietnam will be eligible for tax exemption and reduction.

What does the application for non-agricultural land tax exemption or reduction in Vietnam include? (Image from the Internet)

What does the application for non-agricultural land tax exemption or reduction in Vietnam include?

According to Article 57 Circular 80/2021/TT-BTC, the application for non-agricultural land tax exemption or reduction in Vietnam include:

- In case of exemption of reduction of annual non-agricultural land use tax payable by a household or individual which is not exceeding 50.000 VND, the application shall contain:

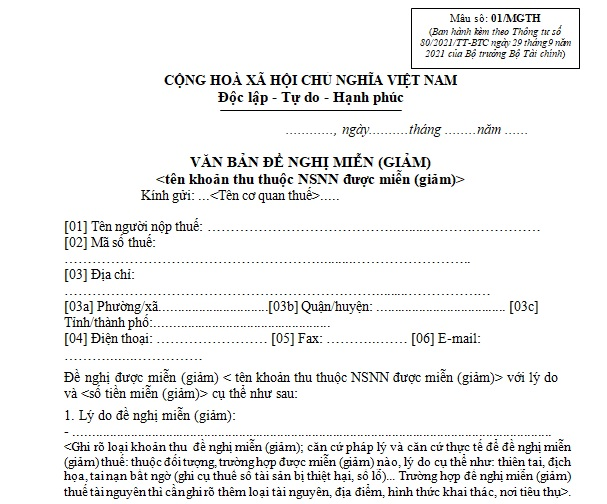

+ The application form No. 01/MGTH in Appendix I hereof;

+ Copies of documents relevant to the land plot on which tax is imposed, such as, the LUR Certificate, land allocation decision, land lease decision or contract, decision to permit land repurposing;

+ Documents of documents proving eligibility for exemption or reduction of non-agricultural land use tax.

The head of the tax authority responsible for the area where the land plot is location shall, on the basis of the application for tax exemption/reduction specified in this Clause, determine the amount of non-agricultural land use tax eligible to exemption or reduction and decide whether to grant exemption or decision.

In the cases specified in Clause 4, Clause 5, Clause 6 Article 9 and Clause 2, Clause 3 Article 10 of the Law on Non-agricultural Land Use Tax 2010, the head of the tax authority responsible for the area where the land plot is located shall issue a common decision according to the list of eligible taxpayers compiled by the People’s Committee of the commune. Annually, the People’s Committee of the commune shall review and send the list of taxpayers eligible for tax exemption or reduction to the tax authority.

In the cases specified in Clause 9 Article 9 and Clause 4 Article 10 of the Law on Non-agricultural Land Use Tax 2010, the head of the tax authority responsible for the area where the land plot is located shall issue a decision on tax exemption or reduction according to application submitted by the taxpayer and confirmation of the People’s Committee of the commune where the land plot is located.

- In case the annual non-agricultural land use tax payable by a household or individual is not exceeding 50.000 VND, submission of the tax exemption application is not required. The tax authority shall, via TMS application, extract a list of taxpayers eligible for tax exemption and send it to the People’s Committee of the communes where the taxpayers' land is located for comparison and confirmation.

What is the application form for non-agricultural land tax exemption or reduction in Vietnam?

The application form for non-agricultural land tax exemption or reduction in Vietnam is form 01/MGTH issued with Appendix 1 Circular 80/2021/TT-BTC:

Download Form 01/MGTH - the application form for non-agricultural land tax exemption or reduction in Vietnam: Here