What does the application for first-time taxpayer registration for a dependent unit in Vietnam include?

What does the application for first-time taxpayer registration for a dependent unit in Vietnam include?

Under sub-section 2, Section 2 of the administrative procedures issued together with Decision 2589/QD-BTC in 2021, the following documents are required for the first-time taxpayer registration for a dependent unit:

- For dependent units of economic organizations (except partnerships), include:

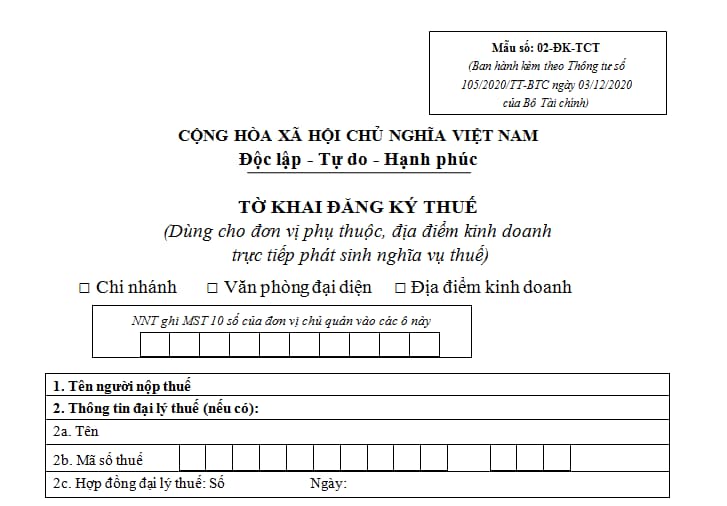

+ Application form for taxpayer registration made in Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance;

+ List of dependent units made in Form No. BK02-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ List of business locations made in Form No. BK03-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ List of foreign contractors and subcontractors made in Form No. BK04-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ List of oil and gas contractors and investors made in Form No. BK05-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ A copy of the Certificate of registration of the dependent unit's operation, or Decision of establishment, or equivalent document issued by a competent authority, or Business registration certificate according to the law of the bordering country (in case of an organization from a country sharing a land border with Vietnam conducting trade activities at border markets, border gates, or economic zones' markets in Vietnam).

- For dependent units of other organizations, include:

+ Application form for taxpayer registration made in Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance;

+ List of dependent units made in Form No. BK02-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ List of business locations made in Form No. BK03-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ List of foreign contractors and subcontractors made in Form No. BK04-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020 by the Ministry of Finance (if any);

+ A copy of the establishment decision, or equivalent document issued by a competent authority in which no certification is required.

What does the application for first-time taxpayer registration for a dependent unit in Vietnam include? (Image from Internet)

Where to download the application form for first-time taxpayer registration - Form 02-DK-TCT applicable to a dependent unit in Vietnam?

The application form for first-time taxpayer registration - Form 02-DK-TCT issued together with Circular 105/2020/TT-BTC applies to dependent units and business locations that directly incur tax liability as follows:

>> Download the application form for first-time taxpayer registration - Form 02-DK-TCT issued together with Circular 105/2020/TT-BTC: Download

>> Download the application form for first-time taxpayer registration - Form 02-DK-TCT issued together with Circular 105/2020/TT-BTC: Download

What is the structure of the TIN issued to a dependent unit after the first-time taxpayer registration in Vietnam?

According to Clause 3, Article 30 of the Law on Tax Administration 2019, the issuance of TINs is regulated as follows:

Applying for taxpayer registration and TIN issuance

...

2. Types of TINs:

a) 10-digit TINs shall be issued to enterprises and organizations that are legal persons; representatives of households, household businesses and other individuals;

b) 13-character TINs shall be issued to dependent units and other entities;

c) The Minister of Finance shall elaborate this clause.

3. Issuance of TINs:

a) Each enterprise, business organization or other organization is issued with 01 unique TIN to use throughout its entire operation, from the date of taxpayer registration to the date of TIN deactivation. A taxpayer’s branches, representative offices and/or dependent units that pay their own tax shall be issued with separate TINs. In case an enterprise, organization, branch, representative office or dependent unit combines taxpayer registration via the interlinked single-window system with business registration, the number of the certificate of enterprise registration, cooperative registration and/or business registration (hereinafter referred to as “business registration certificate”) is also the TIN;

b) Each individual is issued 01 unique TIN to use throughout their whole life. Any dependant of that individual shall be issued with a TIN for the purpose of claiming personal exemption for personal income taxpayers. The TIN issued to the dependant is also his/her personal TIN, which is used when paying his/her tax;

c) Enterprises, organizations and individuals responsible for deducting and paying tax on behalf of taxpayers shall be issued with separate TINs for use when deducting tax;

d) Issued TINs shall not be reissued to another taxpayer;

dd) TINs of enterprises, business organizations and other organizations shall remain unchanged after they are converted, sold, gifted or inherited;

e) TIN issued to a household, household business or individual business is issued to the individual representing the household, household business or individual business.

...

Therefore, the TIN of a dependent unit consists of 13 digits and other characters.