What documents are required for persons finalizing personal income tax directly in Vietnam? What is the personal income tax finalization declaration form in Vietnam 02/QTT-TNCN?

What documents are required for persons finalizing personal income tax directly in Vietnam?

As stipulated in Section 1.1, Subsection 1, Section 4 of Official Dispatch 883/TCT-DNNCN of 2022, the personal income tax finalizations for individuals who directly file tax finalization with tax authorities include the following paperwork:

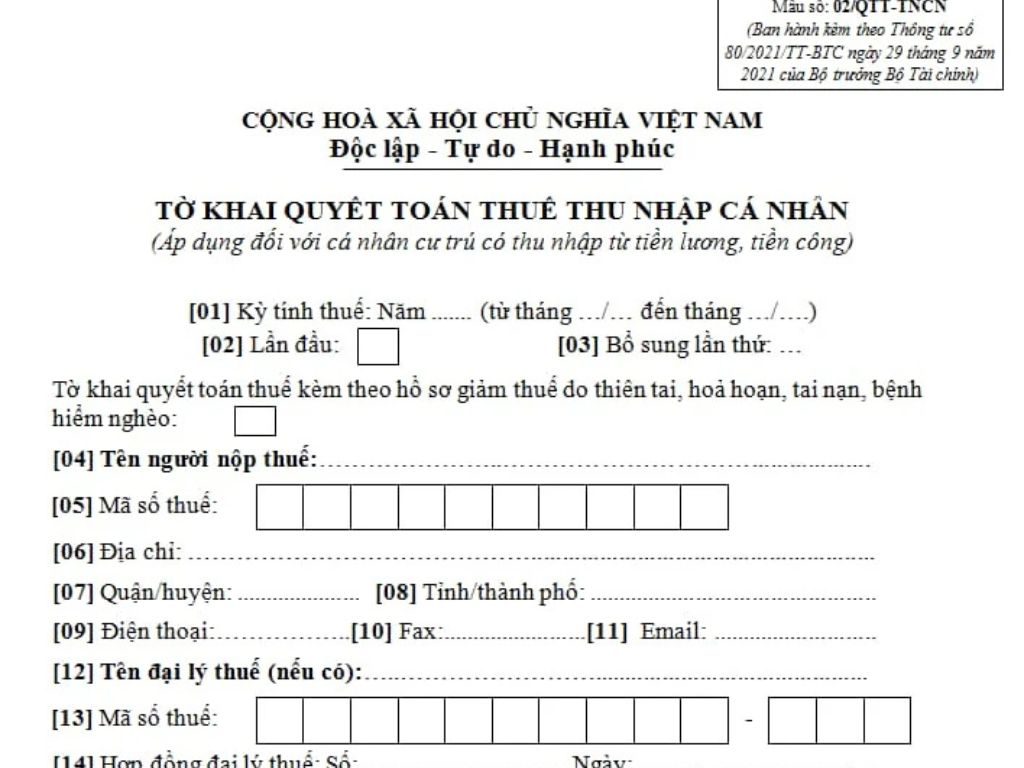

- personal income tax finalization declaration form No. 02/QTT-TNCN, issued together with Appendix 2 of Circular 80/2021/TT-BTC Download.

- Appendix detailing dependent reductions form No. 02-1/BK-QTT-TNCN, issued together with Appendix 2 of Circular 80/2021/TT-BTC Download.

- A copy (photographed from the original) of documents proving tax amounts withheld, pre-paid during the year, or paid overseas (if any). If the income paying organization has ceased operations and therefore cannot provide tax withholding certificates to individuals, the tax authority will refer to the tax sector’s database to process the tax finalizations for individuals, without requiring tax withholding certificates.

In cases where the organization or individual paying income uses electronic personal income tax withholding certificates, the taxpayer will use the electronic representation of the personal income tax withholding certificate (a paper version self-printed by the taxpayer from the original electronic certificate sent by the income paying organization or individual to the taxpayer).

- A copy of the Tax Deduction Certificate (clearly stating which income tax return the tax was paid with) issued by the income paying organization, or a copy of the bank document for the tax paid overseas, verified by the taxpayer when under foreign law, the foreign tax authority does not issue a confirmation of paid tax.

- Copies of invoices and documents proving contributions to charity, humanitarian, and study promotion funds (if any).

- Documents proving amounts paid by foreign income-paying organizations in cases where individuals receive income from international organizations, embassies, consulates, and income from overseas.

- Registration documents for dependents (if claiming deductions for dependents at the time of tax finalization for those who have not yet registered their dependents).

What documents are required for persons finalizing personal income tax directly in Vietnam? What is the personal income tax finalization declaration form in Vietnam 02/QTT-TNCN? (Image from Internet)

What is the personal income tax finalization declaration form in Vietnam 02/QTT-TNCN?

Appendix 2, issued together with Circular 80/2021/TT-BTC, regulates the personal income tax finalization declaration form as follows:

Note: The personal income tax finalization declaration form 02/QTT-TNCN is applicable to individuals with income from salaries and wages.

See detailed personal income tax finalization declaration form 02/QTT-TNCN Download

When is the deadline to submit personal income tax finalizations in Vietnam?

Based on points a and b, clause 2, Article 44 of the Tax Administration Law 2019, the deadline for filing and submitting personal income tax finalizations is as follows:

Tax Declaration Filing Deadline

1. For monthly and quarterly tax declarations, the deadlines are stipulated as follows:

a) No later than the 20th day of the subsequent month for monthly declarations and payments;

b) No later than the last day of the first month of the subsequent quarter for quarterly declarations and payments.

2. For annual tax declarations, the deadlines are stipulated as follows:

a) No later than the last day of the third month after the end of the calendar or fiscal year for annual tax finalization; or no later than the last day of the first month of the calendar or fiscal year for annual tax declarations;

b) No later than the last day of the fourth month following the end of the calendar year for an individual's personal income tax finalization directly filed with the tax authority;

c) No later than December 15 of the previous year for presumptive tax declarations of business households and individuals paying tax under the presumptive method; for new business households, the deadline for filing tax declarations is no later than 10 days from the start of business.

3. For tax declarations and payments arising on a per-incident basis, the deadline is no later than the 10th day from the day the tax obligation arises.

4. For cessation of operations, termination of contracts, or business reorganization, the tax declaration deadline is no later than the 45th day from the occurrence of the event.

Thus, according to the above regulation, the deadline for submitting personal income tax finalizations is:

- No later than the last day of the third month following the end of the calendar or fiscal year for annual tax finalization; or no later than the last day of the first month of the calendar or fiscal year for annual tax declarations;

- No later than the last day of the fourth month following the end of the calendar year for the personal income tax finalization for individuals directly filing tax finalization.