What documents are included in the Application for requesting tax refunds under the Double Taxation Avoidance Agreement and other international treaties in Vietnam?

What documents are included in the Application for requesting tax refunds under the Double Taxation Avoidance Agreement and other international treaties in Vietnam?

According to Article 30 of Circular 80/2021/TT-BTC, the documents required for a tax refund application under a Double Taxation Avoidance Agreement (DTAA) and other international treaties are specified as follows:

In case of a tax refund application under a Double Taxation Avoidance Agreement, the dossier includes:

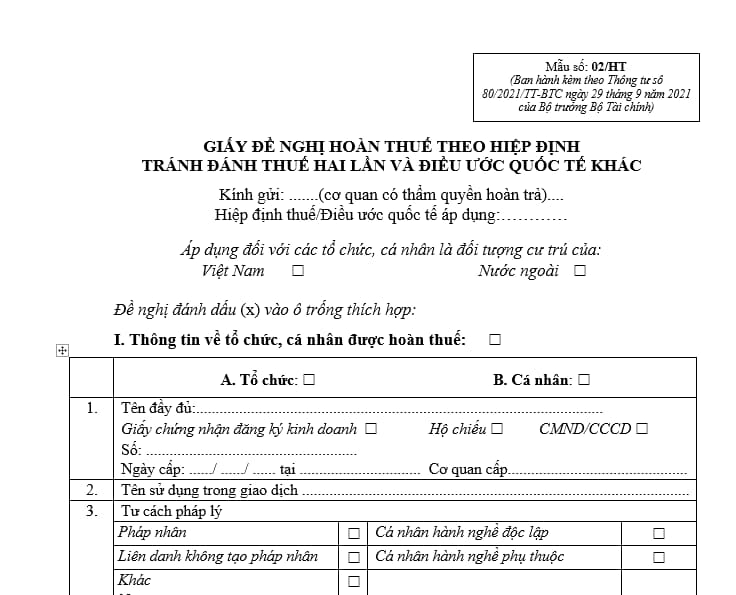

- An application for a tax refund under the DTAA and other international treaties, according to form 02/HT issued together with Appendix 1 of Circular 80/2021/TT-BTC.

- Documents related to the tax refund dossier, including:

+ A certificate of residence issued by the tax authority of the country of residence, legalized, indicating the year for which the individual is a resident;

+ A copy of the economic contract, service supply contract, agency contract, entrustment contract, technology transfer contract, or labor contract signed with a Vietnamese organization or individual; certificate of deposit in Vietnam; certificate of capital contribution to a company in Vietnam (depending on the type of income in each specific case) with the taxpayer's confirmation;

+ A confirmation letter from the Vietnamese organization or individual signing the contract about the duration and actual activities following the contract (excluding the case of tax refunds for foreign transportation companies);

+ A power of attorney in case the organization or individual authorizes a legal representative to carry out tax treaty procedures. If the authorization is carried out abroad, it must be legalized (if done abroad) or notarized (if done in Vietnam) as per regulations;

+ A tax payment voucher list according to form 02-1/HT issued together with Appendix 1 of Circular 80/2021/TT-BTC.

In case of a tax refund application under other international treaties, the dossier includes:

- An application for a tax refund under the DTAA and other international treaties according to form 02/HT issued together with Appendix 1 of Circular 80/2021/TT-BTC with the confirmation of the proposing agency for signing the international treaty.

- Documents related to the tax refund dossier, including:

+ A copy of the international treaty;

+ A contract copy with the Vietnamese party, confirmed by the foreign organization or individual, or their authorized representative;

+ A contract summary confirmed by the foreign organization or individual, or their authorized representative. The contract summary must include the contract name and clause names, contract scope of work, and tax obligations under the contract;

+ A power of attorney in case the foreign organization or individual authorizes a Vietnamese organization or individual to carry out tax refund procedures under the international treaty. If the authorization is carried out abroad, it must be legalized (if done abroad) or notarized (if done in Vietnam) as per regulations;

+ A tax payment voucher list according to form 02-1/HT issued together with Appendix 1 of Circular 80/2021/TT-BTC.

What documents are included in the Application for requesting tax refunds under the Double Taxation Avoidance Agreement and other international treaties in Vietnam? (Image from the Internet)

How to submit an electronic tax refund application under a Double Taxation Avoidance Agreement and other international treaties in Vietnam?

According to Clause 1, Article 32 of Circular 80/2021/TT-BTC, the process of submitting an electronic tax refund application under a Double Taxation Avoidance Agreement (DTAA) and other international treaties is as follows:

- Taxpayers submit their electronic tax refund application through the General Department of Taxation's electronic portal or other electronic portals as per regulations on electronic transactions in the tax field.

- The receipt of the taxpayer's electronic tax refund application is conducted according to regulations on electronic transactions in the tax field.

- Within 03 working days from the date indicated on the Notification of receipt of the tax refund application, the tax authority must resolve the tax refund dossier as regulated in Article 27 of Circular 80/2021/TT-BTC and issue a Notification of acceptance of the tax refund application or a Notification of non-refund in case the dossier is not eligible for a refund through the General Department of Taxation's electronic portal or other electronic portals where the taxpayer submitted the electronic tax refund application.

What is the form for a tax refund application under a Double Taxation Avoidance Agreement or other international treaties in Vietnam?

The form for a tax refund application under a Double Taxation Avoidance Agreement or other international treaties in Vietnam is form 02/HT issued together with Appendix 1 of Circular 80/2021/TT-BTC.

Download the form for a tax refund application under a Double Taxation Avoidance Agreement or other international treaties in Vietnam here