What day is October 31? Is it possible to extend the deadline for third-quarter tax payment in Vietnam?

What is October 31?

Based on Clause 1, Article 44 of the 2019 Law on Tax Administration, the regulation states:

Deadline for submission of tax declaration dossiers

- The deadline for submission of tax declaration dossiers for the types of taxes declared monthly, quarterly is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and submissions;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and submissions.

...

Additionally, pursuant to Clause 1, Article 55 of the 2019 Law on Tax Administration:

Deadline for tax payment

1. In cases where the taxpayer calculates the tax, the deadline for tax payment is no later than the last day of the deadline for submitting tax declaration dossiers. In cases of additional tax declaration dossiers, the deadline for tax payment is the deadline for submitting tax declaration dossiers of the tax period with mistakes or omissions.

For corporate income tax, temporary quarterly payments are due no later than the 30th day of the first month of the following quarter.

For crude oil, the deadline for natural resource tax payment and corporate income tax according to crude oil export sales is 35 days from the date of domestic sale or from the date of customs clearance for exported crude oil in accordance with customs law.

For natural gas, the deadline for natural resource tax and corporate income tax payments is monthly.

...

Thus, it can be seen that October 31 is the last day of the first month of the quarter following the quarter in which the tax obligation arises. Therefore, October 31 is the deadline for submitting tax declaration and tax payment for the third quarter of 2024.

What is October 31? (Image from Internet)

Is it possible to extend the deadline for third-quarter tax payment in Vietnam?

According to Article 62 of the 2019 Law on Tax Administration, the conditions for tax extension in cases of force majeure are as follows:

Tax payment extension

- Tax payment extension is considered based on the request of the taxpayer in one of the following cases:

a) Suffering material damage, directly affecting production or business due to force majeure situations specified in Clause 27, Article 3 of this Law;

b) Being forced to suspend operations due to the relocation of production or business facilities as requested by competent authorities, affecting business results.

...

Additionally, Article 4 of Decree 64/2024/ND-CP stipulates the extension of tax payment deadlines and land rent as follows:

Extension of tax payment and land rent

- For value-added tax (excluding value-added tax at import)

a) Extension of tax payment deadlines for the value-added tax payable (including tax allocated to various provincial-level localities where the taxpayer’s headquarters is located, tax paid according to each occurrence) for the tax periods from May to September 2024 (for monthly value-added tax declarations) and the second quarter of 2024, third quarter of 2024 (for quarterly value-added tax declarations) of enterprises and organizations as mentioned in Article 3 of this Decree. The extension period is 05 months for the value-added tax of May 2024, June 2024, and the second quarter of 2024, 04 months for July 2024, 03 months for August 2024, and 02 months for September 2024 and the third quarter of 2024. The extension period at this point is calculated from the end date of the value-added tax payment deadline in accordance with tax administration law.

Enterprises and organizations qualifying for the extension will complete their monthly or quarterly value-added tax filings according to current legislation, but are not required to make the resulting value-added tax payments from the filed value-added tax return. The extended deadlines for value-added tax are as follows:

The deadline for value-added tax of the May 2024 tax period is November 20, 2024.

The deadline for value-added tax of the June 2024 tax period is December 20, 2024.

The deadline for value-added tax of the July 2024 tax period is December 20, 2024.

The deadline for value-added tax of the August 2024 tax period is December 20, 2024.

The deadline for value-added tax of the September 2024 tax period is December 20, 2024.

The deadline for value-added tax of the second quarter of 2024 tax period is December 31, 2024.

The deadline for value-added tax of the third quarter of 2024 tax period is December 31, 2024.

Thus, it is possible to extend the deadline for the third quarter tax payment to December 31, 2024.

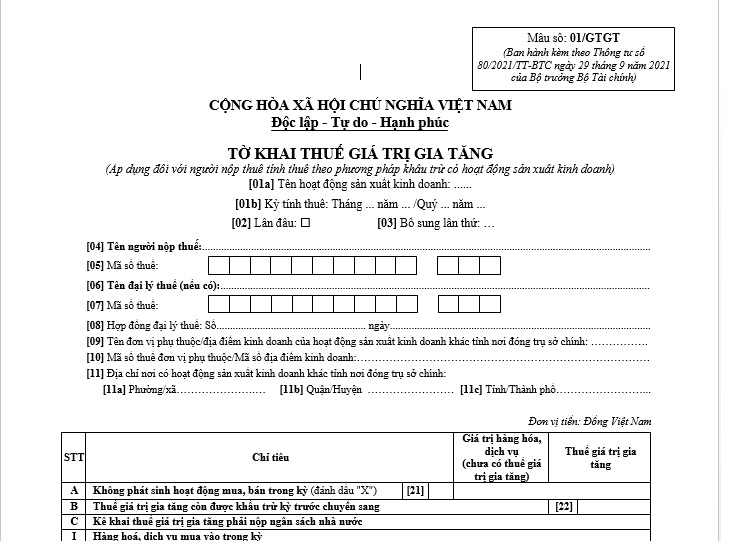

What is the VAT declaration form for the third quarter of 2024 in Vietnam?

The latest VAT declaration form currently used is form 01/GTGT issued in Appendix 2 of Circular 80/2021/TT-BTC, applicable to organizations and individuals who must calculate tax by the deduction method and engage in production or business activities during the tax period (month/quarter).

Form 01/GTGT issued in Appendix 2 of Circular 80/2021/TT-BTC... Download