What day does the 5th day of Tet fall on in the 2025 Gregorian calendar? Are tax officers required to return to work on the 5th day of Tet?

What day does the 5th day of Tet fall on in the 2025 Gregorian calendar?

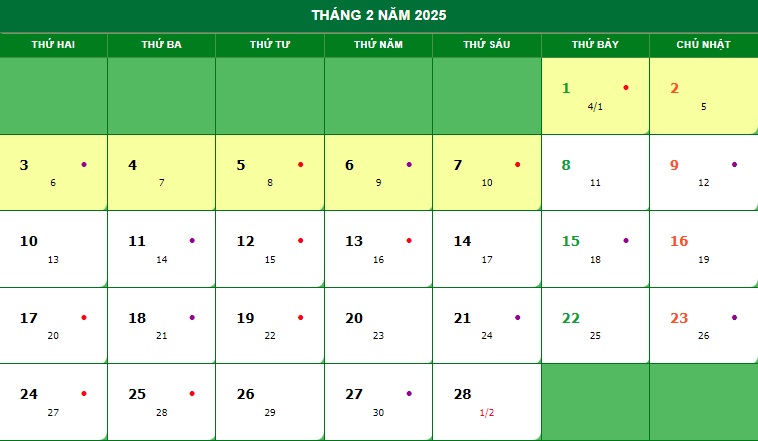

Based on the Perpetual Calendar for February 2025 as follows:

Thus, the 5th day of Tet will fall on Sunday, February 2, 2025 (equivalent to the 5th day of the 1st lunar month 2025, which is February 2, 2025, in the Gregorian calendar).

Additionally, the 5th day of Tet is also known as the Dragon Boat Festival, an important traditional holiday in the cultures of several East Asian countries such as Vietnam, China, Korea, and Japan. The Dragon Boat Festival falls on the 5th day of the 5th lunar month annually.

In Vietnam, the Dragon Boat Festival is also popularly known as "Tết diệt sâu bọ" or "Insect Elimination Festival." This is the day when people perform rituals such as catching insects and eliminating pests that harm crops, and it is also an occasion to eat traditional foods such as sticky rice cakes and drink rice wine.

The early days of May coincide with seasonal transitions, from sunny to rainy season, cold to hot. In ancient agriculture, these were the transitional dates from the Chiêm crop to the Mùa crop. During these days, insects also begin to rapidly proliferate. People have passed down various cultural festival customs, eating, drinking, and picking medicinal leaves to thank ancestors; praying for bountiful harvests, good health, and freedom from sickness and disease.

Note: Information is for reference only!

What day does the 5th day of Tet fall on in the 2025 Gregorian calendar? (Image from Internet)

Do Vietnamese tax officials have to return to work by the 5th day of Tet?

Recently, the Government Office of Vietnam issued Official Dispatch 8726/VPCP-KGVX year 2024 regarding Lunar New Year and several holiday breaks in 2025.

The Prime Minister has agreed to the proposal of the Ministry of Labor, Invalids and Social Affairs regarding the Lunar New Year break for officials, employees, and public workers as follows:

- For the 2025 Lunar New Year, officials and public employees will have 9 consecutive days off, including 5 days for Tet and 4 weekly days off.

- Specifically, officials and public employees will have 5 days off for the Lunar New Year, from Monday, January 27, 2025, to Friday, January 31, 2025 (from the 28th day of the 12th month of the Year of the Dragon to the 3rd day of the first month of the Year of the Snake).

- However, since in 2025, all 5 Tet holidays fall on weekdays, workers will get 2 additional weekend days off before and 2 days off after Tet.

- Agencies and units should arrange on-call shifts and work reasonably to maintain continuous operations, ensuring proper service for organizations and the public, paying attention to assigning officials on duty to handle unexpected events that may arise during the Tet and holiday breaks as per regulations.

- Ministries, agencies, and localities should have specific and suitable plans and measures to encourage units, businesses, organizations, and individuals to actively deploy production, business, and socio-economic activities, ensuring the stability of supply and demand of goods, services, prices, and markets, contributing to promoting production, business, economic growth, practicing thrift, combating waste, and striving to successfully achieve the goals and tasks of the 2025 plan, a year of acceleration and breakthrough for the 5-year plan 2021 - 2025, creating a solid foundation and premise for rapid and sustainable development in the future.

Therefore, the Lunar New Year holiday schedule for Vietnamese tax officials and employees in 2025 may be 9 consecutive days starting from January 25 to February 2, 2025 (from the 26th of the 12th lunar month to the end of the 5th day of the first lunar month).

Thus, only until the 6th day of Tet (February 3, 2025, in the Gregorian calendar) will Vietnamese tax officials return to work.

What are the positions of Vietnamese tax officials?

Based on Clause 2, Article 3 of Circular 29/2022/TT-BTC, there are 5 official positions for tax officers as follows:

| Position | Position Code |

| Senior Tax Inspector | 06.036 |

| Principal Tax Inspector | 06.037 |

| Tax Inspector | 06.038 |

| Intermediate Tax Inspector | 06.039 |

| Tax Employee | 06.040 |

Among them:

(1) Senior Tax Inspector:

According to Clause 1, Article 9 of Circular 29/2022/TT-BTC, the senior tax inspector is an official with the highest professional expertise in the tax field, assigned to leadership positions at the General Department, department leaders, equivalent, and provincial tax department leaders, responsible for advising on state tax management at the General Department and provincial tax departments, and handling complex tax operations within the province, across multiple provinces, or nationwide.

(2) Principal Tax Inspector:

According to Clause 1, Article 10 of Circular 29/2022/TT-BTC, the principal tax inspector is an official with high-level professional expertise in the tax sector, assisting leadership in organizing tax management or directly implementing tax operations according to assigned functions in tax units.

(3) Tax Inspector:

According to Clause 1, Article 11 of Circular 29/2022/TT-BTC, the tax inspector is an official with basic professional expertise in the tax sector, directly implementing tax management tasks.

(4) Intermediate Tax Inspector:

According to Clause 1, Article 12 of Circular 29/2022/TT-BTC, the intermediate tax inspector is an official executing professional tax tasks, directly performing some tax management tasks at the unit.

(5) Tax Employee:

According to Clause 1, Article 13 of Circular 29/2022/TT-BTC, a tax employee is an official executing simple professional tasks in the tax sector, directly implementing some tasks in tax management as assigned by the unit.