What contents are included in the Form No. 02/TXNK of the Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam?

What contents are included in the Form No. 02/TXNK of the Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam?

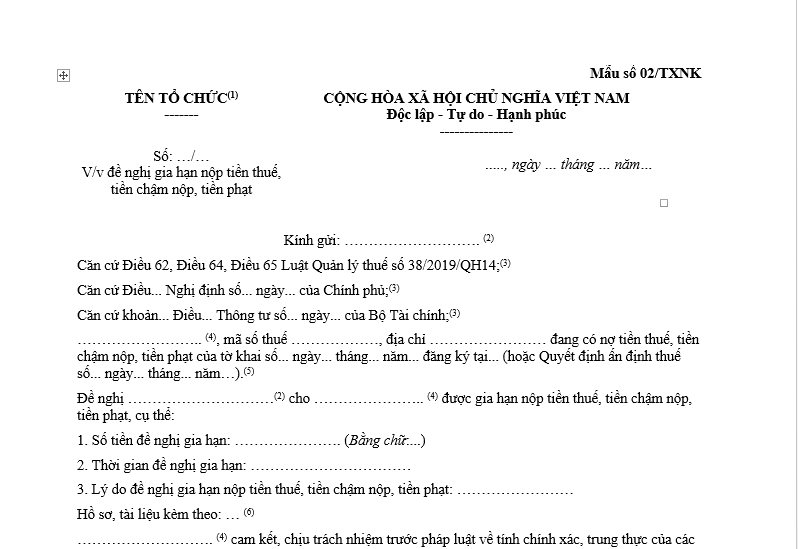

Form No. 02/TXNK of the Official Dispatch requesting an extension of tax payment for imported and exported goods is issued according to Circular 06/2021/TT-BTC.

Download Form No. 02/TXNK of the Official Dispatch requesting an extension of tax payment for imported and exported goods here: Here

What contents are included in the Form No. 02/TXNK of the Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam? (Image from the Internet)

What are regulations on the deadline for paying import and export taxes in Vietnam?

Based on Article 9 of the Law on Export and Import Duties 2016, the deadline for paying import and export taxes is prescribed as follows:

- Goods subject to export and import duties must pay taxes before customs clearance or release of goods according to the provisions of the Customs Law, except as provided in Clause 2 of Article 9 of the Law on Export and Import Duties 2016.

In cases where a credit institution guarantees the tax payable, the goods can be cleared or released, but late payment penalties must be paid according to the provisions of the Law on Tax Administration 2019 from the date the goods are cleared or released until the tax is paid. The maximum guarantee period is 30 days from the date of customs declaration registration.

If the guarantee period has expired but the taxpayer has not paid the taxes and late payment penalties, the guarantor institution is responsible for paying the full tax and late payment penalties on behalf of the taxpayer.

- Taxpayers who are applied priority policies according to the provisions of the Customs Law 2014 must pay taxes for customs declarations that have been cleared or released in a month by the tenth day of the following month at the latest.

If the taxpayer fails to pay taxes by this deadline, they must pay the full amount of outstanding taxes and late payment penalties according to the provisions of the Law on Tax Administration 2019.

How long is the extension for paying import and export taxes in Vietnam?

Based on Article 62 of the Law on Tax Administration 2019, the extension for paying taxes is prescribed as follows:

Tax Payment Extension

- The tax payment extension is considered based on the request of the taxpayer in one of the following cases:

a) Suffered physical damage, directly affected production, business due to force majeure events as stipulated in Clause 27 Article 3 of this Law;

b) Had to cease operations due to the relocation of production and business premises as required by the competent authority, affecting the production and business results.

- The taxpayer eligible for the tax payment extension as prescribed in Clause 1 of this Article will be granted an extension for part or all of the tax payable.

- The extension period is specified as follows:

a) Not exceeding 02 years from the tax payment deadline for cases prescribed in point a, Clause 1 of this Article;

b) Not exceeding 01 year from the tax payment deadline for cases prescribed in point b, Clause 1 of this Article.

- The taxpayer will not be fined and will not have to pay late payment penalties on the overdue tax amount during the extension period.

- The head of the directly managing tax authority, based on the tax extension dossier, will decide the extended tax amount and the extension period.

In Article 19 of Decree 126/2020/ND-CP:

Tax Payment Extension in Special Cases

In certain periods, when specific subjects, business sectors face exceptional difficulties, the Ministry of Finance will lead and cooperate with relevant ministries and central authorities to submit to the Government of Vietnam for prescribing the subjects, types of taxes and other amounts to be collected into the state budget, duration, procedures, sequence, authority, and dossier for tax payment extension. The tax payment extension will not lead to adjustments in the state budget estimates decided by the National Assembly.

Thus, the deadline for extending the payment of import and export taxes is stipulated as follows:

- For cases of physical damage directly affecting production and business due to force majeure: Not exceeding 02 years from the tax payment deadline;

- For cases of ceasing operations due to the relocation of production and business premises required by the competent authority, affecting production and business results: Not exceeding 01 year from the tax payment deadline;

- For cases of tax payment extension in special circumstances, the extension period will be prescribed by the Government of Vietnam.