What are types of tax identification numbers in Vietnam?

What is the structure of tax identification numbers in Vietnam?

According to Clause 1 Article 5 Circular 105/2020/TT-BTC, the structure of the tax identification number is regulated as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

In which:

- The first two digits N1N2 represent the segment number of the tax identification number.

- Seven digits N3N4N5N6N7N8N9 are defined according to a specific structure, increasing from 0000001 to 9999999.

- The digit N10 is the check digit.

- Three digits N11N12N13 are ordinal numbers from 001 to 999.

- The hyphen (-) is a character to separate the group of the first 10 digits and the last 3 digits.

What are types of tax identification numbers in Vietnam? (Image from the Internet)

What are types of tax identification numbers in Vietnam?

According to Clause 3 Article 5 Circular 105/2020/TT-BTC, the structure of the tax identification number comprises 2 types of codes: a 10-digit tax identification number and a 13-digit tax identification number. To be specific:

- The 10-digit tax identification number is used for enterprises, cooperatives, organizations with legal status, or organizations without legal status but directly generating tax obligations; representatives of households, business households, and other individuals (hereinafter referred to as independent units).

- The 13-digit tax identification number, with a hyphen (-) to separate the first 10 digits and the last 3 digits, is used for dependent units and other entities.

What are cases of termination of tax identification numbers in Vietnam?

Based on Article 39 Law on Tax Administration 2019, the tax identification number becomes invalid in the following cases:

Taxpayer registration along with enterprise registration, cooperative registration, business registration should terminate the validity of the tax identification number in any of the following cases:

- Termination of business activities or dissolution, bankruptcy;

- Revocation of enterprise registration certificate, cooperative registration certificate, business registration certificate;

- Splitting, merging, consolidation.

Taxpayer registration directly with the tax authorities should terminate the validity of the tax identification number in the following cases:

- Termination of business activities, no longer generating tax obligations for non-business organizations;

- Revocation of business registration certificate or equivalent license;

- Splitting, merging, consolidation;

- Tax authorities issue a notice that the taxpayer is not operating at the registered address;

- Individual deceased, missing, loss of civil capacity according to the legal regulations;

- Foreign contractor upon the conclusion of the contract;

- Contractor, investor participating in oil and gas contracts upon the conclusion of the contract or transfer of all interests in the oil and gas contract.

What are cases of restoration of the tax identification number in Vietnam?

According to Article 40 Law on Tax Administration 2019, the tax identification number can be restored in the following cases:

- Taxpayer registration along with enterprise registration, cooperative registration, business registration, when legal status is reinstated according to the provisions of the law on enterprise registration, cooperative registration, business registration, simultaneously the tax identification number is reinstated.

- Taxpayer registration directly with the tax authorities submits a request for reinstatement of the tax identification number to the direct managing tax authority in the following cases:

+ Authorized agency issues a document canceling the revocation of the business registration certificate or equivalent license;

+ When there is a demand to continue business activities after submitting the dossier for termination of the validity of the tax identification number to the tax authority but the tax authority has not yet issued a notice of termination of the validity of the tax identification number;

+ When the tax authority issues a notice that the taxpayer is not operating at the registered address but has not yet revoked the license and the tax identification number has not yet been terminated.

* The tax identification number can be reused in economic transactions from the effective date of the legal status reinstatement decision of the business registration authority or the tax authority's notice of tax identification number reinstatement.

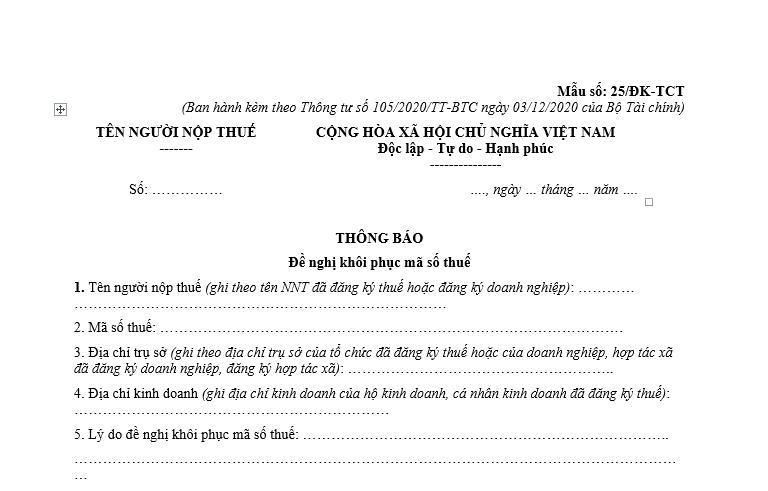

What contents are included in the Form 25/DK-TCT - Request for restoration of tax identification number in Vietnam?

The current form for requesting restoration of tax identification number is Form 25/DK-TCT issued along with Circular 105/2020/TT-BTC.

Download the current request form for restoration of tax identification number here