What are the requirements for taxpayer who is a foreign contractor in Vietnam?

What are the types of taxes that foreign contractors in Vietnam are required to pay?

According to Article 5 of Circular 103/2014/TT-BTC the provisions are as follows:

Applicable taxes

1. Foreign contractors and foreign sub-contractors that are business organizations are liable for value-added tax (VAT), corporate income tax (CIT) according to the guidelines in this Circular.

2. Foreign contractors and foreign sub-contractors that are foreign individuals conducting business are liable for VAT according to the guidelines in this Circular, and personal income tax (PIT) according to the law on PIT.

3. For other taxes, fees, and charges, foreign contractors and foreign sub-contractors shall comply with the current legal documents on other taxes, fees, and charges.

Thus, when conducting business in Vietnam, foreign contractors are required to pay the following taxes:

- Foreign contractors that are business organizations are required to fulfill obligations for VAT and CIT.

- Foreign contractors that are foreign individuals conducting business are required to fulfill obligations for VAT according to the guidelines in this Circular, and PIT according to the law on PIT.

- For other taxes, fees, and charges, foreign contractors shall comply with the current legal documents on other taxes, fees, and charges.

What are the requirements for taxpayer who is a foreign contractor in Vietnam? (Image from the Internet)

What are the requirements for taxpayer who is a foreign contractor in Vietnam?

Based on Article 4 of Circular 103/2014/TT-BTC, the provisions are as follows:

Taxpayer

1. Foreign contractors and foreign sub-contractors must ensure the requirements stipulated in Article 8 Section 2 Chapter II or Article 14 Section 4 Chapter II, doing business in Vietnam or having income in Vietnam. The business is conducted based on a contractor agreement with Vietnamese organizations or individuals or with other foreign organizations or individuals doing business in Vietnam, based on a sub-contractor agreement.

The determination of whether a foreign contractor or foreign sub-contractor has a permanent establishment in Vietnam or is a resident entity in Vietnam shall be in accordance with the provisions of the Law on Corporate Income Tax, the Law on Personal Income Tax, and guiding documents.

In the case where a Double Tax Avoidance Agreement that the Socialist Republic of Vietnam has signed includes different provisions concerning permanent establishments or residency status, the provisions of that Agreement shall apply.

2. Organizations established and operating under Vietnamese law, organizations registered to operate under Vietnamese law, other organizations, and individuals conducting business, who purchase services, services associated with goods or pay for income generated in Vietnam based on contractor contracts or sub-contractor contracts; purchase goods in the form of domestic export-import or according to international commercial terms (Incoterms); distribute goods, provide services on behalf of foreign organizations and individuals in Vietnam (hereinafter collectively referred to as the Vietnamese Party) include:

- Business organizations established under the Law on Enterprises, the Law on Investment, and the Law on Cooperatives;

- Economic organizations of political organizations, political-social organizations, social organizations, social-professional organizations, armed units, professional units, and other organizations;

- Petroleum contractors operating under the Law on Petroleum;

- Branches of foreign companies allowed to operate in Vietnam;

- Foreign organizations or representatives of foreign organizations allowed to operate in Vietnam;

- Ticket offices, agents in Vietnam of foreign airlines with the right to transport to and from Vietnam, directly transport or jointly operate;

- Organizations and individuals providing maritime services of foreign shipping lines; representatives in Vietnam of foreign logistic companies, foreign courier companies;

- Securities companies, securities issuers, fund management companies, commercial banks where foreign investment funds or foreign organizations open investment accounts;

- Other organizations in Vietnam;

- Individuals conducting business in Vietnam.

Taxpayers as guided in Clause 2, Article 4, Chapter I, have the responsibility to withhold value-added tax and corporate income tax as instructed in Section 3, Chapter II, before making payments to foreign contractors and foreign sub-contractors.

Thus, a taxpayer who is a foreign contractor must comply with the following regulations:

- Have a permanent establishment in Vietnam, or be a resident entity in Vietnam;

- Business duration in Vietnam according to the contractor agreement, sub-contractor agreement of 183 days or more from the effective date of the contractor agreement, sub-contractor agreement;

- Apply Vietnamese accounting policies and perform Tax Registration, with a tax code issued by the tax authorities.

- Conduct business in Vietnam or have income in Vietnam.

Note: The determination of whether a foreign contractor or foreign sub-contractor has a permanent establishment in Vietnam, or is a resident entity in Vietnam shall follow the provisions of the Law on Corporate Income Tax, the Law on Personal Income Tax, and guiding documents.

- In the case where a Double Tax Avoidance Agreement that the Socialist Republic of Vietnam has signed includes different provisions concerning permanent establishments or residency status, the provisions of that Agreement shall apply.

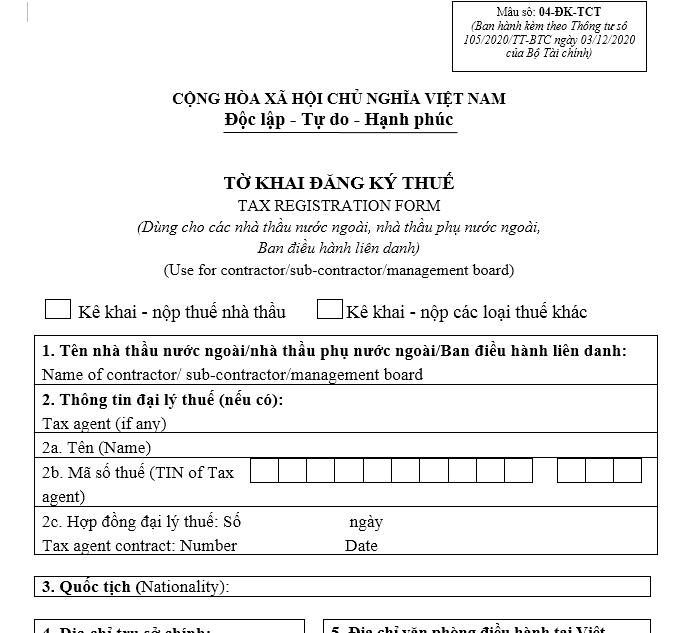

What is the Form 04-DK-TCT Tax Registration Declaration for foreign contractors in Vietnam?

According to Appendix I List of tax code status issued together with Circular 105/2020/TT-BTC, Form 04-DK-TCT is the Tax Registration Declaration Form for foreign contractors issued as follows:

Download Form 04-DK-TCT Tax Registration Declaration for foreign contractors, foreign sub-contractors, and Joint Operating partners.