What are the regulations on the application for changes to taxpayer registration information and places for submission hereof in Vietnam?

What are the regulations on the application for changes to taxpayer registration information and places for submission hereof in Vietnam?

According to Article 10 of Circular 105/2020/TT-BTC, the location of submission and application for changes to taxpayer registration information are specified in Article 36 of the Law on Tax Administration 2019 and the following regulations:

(1) Changes to taxpayer registration information without alternation of supervisory tax authority

* The taxpayer specified in point a, b, c, d, dd, e h, i, or n clause 2 Article 4 of Circular 105/2020/TT-BTC shall file the following application with the supervisory tax authority:

- The application for changes to taxpayer registration information of the taxpayer mentioned in point a, b, c, dd, h, or n clause 2 Article 4 of Circular 105/2020/TT-BTC includes:

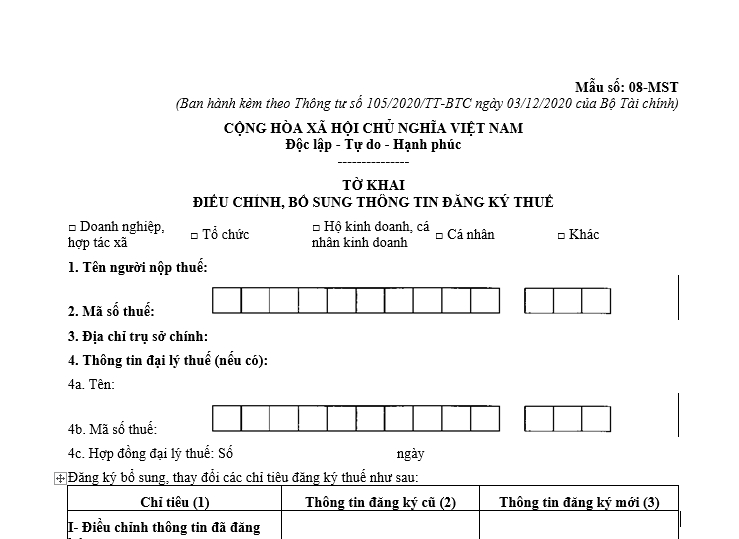

+ Application form for changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC;

+ Copy of establishment and operation license, or certificate of operation registration of affiliated entity, or establishment decision, or equivalent license issued by the competent authority, if any information of the said document is changed.

- The application for changes to taxpayer registration information of the taxpayer mentioned in point d clause 2 Article 4 hereof includes: Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC.

- The application for Changes to taxpayer registration information of the overseas supplier specified in point e clause 2 Article 4 of Circular 105/2020/TT-BTC shall comply with the Circular of the Ministry of Finance on guidelines for the Law on Tax Administration.

- The application for changes to taxpayer registration information of the household/individual business mentioned in point d clause 2 Article 4 of Circular 105/2020/TT-BTC includes:

+ Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC or the tax return as per the law on tax administration;

+ Copy of certificate of household business registration if the information thereon is changed;

+ Copy of unexpired citizen identification card or ID card, for a Vietnamese nationality individual; copy of unexpired passport, for foreign national or overseas Vietnamese if the information thereon is changed.

* If the taxpayer being contract or investor entering into a petroleum contract as prescribed in point h Article 4 of Circular 105/2020/TT-BTC transfers a part of contributed capital in a business entity or interest in petroleum contract, the taxpayer shall file an application for Changes to taxpayer registration information with the Department of Taxation of province where they are headquartered.

The application for changes to taxpayer registration information includes: Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC.

(2) Changes to taxpayer registration information together with alternation of supervisory tax authority

* If the taxpayer that previously applied for taxpayer registration together with enterprise/cooperative/business registration relocates the headquarters to another province or central-affiliated city (hereinafter referred to as province) or another district but within the same province resulting in alternation of the supervisory tax authority,

The taxpayer shall file an application for changes to taxpayer registration information with the supervisory tax authority (the tax authority in charge of the old location) to complete the tax-related procedures before applying for change of the headquarters to the business/cooperative registration authority.

The application filed with the tax authority in charge of the old location includes: Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC

After receiving the notice of taxpayer’s relocation form No. 09-MST issued with Circular 105/2020/TT-BTC from the tax authority in charge of the old location, the enterprise/cooperative shall apply for change of headquarters to the business/cooperative registration authority as per the law on business/cooperative registration.

* The taxpayer subject to direct taxpayer registration with the tax authority as prescribed in point a, b, c, d, dd, h, i, n clause 2 Article 4 of Circular 105/2020/TT-BTC, upon relocation of headquarters to another or another district but within the same province resulting in alternation of the supervisory tax authority, shall:

- At the tax authority in charge of the old location

The taxpayer shall file an application for Changes to taxpayer registration information with the supervisory tax authority (the tax authority in charge of the old location). The application for Changes to taxpayer registration information:

+ As for the taxpayer provided for in point a, b, c, dd, h, or n clause 2 Article 4 of Circular 105/2020/TT-BTC, the application includes:

++ Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC;

++ Copy of establishment and operation license, or certificate of household business registration, equivalent document issued by the competent authority if the address thereon is changed.

+ As for the taxpayer provided for in point d clause 2 Article 4 of Circular 105/2020/TT-BTC, the application includes: Application form for Changes to taxpayer registration information No. 08- issued with Circular 105/2020/TT-BTC.

+ As for the household/individual business mentioned in point i clause 2 Article 4 of Circular 105/2020/TT-BTC, the application includes:

++ Application form for Changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC or the tax return as per the law on tax administration;

++ Copy of certificate of household business registration issued by the competent authority according to the new address (if any);

++ Copy of unexpired citizen identification card or ID card, for a Vietnamese nationality individual; copy of unexpired passport, for foreign national or overseas Vietnamese if the taxpayer registration information thereon is changed.

- At the tax authority in charge of the new location

+ The taxpayer shall file an application for Changes to taxpayer registration information with the tax authority in charge of the new location within 10 business days after the tax authority in charge of the new location issues a notice of taxpayer’s relocation form No. 09-MST issued with Circular 105/2020/TT-BTC. In specific:

++ The taxpayer provided for in point a, b, d, dd, h, or n clause 2 Article 4 of Circular 105/2020/TT-BTC shall file an application with the Department of Taxation of province where the new headquarters is located.

++ The taxpayer being the artel provided for in point a clause 2 Article 4 of Circular 105/2020/TT-BTC shall file an application with the Sub-department of Taxation or regional Sub-department of Taxation of district where the new headquarters is located.

++ The taxpayers specified in point c clause 2 Article 4 of Circular 105/2020/TT-BTC shall file an application with the Department of Taxation where they are headquartered, for those established by central agencies and provincial authorities; or to the Sub-department of Taxation or regional Sub-department of Taxation where they are headquarters, for those established by district authorities).

++ The taxpayers being household/individual businesses specified in point i clause 2 Article 4 of Circular 105/2020/TT-BTC shall file an with the Sub-department of Taxation or regional Sub-department of Taxation where the new place of business is located.

+ The application for Changes to taxpayer registration information includes:

++ The application form for relocation to the tax authority in charge of the new location No. 30/DK-TCT issued with Circular 105/2020/TT-BTC

++ Copy of establishment and operation license, or certificate of household business registration, equivalent document issued by the competent authority if the address thereon is changed.

(3) The taxpayer being individual specified in point k, l or n clause 2 Article 4 of Circular 105/2020/TT-BTC shall file an application for amendments to his/her or dependent’s taxpayer registration information (including the case of alternation of the supervisory tax authority) with the income payer or the Sub-department of Taxation or regional Sub-department of Taxation of district where he/she registers permanent or temporary residence (if he/she has not worked at the place of income payer) as follows:

* The application for Changes to taxpayer registration information, filed with the income payer, includes: A letter of authorization (if the taxpayer has not authorized the income payer before) and copies of documents having changes related to the taxpayer registration of the taxpayer or his/her dependent(s).

The income payer shall consolidate Changes to taxpayer registration information of the individual or dependent(s) in a single application form for taxpayer registration No. 05-DK-TH-TCT or 20-DK-TH-TCT issued with Circular 105/2020/TT-BTC and file it with their supervisory tax authority.

* The application for changes to taxpayer registration information, filed with the tax authority in person, includes:

- Application form for changes to taxpayer registration information No. 08-MST issued with Circular 105/2020/TT-BTC;

- Copy of unexpired citizen identification card or ID card, for a Vietnamese nationality individual; copy of unexpired passport, for a foreign national or overseas Vietnamese, if the taxpayer registration information thereon is changed.

What are the regulations on the application for changes to taxpayer registration information and places for submission hereof in Vietnam? (Image from Internet)

What are the regulations on processing the application for changes to taxpayer registration information and giving processing results at supervisory tax authorities in Vietnam?

According to Clause 1 Article 11 of Circular 105/2020/TT-BTC, processing the application for changes to taxpayer registration information and giving processing results are specified as follows:

-Change of information not mentioned in the certificate of taxpayer registration or TIN notification:

Within 2 business days after receiving a duly completed application from the taxpayer, the supervisory tax authority of the taxpayer shall update the changed information in the taxpayer registration system.

- Change of information mentioned in the certificate of taxpayer registration or TIN notification:

Within 3 business days after receiving a duly completed application from the taxpayer, the supervisory tax authority of the taxpayer shall update the changed information in the taxpayer registration system; and issue a certificate of taxpayer registration or TIN notification with updated information.

What is the application form for changes to taxpayer registration information in Vietnam?

The application form for changes to taxpayer registration information in Vietnam is Form 08-MST issued together with Circular 105/2020/TT-BTC.

Download The application form for changes to taxpayer registration information in Vietnam: here