What are the regulations on notarization fees for LUR transfer contracts in Vietnam? Who is responsible for paying notarization fees when buying and selling real estate in Vietnam?

What are the regulations on notarization fees for land use right (LUR) transfer contracts in Vietnam?

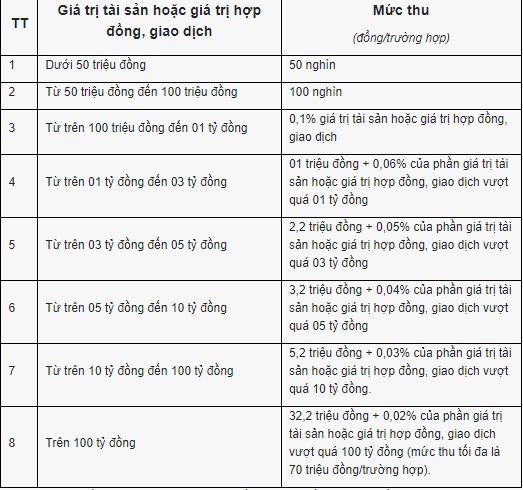

Based on Clause 2, Article 4 of Circular 257/2016/TT-BTC, the notarization fees for LUR transfer contracts are regulated as follows:

- Notarization of contracts for transferring, gifting, dividing, separating, merging, exchanging, or contributing capital by land use rights: Calculated based on the value of the land use rights.

- Notarization of contracts for transferring, gifting, dividing, merging, exchanging, or contributing capital by land use rights with assets attached to land, including housing and constructions on land: Calculated based on the total value of land use rights and the value of assets attached to the land, including housing and constructions on the land. The specific fee for asset value is as follows:

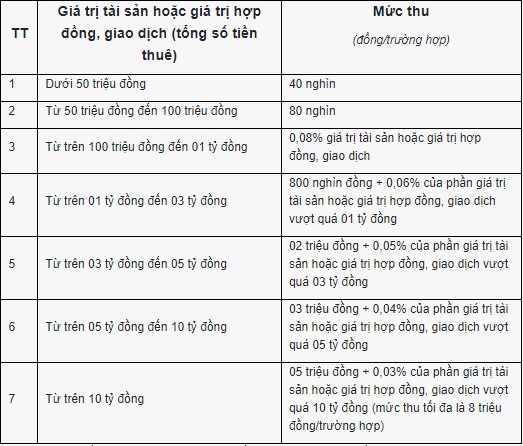

- Fee rates for notarizing contracts for leasing land use rights; leasing housing; leasing, subleasing assets:

- For contracts or transactions involving land use rights and assets with values regulated by competent state agencies, the notarization fee is determined according to the agreement of the parties in that contract or transaction. If the agreed price is lower than the price regulated by competent state agencies at the time of notarization, the notarization fee is calculated as follows:

The value of land use rights and assets for notarization fee = Land area, asset quantity recorded in the contract, transaction (x) Land price, asset price regulated by competent state agencies.

What are the regulations on notarization fees for LUR transfer contracts in Vietnam? (Image from Internet)

Who is responsible for paying notarization fees when buying and selling real estate in Vietnam?

According to Article 2 of Circular 257/2016/TT-BTC, the person liable for the fee is defined as follows:

Person liable for fees, charges

- Organizations and individuals who request notarization of contracts, transactions, translations, will safekeeping, or issuance of copies of notarized documents must pay notarization fees.

- Organizations and individuals who request authentication of copies from originals, or authentication of signatures in documents must pay authentication fees.

- Individuals submitting dossiers for the examination of apprenticeship results in the notarial profession to be appointed as notaries or individuals submitting dossiers for reappointment as notaries must pay the fee for assessing notarial practice standards and conditions.

- Organizations submitting dossiers for registration to operate a Notary Office must pay the fee for assessing the operating conditions of the Notary Office.

- Individuals receiving new or reissued notary cards must pay the fee for issuing notary cards.

Thus, under this regulation, the person responsible for paying notarization fees for real estate transactions is the person requesting notarization. However, the law requires that the person requesting notarization must pay the fee and service charges related to notarization but does not prohibit the parties from agreeing on who will pay. In other words, the transferring parties are allowed to agree on who will pay.

Therefore, the parties can agree on who will pay the notarization fees and service charges as required related to notarization. If no agreement is reached, the requester must pay.

When is LURs exempt from personal income tax in Vietnam?

According to Article 4 of the Personal Income Tax Law 2007 (supplemented by Clause 3, Article 2 of Law Amending and Supplementing Certain Articles of the Laws on Taxation 2014 and Clause 2, Article 1 of Law on the Amendment of the Personal Income Tax Law 2012) exemptions from personal income tax are specified as follows:

Income exempt from tax

- Income from the transfer of real estate between spouses; biological parents and children; adoptive parents and adopted children; in-laws and daughters-in-law; in-laws and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; and siblings.

- Income from the transfer of housing, homestead land use rights, and assets attached to the homestead land by individuals in the case where the individual owns only one housing, homestead land.

- Income from land use rights granted to individuals by the State.

- Income from inheritance, gifts of real estate between spouses; biological parents and children; adoptive parents and adopted children; in-laws and daughters-in-law; in-laws and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; and siblings.

- Income of households and individuals directly engaged in agricultural, forestry, salt production, aquaculture, and fishing that are not processed into other products or are only subject to simple processing.

- Income from the conversion of agricultural land of households and individuals assigned by the State for production.

- Income from interest on deposits at credit institutions, interest from life insurance contracts.

- Income from overseas remittances.

- Night shift wages, overtime wages paid higher than daytime wages, in-hour wages as prescribed by law.

- Pensions paid by the Social Insurance Fund; monthly pensions paid by the voluntary retirement fund.

- Income from scholarships, including:

a) Scholarships received from the state budget;

b) Scholarships received from domestic and foreign organizations as part of the organization's academic encouragement program.

- Income from compensation of life, non-life insurance contracts, compensation for labor accidents, state compensation, and other compensations as prescribed by law.

- Income from charitable funds that are permitted to be established or recognized by competent state agencies, operating for charitable, humanitarian, non-profit purposes.

- Income from foreign aid for charitable, humanitarian purposes in the form of governmental and non-governmental approved by competent state agencies.

- Income from wages and salaries of Vietnamese crew members working for foreign shipping companies or Vietnamese shipping companies engaging in international transport.

- Income of individuals who are ship owners, individuals with the right to use the ship, and individuals working on a ship from activities that directly provide goods and services for offshore fishing.

Accordingly, cases of LURs exempt from personal income tax include:

- Income from the transfer of real estate between spouses; biological parents and children; adoptive parents and adopted children; in-laws and daughters-in-law; in-laws and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; and siblings.

- Income from the transfer of housing, homestead land use rights, and assets attached to the homestead land by individuals in the case where the individual owns only one housing, homestead land.

- Income from land use rights granted to individuals by the State.

- Income from inheritance, gifts of real estate between spouses; biological parents and children; adoptive parents and adopted children; in-laws and daughters-in-law; in-laws and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; and siblings.