What are the procedures for the first-time taxpayer registration for affiliated entities in Vietnam?

What are the procedures for the first-time taxpayer registration for affiliated entities in Vietnam?

Based on sub-section 2 Section 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 as follows:

Step 1: Within 10 working days from the date of issuance of the establishment decision or equivalent document, the taxpayer (NNT) prepares a complete taxpayer registration dossier conformable and then submits it to the tax authority to conduct the taxpayer registration procedures at the following submission locations:

- affiliated entities of economic organizations (excluding cooperatives) as stipulated in Points a and b Clause 2 Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, which provides guidance on taxpayer registration, submit the first-time taxpayer registration dossier to the Tax Department at the headquarters' location;

- affiliated entities of other organizations as stipulated in Point c, Point n Clause 2 Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, submit the first-time taxpayer registration dossier to the Tax Department at the location where the organization is headquartered for organizations established by central and provincial authorities;

- For online taxpayer registration dossiers: The taxpayer (NNT) accesses the electronic portal of their choice (the General Department of Taxation's portal/the authorized state agency's portal including the national public service portal, ministry-level or provincial-level public service portals as stipulated for implementing one-stop mechanism in administrative procedures and connected with the General Department of Taxation's portal/service provider's T-VAN portal) to fill out the declaration form and attach the required documents electronically (if available), electronically sign and send to the tax authority through the chosen electronic portal;

NNT submits the dossier (simultaneous taxpayer registration and business registration dossier under the one-stop mechanism) to the competent state administrative agency as stipulated. The competent state administrative agency sends the received dossier information of the NNT to the tax authority through the General Department of Taxation's electronic portal.

Step 2: Tax authority reception:

- For paper-based taxpayer registration dossiers:

+ When the dossier is submitted directly to the tax authority: The tax officer receives and stamps the acceptance on the taxpayer registration dossier, noting the date of receipt, the quantity of documents according to the list of dossiers for cases submitted directly at the tax office. The tax officer writes an appointment slip for the date of result return and the processing time for the received dossier;

+ For taxpayer registration dossiers sent via postal service: The tax officer stamps the acceptance, records the date of receipt on the dossier and notes the tax authority's correspondence number;

The tax officer checks the taxpayer registration dossier. In case the dossier is incomplete and requires explanation or additional information, the tax authority notifies the taxpayer according to form No. 01/TB-BSTT-NNT in Appendix II issued together with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 02 (two) working days from the date of receipt of the dossier.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier through the General Department of Taxation's electronic portal, checks and processes the dossier through the tax authority's electronic data processing system:

+ Dossier reception: The General Department of Taxation's electronic portal sends a receipt confirmation to the NNT that they have submitted their dossier via the chosen electronic portal (General Department of Taxation's portal/authorized state agency's portal or T-VAN service provider) no later than 15 minutes from receiving the taxpayer's electronic registration dossier;

+ Dossier checking and processing: The tax authority checks and processes the taxpayer's dossier according to the law on taxpayer registration and returns the processing results via the chosen electronic portal:

+ In case the dossier is complete and compliant with the procedures and requires result return: The tax authority sends the processing result to the electronic portal where the NNT submitted the dossier according to the stipulated time in Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

+ In case the dossier is incomplete or non-compliant, the tax authority sends a notification of dossier rejection to the electronic portal where the NNT submitted the dossier within 02 (two) working days from the date on the dossier receipt confirmation.

What are the procedures for the first-time taxpayer registration for affiliated entities in Vietnam? (Image from the Internet)

What documents are required for the first-time taxpayer registration for affiliated entities in Vietnam?

Based on sub-section 2 Section 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 as follows:

- For affiliated entities of economic organizations (excluding cooperatives), include:

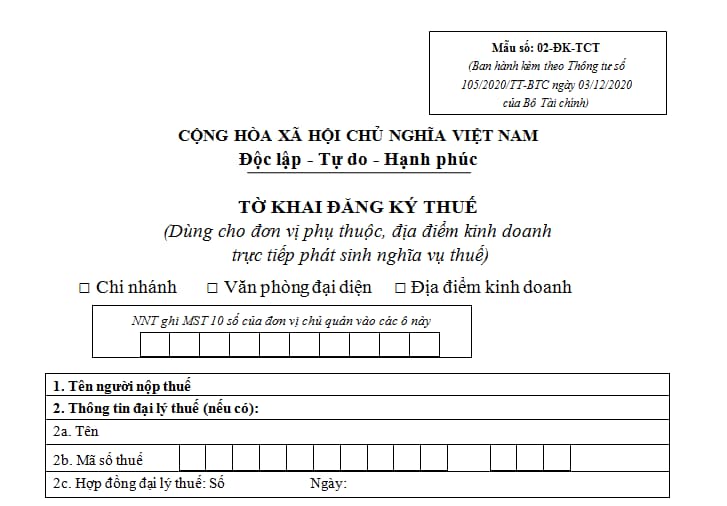

+ Taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

+ Declaration form of affiliated entities No. BK02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ Business location declaration form No. BK03-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ Foreign contractor and foreign sub-contractor declaration form No. BK04-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ Oil and gas contractor and investor declaration form No. BK05-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ A copy of the Certificate of Registration of Dependent Unit Operation, or Establishment Decision, or equivalent document issued by the competent authority, or Business Registration Certificate as stipulated by the laws of the neighboring country (for organizations from countries sharing a land border with Vietnam engaging in trade activities at border markets, border-gate markets, and border economic zone markets in Vietnam).

- For affiliated entities of other organizations, include:

+ Taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

+ Declaration form of affiliated entities No. BK02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ Business location declaration form No. BK03-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ Foreign contractor and foreign sub-contractor declaration form No. BK04-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

+ A copy without certification requirement of the Establishment Decision, or equivalent document issued by the competent authority.

What is the Form 02-DK-TCT - taxpayer registration declaration for affiliated entities in Vietnam?

The taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC applies to affiliated entities and business locations directly arising tax obligations as follows:

>> Download the taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC: Download