What are the procedures for first-time taxpayer registration for independent units in Vietnam?

What are the procedures for first-time taxpayer registration for independent units in Vietnam?

Under subsection 1, Section 2 of the Administrative Procedures issued together with Decision 2589/QD-BTC in 2021, the procedures for first-time taxpayer registration for independent units follow these steps:

Step 1: Within 10 working days from the date of:

Issuance of the establishment and operation license, investment registration certificate, establishment decision; or arising obligations with the state budget; or commencing business activities for organizations not subject to business registration, the taxpayer must prepare a complete taxpayer registration application under the regulations and submit it to the tax authority for the taxpayer registration procedure at the following locations:

- Independent units, managing units of economic organizations (except cooperatives) as per point a, b, Clause 2, Article 4 of Circular 105/2020/TT-BTC guiding the taxpayer registration, submit the first-time taxpayer registration application at the Tax Department where the headquarters are located;

- Independent units, managing units of other organizations as per points c, e, Clause 2, Article 4 of Circular 105/2020/TT-BTC submit the first-time taxpayer registration application at the Tax Department where the organization’s headquarters are located, for organizations established by central or provincial authorities;

- For electronic taxpayer registration applications: The taxpayer accesses the web portal chosen by the taxpayer (the General Department of Taxation's web portal or the competent state authority’s web portal, including the national public service portal, the ministry-level public service portal, the provincial public service portal according to the regulations on single-window system and interlinked single-window system connected with the General Department of Taxation's web portal or the web portal of the T-VAN service provider) to fill out the declaration form and attach electronic files as required, sign electronically, and send to the tax authority through the chosen web portal;

The taxpayer submits the application (taxpayer registration application simultaneously with the business registration application according to the interconnected one-stop mechanism) to the competent state authority as prescribed.

The competent state authority transfers the accepted application information to the tax authority via the General Department of Taxation's web portal.

Step 2: Reception by tax authority:

- For physical taxpayer registration applications:

+ In case the application is submitted directly to the tax authority: The tax officer receives and stamps the reception on the taxpayer registration application, clearly stating the reception date and the number of documents according to the document list for applications submitted directly at the tax authority.

The tax officer issues an appointment note indicating the date of the result return and the processing time of the accepted application;

+ In case the taxpayer registration application is sent by postal services: The tax officer stamps the reception, notes the reception date on the application, and records the tax authority's dispatch number;

The tax officer checks the taxpayer registration application. In case the application is incomplete and needs explanation or additional information, the tax authority notifies the taxpayer according to form No. 01/TB-BSTT-NNT in Appendix 2 issued together with Decree 126/2020/ND-CP within 2 (two) working days from the date of receipt of the application.

- For electronic taxpayer registration applications: The Tax Authority receives the application through the General Department of Taxation's web portal, checks and handles the application through the Tax Authority's electronic data processing system:

+ Receiving the application: The General Department of Taxation's web portal sends a receipt notification to the taxpayer via the chosen web portal (General Department of Taxation's web portal or the competent state authority's web portal or T-VAN service provider) within 15 minutes from the time the taxpayer submits the electronic taxpayer registration application;

+ Checking and processing the application: The tax authority checks and processes the taxpayer's application according to the legal regulations on taxpayer registration and returns the result through the chosen web portal:

++ In case the application is complete and correctly follows the procedure, and the result needs to be returned: The tax authority sends the result to the chosen web portal according to the timeframe specified in Circular 105/2020/TT-BTC dated December 3, 2020, by the Ministry of Finance;

++ In case the application is incomplete or incorrect, the tax authority sends a notice of rejection to the chosen web portal within 2 (two) working days from the receipt date on the receipt notice.

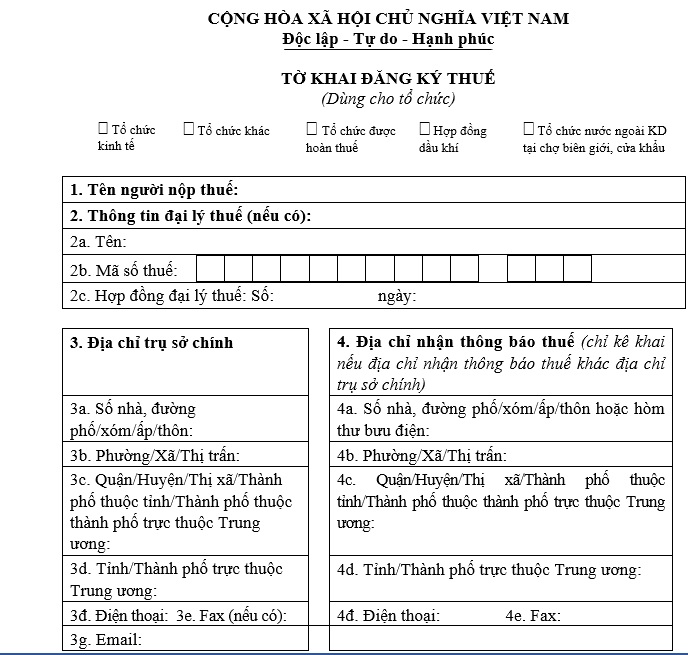

What are the procedures for first-time taxpayer registration for independent units in Vietnam? (Image from Internet)

What are the methods of carrying out the procedures for first-time taxpayer registration for independent units in Vietnam?

Under subsection 1, Section 2 of the Administrative Procedures issued together with Decision 2589/QD-BTC in 2021, the methods of carrying out the procedures for first-time taxpayer registration for independent units in Vietnam are as follows:

- Submit directly to the Tax Authority;

- Send through the postal system;

- Or electronically through the General Department of Taxation's web portal or the competent state authority's web portal, including the national public service portal, the ministry-level public service portal, the provincial public service portal following the regulations on single-window system and interlinked single-window system connected with the General Department of Taxation's web portal or the T-VAN service provider's portal.

Where to download the first-time taxpayer registration declaration form for independent units (Form 01-DK-TCT) in Vietnam?

The taxpayer registration declaration form (Form 01-DK-TCT) issued together with Circular 105/2020/TT-BTC can be found below:

>> Download the first-time taxpayer registration declaration form for independent units (Form 01-DK-TCT): Download