What are the procedures for excise tax deferral for domestically assembled automobiles in Vietnam?

What are the procedures for excise tax deferral for domestically assembled automobiles in Vietnam?

Under Article 4 of Decree 65/2024/ND-CP, the procedures for excise tax deferral for domestically assembled automobiles are as follows:

(1). Taxpayers eligible for the deferral shall submit the application form for excise tax deferral (electronically or directly to the tax authority, or via postal service) using the Form in the Appendix issued with Decree 65/2024/ND-CP to the supervisory tax authority once for all the periods being extended coinciding with the time of submitting the excise tax declaration dossiers in accordance with the law on tax management.

In case the Request for excise tax deferral is not submitted at the same time as the excise tax declaration dossiers, the latest submission deadline for the Request for excise tax deferral is November 20, 2024. The tax authority will still process the excise tax deferral as stipulated in Article 3 of Decree 65/2024/ND-CP.

Taxpayers must self-assess and take responsibility for the correctness of their deferral requests, ensuring eligibility in accordance with Decree 65/2024/ND-CP.

(2). The tax authority is not required to notify taxpayers of the acceptance of the excise tax deferral.

In the event during the deferral period, the tax authority finds that the taxpayer is not eligible for the deferral, the tax authority shall issue a written notice to the taxpayer on the cessation of the deferral, and the taxpayer must pay the full amount of tax and late payment interest for the extended period to the state budget.

If, after the deferral period, the tax authority discovers through inspection or audit that a taxpayer was not eligible for the excise tax deferral under Decree 65/2024/ND-CP, the taxpayer must pay the outstanding tax amount, fines, and late payment interest as re-assessed by the tax authority to the state budget.

* During the deferral period for the excise tax, the tax authority will not charge late payment interest on the extended excise tax amounts.

In cases where the tax authority has charged late payment interest on excise tax declaration dossiers eligible for deferral under Decree 65/2024/ND-CP, the tax authority shall adjust and not charge late payment interest on the excise tax.

What are the procedures for excise tax deferral for domestically assembled automobiles in Vietnam? (Image from the Internet)

What is the excise tax deferral period for domestically assembled automobiles in Vietnam?

Pursuant to Article 4 of Decree 65/2024/ND-CP, the excise tax deferral period for domestically assembled automobiles in Vietnam is defined as follows:

The tax deferral applies to the excise tax amounts incurred in the tax periods of May, June, July, August, and September 2024 for domestically produced or assembled cars.

The deferral period is from the end of the legal tax payment deadline until November 20, 2024. To be specific:

- The excise tax payment deadline for the tax period of May 2024 is no later than November 20, 2024.

- The excise tax payment deadline for the tax period of June 2024 is no later than November 20, 2024.

- The excise tax payment deadline for the tax period of July 2024 is no later than November 20, 2024.

- The excise tax payment deadline for the tax period of August 2024 is no later than November 20, 2024.

- The excise tax payment deadline for the tax period of September 2024 is no later than November 20, 2024.

* Regulations for specific cases:

- If taxpayers file supplementary declarations resulting in increased excise tax obligations for the extended tax periods before the deferral deadline, the extended tax also includes the additional amounts.

- Taxpayers eligible for the deferral who file the excise tax declarations according to current regulations do not have to pay the excise tax incurred on the declarations during the deferral period.

- If enterprises have subsidiaries or units that file separate excise tax declarations with their respective managing tax authorities, the subsidiaries and units are also eligible for the tax payment deferral.

Subsidiaries and units of the enterprise without car production or assembly activities are not eligible for the excise tax deferral.

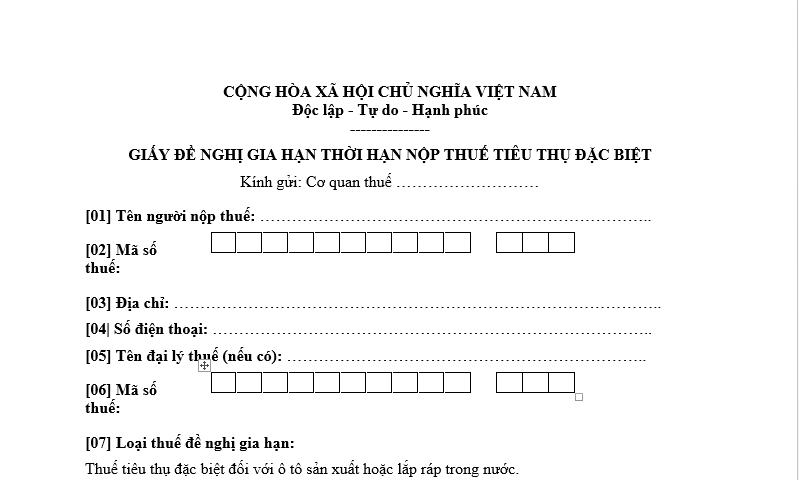

What is the application form for excise tax deferral for domestically assembled automobiles in Vietnam?

The application form for excise tax deferral for domestically assembled automobiles is provided in Decree 65/2024/ND-CP.

Download the application form for excise tax deferral for domestically assembled automobiles: Here