What are the procedures for compulsion to cease customs procedures for import-export goods of taxpayers owing tax in Vietnam?

What are the procedures for compulsion to cease customs procedures for import-export goods of taxpayers owing tax in Vietnam?

Based on Section 3, Part B of the Process issued together with Decision 1795/QD-TCT of 2022, which stipulates the process for compelling the cessation of customs procedures for import-export goods of taxpayers owing tax, it consists of the following steps:

Step 1: Create a List of Taxpayers Subject to Compulsion

(1) Basis for creating a list of taxpayers subject to compulsion:

Taxpayers with outstanding tax debts who are engaged in import-export activities or have conducted import-export activities at least once within the last 12 months fall under one of the following cases:

- Taxpayers do not have accounts at the State Treasury, Commercial Banks, or other credit institutions, or the tax authority has sent a document to verify information about the account, but the taxpayers being compelled or the State Treasury, Commercial Banks, or other credit institutions do not provide or provide incomplete information.

- Taxpayers have been subjected to measures by the tax authority such as withdrawal of money from the account, freezing the taxpayer's account, but by the date of creating the list, the outstanding tax debt under compulsion has not been fully paid to the State Budget.

- Taxpayers are subjected to one of the following compulsion measures by the tax authority: Suspension of invoice use; Asset seizure, auction of seized assets; Collection of money and other assets held by other agencies, organizations, or individuals; or the taxpayers are in the period during which the tax authority has requested the business registration authority to revoke their business registration certificate, but the business registration authority has not issued a revoking decision.

- Taxpayers with outstanding tax debts who are disseminating assets or absconding.

(2) Creation of the List

Daily, officials review the tax authority's database and other documents provided by relevant organizations and individuals to identify taxpayers currently engaged in import-export activities or who have conducted import-export activities at least once within the last 12 months that fall into the aforementioned cases, compiling them into the list of taxpayers to request the Customs authority to apply the measure of cessation of customs procedures for import-export goods (Form No. 03/DS-HQ issued together with this process).

Officials can extract information about taxpayers' import-export activities provided by the Customs authority according to the Information Exchange Regulation between the Customs authority and the tax authority (lookup on Webservice, ...).

Step 2: Draft and Send Proposal Document for Compulsion

Officials draft a submission and a proposal document requesting the Customs authority to enforce the measure of cessation of customs procedures (Form No. 01/VBĐN issued together with this process), report to the department/team leader for the tax authority leader's signature and issuance, and send it to the Customs authority on the same day the document is issued.

Step 3: Monitor the Implementation of the Compulsion Measure

- Upon receiving a response from the Customs authority:

+ If the Customs authority does not immediately comply with the tax authority's request or is already applying this compulsion measure, officials enforce other appropriate measures as per regulations.

+ If the Customs authority issues a compulsion decision based on the tax authority's request, officials update the compulsion decision into the tax management application system.

- During the effective period of the compulsion decision, on the same working day of receiving information that the taxpayer under compulsion has fully paid the outstanding tax debt stated in the compulsion decision; or the outstanding tax debt under compulsion has been subjected to the tax authority's decision for gradual payment, tax extension, or late payment penalty waiver; or notification of no late payment, officials draft a submission with all documents for the department/team leader to present to the tax authority leader for signature and issuance of a document to the Customs authority (Form No. 02/TB-HQ issued together with this process) to terminate the compulsion measure.

What are the procedures for compulsion to cease customs procedures for import-export goods of taxpayers owing tax in Vietnam? (Image from the Internet)

Which is the decision form for compulsion by cessation of customs procedures for export goods in Vietnam?

Pursuant to the provisions of Clause 4, Article 33 Decree 126/2020/ND-CP as follows:

Compulsion by cessation of customs procedures for import-export goods

...

4. The compulsion decision shall follow Form No. 03/CC in Appendix III issued together with this Decree. The compulsion decision needs to clearly state the date, month, year of issue; decision number, legal basis for the decision; reason for compulsion, name, title, working unit of the decision issuer; name and address of the compelled entity; uncollected tax amount detailed by each customs declaration, case; total amount under compulsion; name, address, account number at the state treasury; execution time limit; signature of the decision issuer, seal of the decision-issuing agency.

...

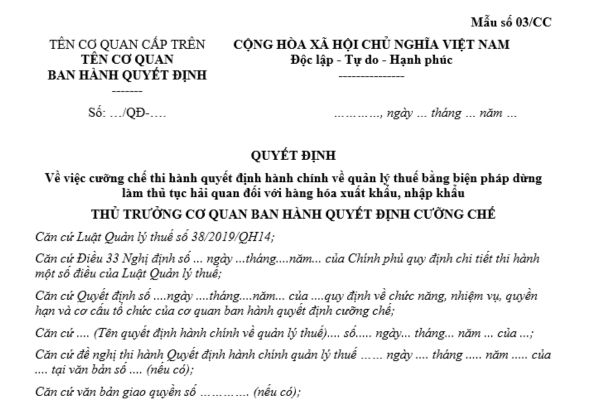

Thus, the compulsion decision by cessation of customs procedures for export goods is implemented according to Form No. 03/CC as follows:

>> Download Form No. 03/CC: Download

When does the compulsion measure of ceasing customs procedures for export goods cease to be effective in Vietnam?

According to Article 125 of the Law on Tax Administration 2019 is stipulated as follows:

Compulsion Measures for Enforcing Administrative Decisions on Tax Management

1. Compulsion measures for enforcing administrative decisions on tax management include:

a) Withdrawing money from the bank account of the taxpayer compelled to comply with administrative decisions on tax management at the State Treasury, commercial banks, other credit institutions; freezing accounts;

b) Deducting a portion of wages or income;

c) Ceasing customs procedures for export, import goods;

d) Suspending the use of invoices;

e) Seizing assets, auctioning seized assets as stipulated by law;

f) Collecting money and other assets of the taxpayer compelled to comply with administrative decisions on tax management held by agencies, organizations, or individuals;

g) Revoking business registration certificates, business registration certificates, cooperative registration certificates, investment registration certificates, establishment and operating licenses, practicing certificates.

2. The compulsion measures for enforcing administrative decisions on tax management prescribed in Clause 1 of this Article cease to be effective when the tax debt is fully paid into the state budget.

...

Thus, based on the regulation above, the compulsion measure of ceasing customs procedures for export goods ceases to be effective when the tax debt is fully paid into the state budget.