What are the origins of the Pi Coin? What is the current value of 1 Pi? What is the role of the Ministry of Finance of Vietnam in enhancing the management of activities related to virtual currencies?

What are the origins of the Pi Coin?

The Pi Coin (Pi Network) was officially launched on March 14, 2019 (also known as Pi Day). The project was initiated by a group of developers from Stanford University.

Pi Coin is the official cryptocurrency unit within the Pi Network ecosystem. Users can mine, trade, and use Pi within applications that belong to this network.

The objective of Pi Network is to create a cryptocurrency that can be easily mined on mobile devices, thereby making blockchain technology accessible to a wide range of users without the need for specialized equipment or excessive energy consumption.

As of today, February 21, 2025, Pi Network has existed for nearly 6 years. However, it should be noted that the project is still under development, and Pi Coin has not yet been officially listed on major exchanges at this time, although there have been some unofficial transactions such as OTC (over-the-counter exchanges).

What is the current value of 1 Pi?

As of today, February 21, 2025, the actual market value of 1 Pi (Pi Network) is still not clearly and officially determined, as the project only recently launched the mainnet on February 20, 2025.

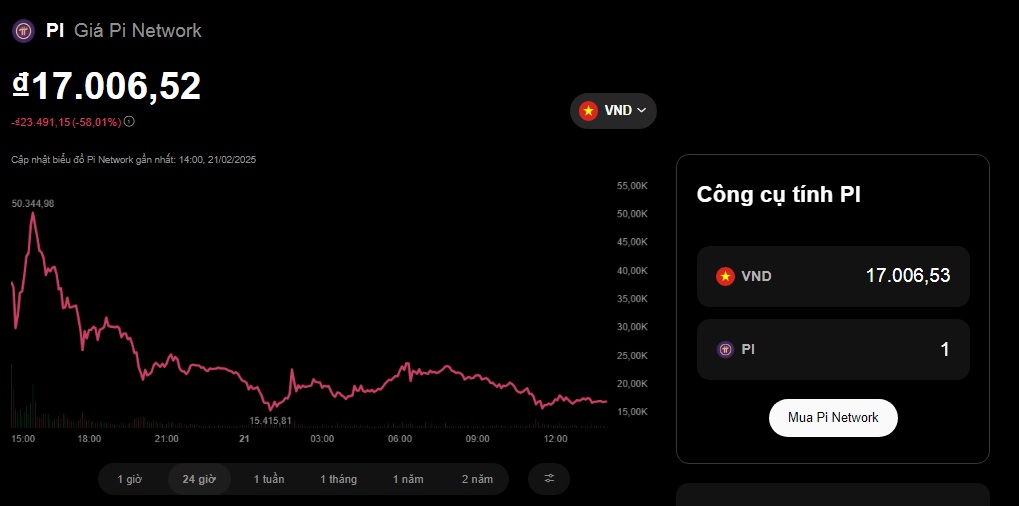

However, Pi Coin was officially listed on the OKX exchange on February 20, 2025. The initial price ranged from 1.3 USD to 2 USD right after trading commenced. Yet, the price experienced significant fluctuations, with the lowest in the 24-hour period being 0.1 USD and the highest reaching 2.2 USD. Around 4:50 PM on February 20 (Vietnam time), the trading price was recorded at 1.56 USD, a roughly 1.5% increase in a short period. Specifically, the current value of Pi Coin is as follows:

Pi Network price today listed on OKX exchange

As of 2:07 PM on February 21, 2025, the value of 1 Pi (PI) fluctuates around 0.7 to 0.8 USDT, equivalent to approximately 17,000 to 19,000 VND. This value has significantly decreased from the initial listing range of 1.3 to 2 USDT/Pi on February 20, 2025.

| Note: The price of Pi may fluctuate heavily during the day as it has just been listed, so this figure is for reference only at the present time. If you need more precise pricing at a specific point in the day, please check directly on the OKX exchange or from reliable cryptocurrency data sources and apply the latest USD/VND exchange rates from banks. |

The strong price fluctuations of Pi have caused considerable concern within the user community. Before investing or trading with Pi, users should exercise caution and thoroughly research the project and potential risks involved.

Note: The information is for reference only and should not be considered investment advice. Investors should conduct their own research and carefully evaluate before making decisions!

What are the origins of the Pi Coin? (Image from the Internet)

What is the role of the Ministry of Finance of Vietnam in enhancing the management of activities related to virtual currencies?

Based on Section 2 of Directive 10/CT-TTg 2018 to limit risks and consequences for society, promptly detect, prevent, and handle violations of the law, the Prime Minister of the Government of Vietnam requests the Ministry of Finance of Vietnam to focus on implementing the following tasks:

- Direct public companies, securities companies, fund management companies, and securities investment funds not to conduct activities of issuing, trading, and brokering transactions related to illegal virtual currencies, complying with regulations on anti-money laundering.

- Research practices and international experiences to propose measures for capital mobilization activities through Initial Coin Offerings (ICO).

- Lead and cooperate with relevant agencies to take measures to limit the import and manage equipment and machinery for the purpose of virtual currency mining.

Does income from virtual currencies subject to Personal Income Tax (PIT) or Value Added Tax (VAT) in Vietnam?

(1) Regarding Personal Income Tax

Based on Clause 1, Article 3 of the Personal Income Tax Law 2007, amended by Clause 1, Article 2 of the Law on Amendments to Tax Laws 2014, it is stipulated as follows:

Taxable Income

Taxable personal income includes the following types of income, except for income exempt from tax as stipulated in Article 4 of this Law:

- Income from business activities, including:

a) Income from production and business activities of goods and services;

b) Income from independent practice activities of individuals with practice licenses or certificates according to the law.

Income from business activities stipulated in this clause does not include income of individuals with business revenue of 100 million VND/year or less.

...

(2) Regarding Value Added Tax (VAT)

According to Article 3 of the Value Added Tax Law 2008 as follows:

Taxable Items

Goods and services used for production, business, and consumption in Vietnam are subject to value-added tax, except for the objects stipulated in Article 5 of this Law.

According to (1) and (2), up to the present time, there is no legal document specifying virtual currency as goods or services used for production, business, and consumption in Vietnam.

According to Article 3 of the Commercial Law 2005 defining goods as follows:

Terminology Explanation

In this Law, the following terms are construed as follows:

...

- Goods include:

a) All types of movable property, including future-movable property;

b) Things attached to land.

...

Thus, goods only include: all types of movable property, including future-movable property; things attached to land, but do not define virtual currencies as goods. Currently, there are also no specific legal frameworks for this subject.

According to Official Dispatch 5747/NHNN-PC 2017 by the State Bank of Vietnam provides guidance as follows:

Based on the stated regulations, virtual currencies in general and Bitcoin, Litecoin in particular are not money and are not legal means of payment according to Vietnamese law. The issuance, provision, and use of virtual currencies in general and Bitcoin, Litecoin in particular (unlawful payment means) as currency or payment methods is prohibited. The sanctions for this act have been stipulated in Decree 96/2014/ND-CP by the Government of Vietnam regarding administrative sanctions in the field of currency and banking and Criminal Code 2015 (as amended and supplemented). Additionally, regarding investment in virtual currencies, the State Bank of Vietnam has repeatedly warned that this investment bears very high risks for investors.

Furthermore, according to Clause 6, Article 26 of Decree 88/2019/ND-CP, amended by point d, Clause 15, Article 1 of Decree 143/2021/ND-CP on violations regarding payment activities, it is regulated as follows:

Payment Activity Violations

...

- A fine ranging from 50,000,000 VND to 100,000,000 VND for any of the following violations:

...

d) Issuing, providing, using unlawful payment means that do not reach the level of criminal prosecution;

...

Therefore, it can be said that Pi Network specifically and virtual currencies generally are not currency and are not a legal means of payment according to Vietnamese law, so the buying, selling, and trading of virtual currencies are illegal.

Thus, virtual currencies are not subject to PIT or VAT. However, it is noted that if trading virtual currency does not reach the level of criminal prosecution, one may be fined from 50,000,000 VND to 100,000,000 VND.

Note: The above-mentioned fine is applicable to individuals; the fine for organizations is twice the fine for individuals (point b, clause 3, Article 3 of Decree 88/2019/ND-CP).